Law firm accounting is a complex system that’s responsible for countless non-billable hours for many legal professionals. In fact, our 2024 Legal Industry Report revealed more than 1 in 10 lawyers and legal professionals cite law firm accounting as the most challenging function their firm faces.

However, accounting is a necessary part of the profession that helps ensure your firm is profitable, your team is fairly compensated, and your accounts are compliant. In this guide, we’ll cover the steps to get started with law firm accounting. We’ll also share tips, resources from our team, and ways our law firm accounting software can help you easily manage accounting tasks while boosting productivity and maintaining compliance.

What Is Law Firm Accounting?

Law firm accounting involves meticulous recordkeeping to comply with regulations set out by local jurisdictions and the American Bar Association (ABA). Detailed information is crucial to reaching your law firm’s financial goals and maintaining client transparency.

Requirements for Compliant Legal Bookkeeping

Before diving into the minutia of law firm bookkeeping, there are a few organizational steps to ensure your firm is compliant.

Form an entity to formally establish your business. This process involves choosing a name, selecting a business structure, and filing paperwork required by your local jurisdiction.

Obtain an Employer Identification Number (EIN). This step is especially important for hiring employees, filing employment taxes, and opening business bank accounts. If you haven’t completed this first step, check out our guide on starting a law firm for more in-depth guidance.

If you have already set up your business, proceed with the next steps.

Law Firm Accounting & Bookkeeping Best Practices

1. Familiarize Yourself with Accounting Basics

Regardless if you’re directly managing your firm’s accounting, it’s important to familiarize yourself with basic accounting terms and principles. A baseline understanding can make it easier to review reports and comprehend recommendations from your accounting team.

Start by learning about the typical accounts in a law firm’s chart of accounts. The chart will include a list of your accounts and transactions for each.

Accounting Terms & Definitions

When performing accounting for law firms, it's important to have a grasp on the basics. Below is a list of standard accounting terms and their definitions to better familiarize yourself with accounting practices for your law firm.

Assets are items your law firm owns that bring financial value. This includes your operating account and physical equipment, like computers.

Liabilities are items that your law firm owes. This includes accounts payable and wages.

Equity is the value of the company after subtracting the value of liabilities from your assets.

Revenue is the funds earned after completing legal services and before deducting expenses. This includes contingency fees and flat fees.

Expenses breakdown specific operational costs. This includes costs for utility bills and rent.

Compensation is items from your team’s payroll. This includes salaries and employee development costs (if included in their benefits package).

Common Legal Accounts & Definitions

Understanding common accounts is equally important to ensure compliance with law firm accounting requirements. Below are common terms to familiarize yourself with as you begin managing these legal accounts:

A general ledger is a complete record of all transactions organized by transaction type and account.

A client trust account (or IOLTA) is an account that solely holds unearned client funds. These are specific to law firms.

A trust ledger is the record of transactions for individual trust accounts. These are specific to law firms.

Client ledger is the record of transactions related to a specific client. These are specific to law firms.

Debit refers to money going into an account.

Credit refers to money coming out of an account.

The double-entry accounting method is the process of recording debits and credits for each transaction. For example, if a client pays an invoice for $1,000, the amount is debited in the cash assets account and credited from the accounts receivable assets account.

Income statements, sometimes called profit and loss statements, document a business’s revenues, expenses, gains, and losses. They determine net income by subtracting total expenses from total revenues. Income statements are used with the balance sheet and cash flow statement to holistically review a company’s financial health and performance.

Balance sheets show a business’s assets, liabilities, and shareholder equity at a specific point in time. These help a business check that its assets equal the combined value of its liabilities and shareholders’ equity.

Cash flow statements show the cash in and cash out during a specific period so businesses can know how much cash they have, how they use their money, and where the money comes from.

Law Firm Tax Obligations & Deductions

Lastly, you should also understand how business taxes work, what you’re responsible for, and potential deductions your firm can benefit from. Eligibility for tax obligations and deductions varies based on the state(s) your firm operates in.

Here are examples of common business tax obligations:

Income tax is a tax based on money received as income. Your tax obligation differs based on your business structure.

Self-employment tax is applicable to self-employed individuals and includes Medicare and Social Security tax.

Employment taxes apply to businesses with employees and include Medicare and Social Security, federal unemployment insurance, and income tax.

You can also deduct business-related expenses to lower your tax obligations. Below are a few examples of deductions:

Rent and utilities

Business insurance

Continuing education

Home office expenses

Advertising

2. Learn How To Manage Law Firm Trust Accounts

Trust accounting requires law firms to meticulously track transactions coming in and out of trust accounts. If lawyers have a pooled trust account with multiple clients’ funds, they must also keep track of transactions made with each client’s funds. Trust account funds must also remain separated from all other funds.

Many lawyers are required to set up Interest on Lawyer Trust (IOLTA) accounts depending on the state they operate in. Interest earned on IOLTA accounts is sent directly to local Bar Associations to support charitable legal services.

Note that all IOLTA accounts are trust accounts, but not all trust accounts are IOLTA accounts. If you’re required (or would like to) set up an IOLTA trust account, double-check that you’re setting up the correct account with your bank.

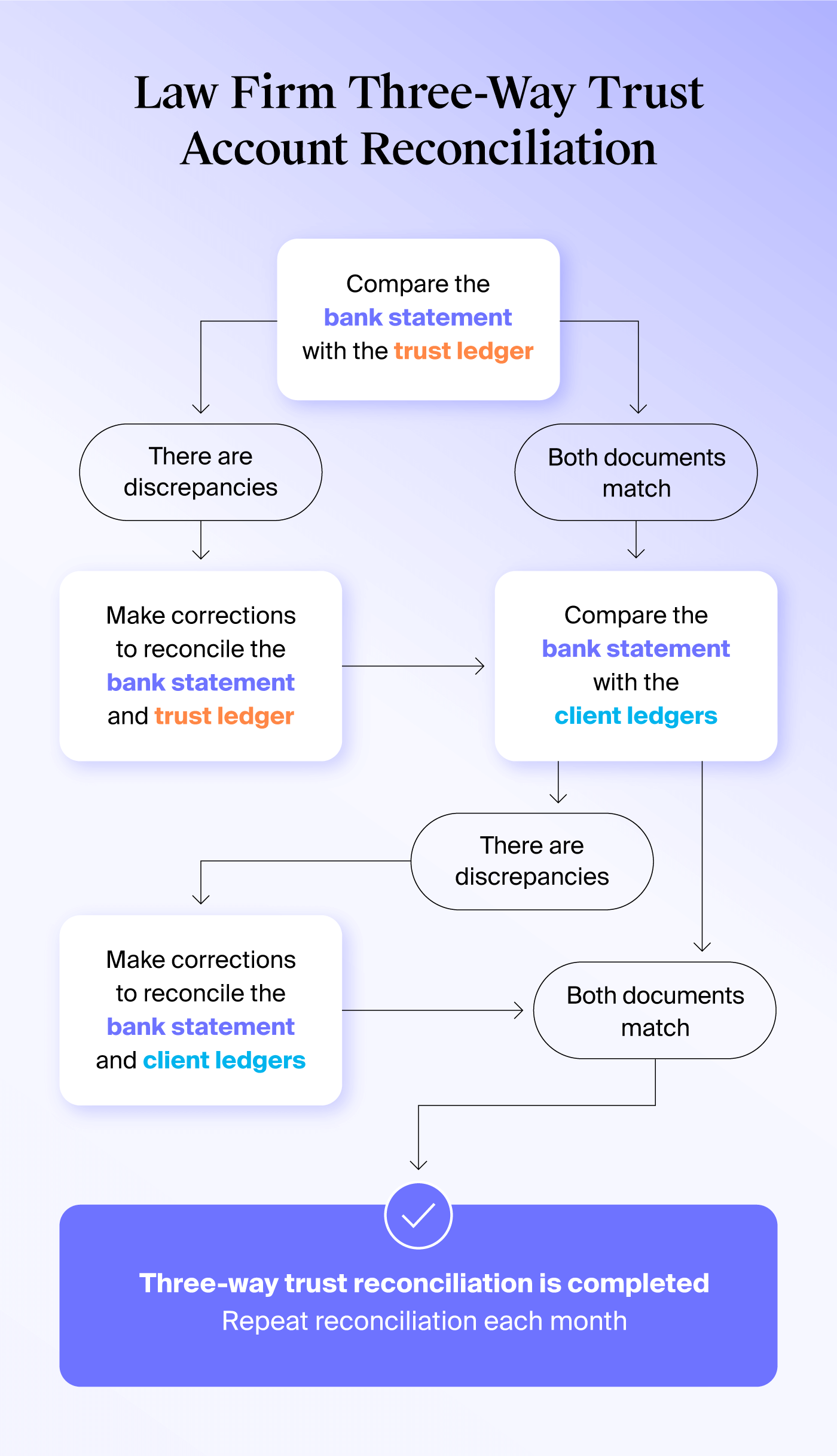

At least quarterly—ideally monthly—law firms must complete three-way trust account reconciliation. This is the process of reconciling your bank statement with your client trust account ledger and individual client ledgers. If statements don’t match, your firm must make corrections and ensure everything is accurately logged.

Failure to keep accurate records may lead to sanctions for your firm, even if the mistake is the fault of your bank or accountant.

3. Hire an Accounting Professional

Accounting for law firms requires a keen eye and a specific skillset. Hiring outside help can free up your time to focus on clients. However, not all financial professionals are equipped to help with your firm’s specific needs.

Your potential new hire should have experience working with law firms, managing IOLTA accounts, and navigating trust accounting requirements.

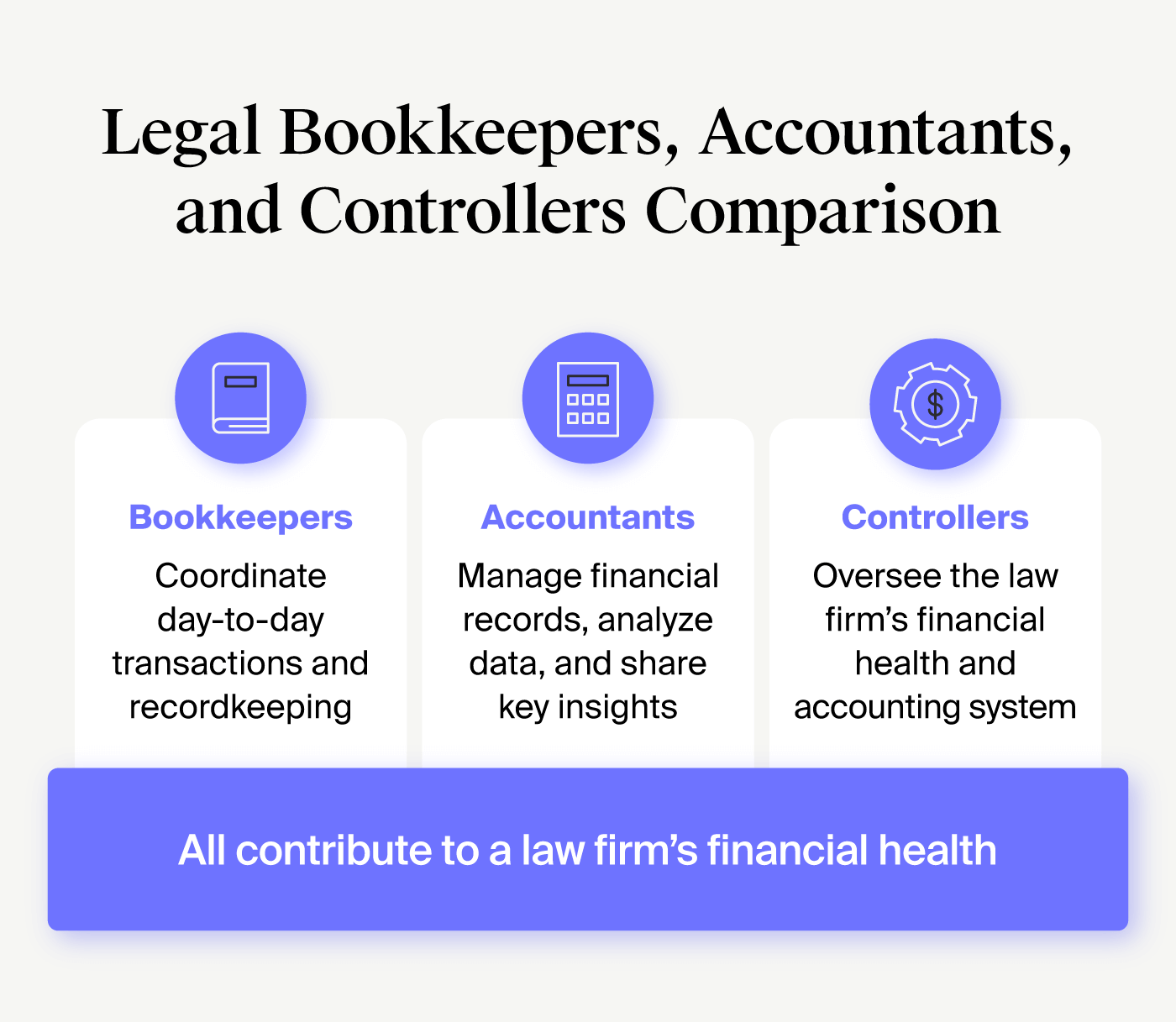

In addition to vetting experience, you should also understand what type of help you need. For example, law firm bookkeepers typically help with day-to-day tasks, while accountants and controllers can help with certain types of financial analysis.

To find someone with the right experience, ask colleagues for recommendations. You should also prepare questions and criteria to easily vet applicants.

Questions to Ask Potential Accounting Professionals

Have you worked with law firms or lawyers in this area recently? How many years of experience do you have working with legal clients?

What’s your experience managing IOLTA client trust accounts?

What’s your experience preparing taxes for law firms?

What legal accounting software do you have experience using?

What’s your experience with analyzing financial data and sharing opportunities with law firms?

What’s your process for creating and managing budgets? Monitoring cash flow?

Can you share your process of managing client billing, vendor relationships, and ensuring on-time payments?

Do I need a bookkeeper, accountant, or controller for my law firm?

Bookkeepers, accountants, and controllers all play specific roles in managing your law firm's financial health. Read their descriptions below to learn which ones are right for your firm!

Bookkeeper

Bookkeepers summarize and organize all the firm’s financial transactions chronologically and systematically, which requires careful attention to detail. Law firm bookkeeping is a more traditional version of accounting that essentially lays the groundwork for incoming and outgoing cash flow.

Best for: Firms that want help with day-to-day accounting and recordkeeping tasks

Legal bookkeeping tasks include:

Recording each financial transaction that occurs (including posting debit and credit transactions)

Creating and sending invoices

Running payroll for your staff

Balancing financial accounts

Accountant

Accountants can help uncover cost-saving opportunities, identify the most profitable cases your firm should consider, and discover opportunities to improve cash flow. Law firm accounting is fairly subjective compared to law firm bookkeeping. A critical part of the accounting process focuses on analyzing financial reports and KPIs for your law firm to uncover critical insights and make informed business decisions.

Best for: Firms that want help with complex accounting tasks, along with analysis and insights into accounting records.

Legal accounting tasks include:

Capturing expenses that weren’t recorded initially and modifying entries accordingly

Planning for tax liabilities

Completing tax returns

Controller

Controllers take a holistic look at your firm’s financial operations. Some controllers have the expertise to help with daily accounting tasks, but their function mainly lies in overseeing your company’s finances and accounting at a high level.

Best for: Firms that want help overseeing their entire accounting and financial management system.

Legal controller tasks include:

Improving processes to boost efficiency and ensure compliance

Overseeing the firm’s budget, forecasting, and sharing insight into the firm’s overall financial health

Managing the accounting team

4. Set A Realistic Budget

The next step is to nail down your law firm’s budget and related goals to help keep your team financially afloat. For example, you may invest in professional development opportunities if your goal is to expand your team’s skill sets.

Below are steps to get started:

Review your firm’s expenses, deposits, and other financial data from the last 12 months to understand your firm’s typical monthly cash flow.

Define your firm’s goals in the short and long term. This includes increasing team size, reducing non-billable hours, or growing client contracts.

List your law firm’s financial benchmarks that you’ll need to meet to reach your goals.

Estimate your firm’s revenue based on your history, goals, and financial benchmarks.

Predict your firm’s expenses and adjust your goals and budget accordingly.

Free Law Firm Budget Template

Use our law firm budget template below to get started. You must be logged in to a Google Account to make a copy of this sheet.

5. Open Your Accounts

The next step is to open all of the accounts needed to operate your law firm. This includes the following:

A business checking account that will serve as your operating account. It will hold operating funds like salaries, office rent, and anything else necessary to manage your law firm.

A business savings account that will hold funds for future payments, taxes, emergencies, and other funds you don’t need in the short term.

A client trust account, which holds client funds from unearned advanced payments.

A corporate credit card account, which provides card(s) to use for business purchases. Corporate cards help avoid reimbursement issues from using personal cards for business transactions.

Ask your bank the following questions to help find the right account(s) for your law firm:

All accounts

What are the minimum balance requirements for each account?

What fees are associated with each type of account?

What cash management services do you offer?

What security measures do you have to protect client information and funds?

What integrations does your bank offer with third-party accounting and financial management software?

What point of sale system(s) do you support?

Trust accounts

Is your bank familiar with the law firm trust accounting process and IOLTA regulations?

Do you currently have clients with IOLTA trust accounts?

What documentation does your institution provide to comply with trust accounting and IOLTA requirements?

Corporate credit card account

How do you determine credit limits?

How many cards can we issue to our team?

Does your card have a rewards program?

If you’re required to open an IOLTA account, your local Bar Association may have a list of recommended financial institutions to work with.

6. Pick An Accounting Method

The main accounting methods are cash accounting, accrual accounting, and a hybrid of both methods. For example, some businesses use different methods based on the account or type of expense.

The ABA supports law firms that use the cash accounting system and opposes legislators who previously tried to impose required accrual accounting for several personal service businesses.

Although that legislation did not pass, we recommend checking tax laws for the upcoming tax year and consulting with an accounting professional to ensure you choose a compliant accounting method. For example, businesses filing taxes for 2024 can only use the cash method if receipts from the past three years do not exceed $30 million.

We’ll go over the cash and accrual accounting along with the pros and cons of both below.

Cash Accounting

Cash accounting, or cash basis accounting, is when a firm reports transactions only when cash is received or paid out. This is the simpler method of the two and is commonly used by small businesses. It also allows you to see how much cash you have in real time.

During tax season, those using cash basis accounting are generally only required to report on income received and expenses paid in the year they were received or paid.

However, cash accounting may not accurately reflect your finances since it does not account for accounts receivable or payable. For example, you may appear to have more cash than you have if outstanding payments are owed to vendors. This contributes to why the general accounting principles (GAAP) does not find cash accounting acceptable. It can also be complicated to switch from cash accounting to accrual accounting.

Pros of Cash Accounting | Cons of Cash Accounting |

Simple process | Can misrepresent financial health |

Shows real-time look at cash on hand | Not acceptable under GAAP |

Generally, only taxed on cash earned in that tax year | Limited to certain businesses |

Accrual Accounting

Law firm accrual accounting is when your team reports transactions when they are earned rather than when cash is deposited or withdrawn. For example, if your payroll period ends on Friday, but you don’t pay employees until the next Monday, you will still record that transaction on Friday.

You may want to consider this method if you’re planning to grow a large firm. Businesses must use accrual accounting if it is publicly traded or receiving federal funding. Some investors also prefer accrual accounting since it more accurately records income and expenses when they were earned.

While accrual accounting is great for looking ahead, it’s not an ideal method for monitoring your cash flow or seeing how much cash you have. It’s also more complex and may require additional accounting staff to manage.

Pros of Accrual Accounting | Cons of Accrual Accounting |

Typically preferred by investors and required by GAAP | More complex than cash accounting |

Provides an accurate look at long-term financial health | Does not show the accurate amount of cash on hand |

Helps law firms make more accurate financial decisions | It may require additional accounting staff to manage |

7. Implement Multiple Payment Methods

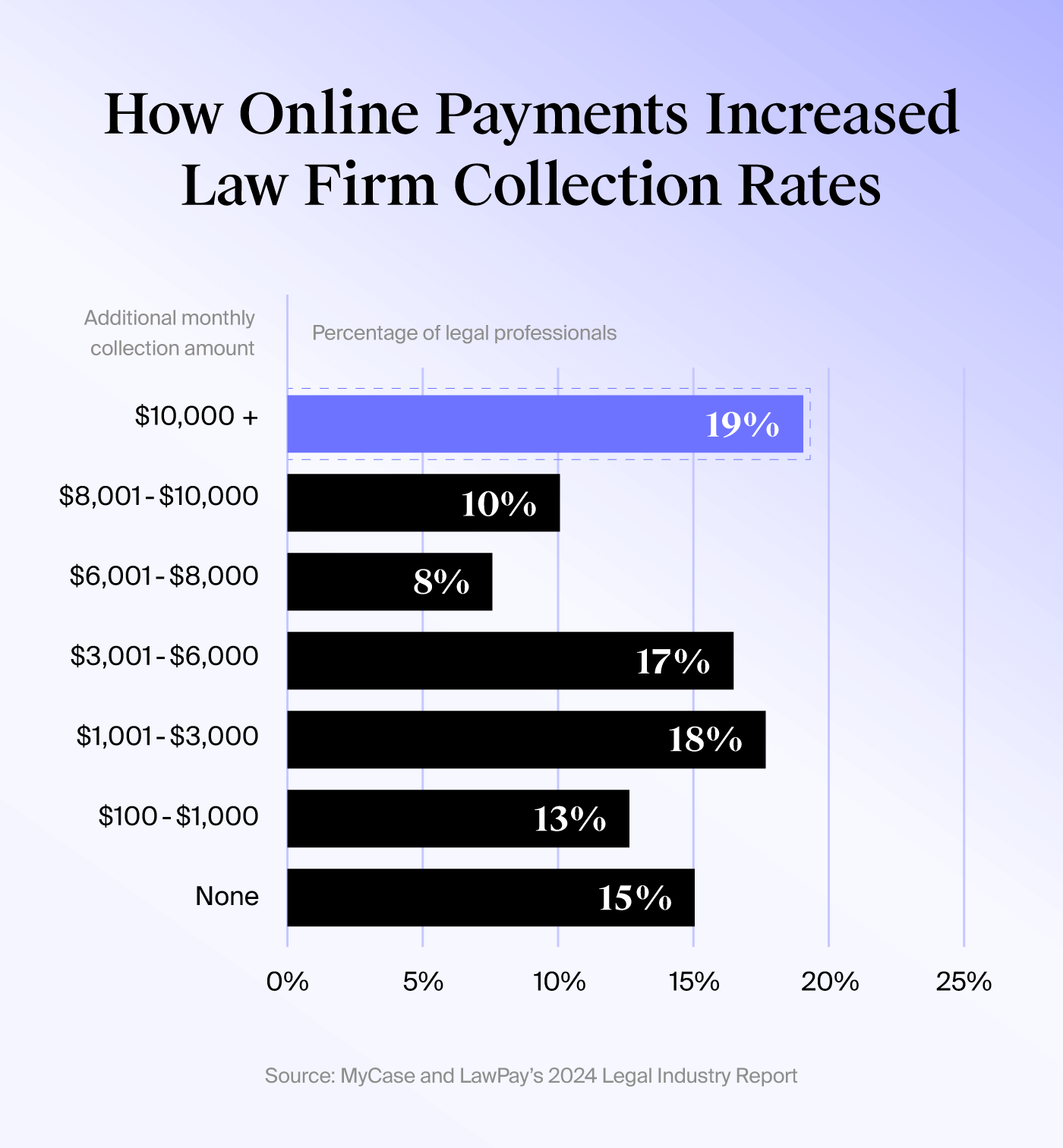

Providing several flexible payment options can help your team get paid faster and improve payment collection. In our 2024 Legal Industry Report, MyCase and LawPay customers collected 33% more from their clients who paid using online payments.

Below are a few online payment methods to consider:

Online card and automated clearing house (ACH) payments

Online payments made via third-party processors (like PayPal)

Credit or debit card

However, additional payment methods and legal payment processors lead to more compliance requirements. Consider trusted solutions like LawPay’s payment processing software, which includes built-in compliance.

8. Set Up Payroll (if You Have Employees)

Correctly setting up payroll helps ensure everyone gets paid on time, your staff understands how they’re compensated, and that you have the information needed for taxes and other requirements. You can follow these general steps to set up your team’s payroll:

Research states requirements that you must comply with when managing your business’s payroll.

Classify workers as employees or contractors, then as exempt or non-exempt workers.

Have employees fill out W-4 withholding certificates and additional state income tax forms to know how much income tax to withhold from each employee’s wage.

Let your team enroll in benefits to help determine how much income to withhold for contributions to 401Ks, health savings accounts, and other similar benefits.

Create a payroll schedule that adheres to state requirements (if any) and aligns with your typical cash flow.

Decide how you will manage payroll, whether you’ll hire an outside company or manage payroll in-house—as well as what software or services your team will use.

At this point, you may use several financial platforms for accounting, financial reporting, payroll, and more. Solutions that streamline services or work with each other can eliminate platform fees, training time, and headaches and help you optimize your financial processes.

9. Set a Schedule for Financial Reporting and Reconciliation

Some jurisdictions may require you to complete financial reporting periodically. For example, the ABA requires firms to do three-way trust reconciliation at least quarterly.

We recommend setting a schedule to regularly reconcile accounts and check in on your financial health more frequently than what may be required. For example, monthly reporting can help your firm get a snapshot of your firm’s overall health to help guide financial decisions each month.

10. Streamline Bookkeeping and Recordkeeping

Law firm accounting requires detailed record-keeping to ensure accuracy and compliance. Decide early on how you plan to complete bookkeeping tasks, how often you plan to do financial reporting, and how you’d like to manage financial records and documents.

The ABA requires lawyers to maintain client trust account records for at least five years after work has ended. Records can include bank statements, checkbook registers, and any supporting documents related to the account. You also need to maintain records for tax and other purposes.

If you’re a new law firm, you may consider DIYing bookkeeping by storing files on your personal computer, using several spreadsheets to keep track of expenses, and then handing these off to your bookkeeper or accountant when needed.

This may sound feasible with one client, but a DIY system can quickly become difficult to manage once you gain more clients and add more lawyers to your team. Files can become difficult to find as they’re stored across different computers and places across your office. Disorganized bookkeeping can lead to data discrepancies, payment issues, and other challenges.

A comprehensive cloud-based accounting solution can help you keep your data organized in one spot—and is available from anywhere. Solutions like MyCase Accounting allow you to streamline accounting work, case data, and client billing to give you control and visibility over your firm’s finances.

Common Law Firm Accounting Errors

Law firm accounting is significantly complex, given the nuance and detail needed to track transactions. We’ll discuss common errors and tips for avoiding them.

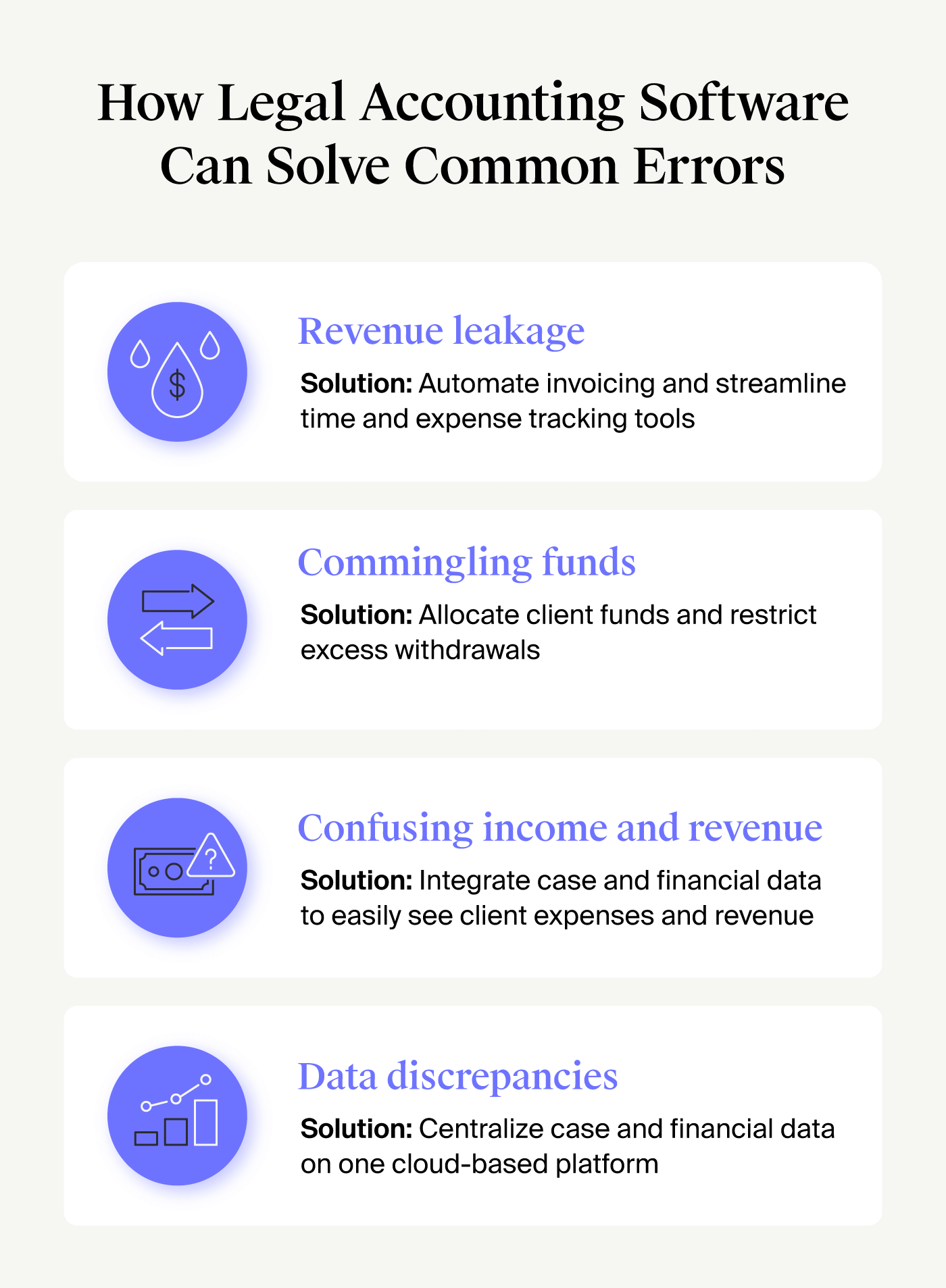

Revenue Leakage

Revenue leakage is when a company has earned money but didn’t receive it due to a lack of cost control. Just like a leaky pipe, leakage can spring from a number of factors:

Failing to report on all billable hours

Unclear billing policies

Inconsistent pricing or billing practices

Data entry errors due to inefficient processes

How to avoid: Establish and enforce clear billing and expense tracking policies across all clients.

Commingling Funds

Law firms must not commingle client trust account funds with funds from other accounts. For example, you can’t use money from trust fund accounts to pay off utility bills if you haven’t earned that money. Trust funds belong to the client unless they are earned or needed for client-related fees. Anything leftover after services are complete will go back to the client.

How to avoid: Use trust accounts as sparingly as possible, keep physical client trust records separate from other financial statements, and maintain diligent records for all transactions.

Failing to Differentiate Revenue and Income

Although these terms may feel interchangeable, they’re different. Revenue is the total amount of money a business has earned. Income is the amount of earnings left over after deducting expenses.

This differentiation can get tricky for law firms. Funds from a paid client invoice are fully considered revenue. However, these funds do not fully count as income.

You must first apply money from the paid invoice toward incurred costs. For example, if your firm paid court filing fees for the client, a part of their paid invoice must cover that cost. After covering client expenses, the leftover amount is considered income.

How to avoid: Keep detailed records of expenses incurred for each client’s legal matter to accurately cover costs once you’ve received payments.

Inaccurately Tracking Time, Mileage, and Other Data Discrepancies

Manually tracking hard and soft law firm expenses can become time-consuming. Even if you use apps or other solutions to track expenses, it can be tedious to consolidate data into one spot.

However, failing to track these expenses can lead to missed billable hours. If your team does not have a clear time tracking policy or a clear agreement with the client, you may also have issues properly billing for that time.

Data discrepancies related to invoices, bills, and other financial transactions can lead to larger issues. Manual bookkeeping can also lead to small mistakes—like duplicate entries—leading to reporting and compliance issues.

How to avoid: Invest in law firm practice management and accounting software to house and sync data on one platform.

Why Is Accurate Accounting for Law Firms Important?

Accurate accounting helps law firms ensure they remain compliant with all laws and requirements, maintain accurate records to inform business decisions, and provide transparency with clients about their funds.

In addition to simply preparing tax returns and complying with relevant ethical and regulatory guidelines, law firm accounting requires advanced organization skills, trust accounting mastery, and expertise with reliable legal accounting software to optimize the process. Without this level of diligence, law firms can become vulnerable to penalties and sanctions.

Trust account management is an especially complex aspect of law firm accounting. Watch a replay of our webinar with Claude E. Ducloux to learn about the basics of trust accounting.

Learn the basics of law firm accounting with Claude E. Ducloux of Lawpay.

Watch Now

Streamline Law Firm Accounting Processes with MyCase

Law firm accounting is a necessary process that helps firms understand their profitability and make better decisions to improve their financial health. Using outdated tools, employing multiple platforms, or attempting to do everything manually with spreadsheets can lead to errors and compliance issues. There are many advantages of using MyCase to fulfill your law firm accounting and law firm bookkeeping needs, including:

Easy three-way trust reconciliation management in compliance with bar regulations

Billing, payments, expenses, and banking data that are housed in one location

Capability to sync QuickBooks Online with MyCase to further help eliminate duplicate data entry or the hassle of reconciling accounts

Full transparency to see financial data and case information side-by-side to gain a clear understanding of your firm’s overall health and outlook.

User-friendly setup with simple accounting enablement and data migration

You can try MyCase Accounting today risk-free to see how our platform can streamline your accounting processes and help you manage your law firm practice with ease. Sign up today for a 10-day free trial or schedule a free demo with MyCase.

About the author

Justin FisherContent Writer

Justin Fisher is a content writer and SEO strategist for leading legal software companies, including MyCase, Docketwise, and CASEpeer, as well as LawPay, the #1 legal payment processor. He specializes in writing about emerging legal technology, financial wellness for law firms, and more.