Key takeaways

An Interest on Lawyer Trust Accounts (IOLTA) account is a trust account that sends earned interest to local Bar Associations. Interest funds are used for charitable causes like pro bono legal work.

Whether you’re new to managing trust accounts or a seasoned attorney, you’ve likely heard the term “IOLTA” at this point in your career. Most lawyers in the United States are required to use Interest on Lawyer Trust Accounts (IOLTA) accounts to house and manage client funds.

The IOLTA program was first launched in Florida in 1981 with the goal to use earned interest to support charitable causes, like providing civil aid to those who can’t afford it. Today, all 50 states and several U.S. territories have IOLTA programs. The American Bar Association (ABA) says IOLTA grants reached over $175 million in 2020.

Although IOLTA accounts have positively impacted our community, navigating the requirements can prove tricky for most law firms. Our 2024 Legal Industry Report uncovered that the process of law firm accounting is a function more than 1 in 10 legal professionals cite as a significant challenge.

Below, we’ll give an overview of what an IOLTA account is, how it works, rules to keep in mind, and best practices for managing IOLTA accounts.

What is an IOLTA Account and How Are They Used?

IOLTA accounts are a type of trust account that most local Bar Associations require lawyers to use to house unearned client funds and other funds that belong to the client. This can include settlement funds and retainer fee payments. These funds are kept separately from operating account cash flows and other funds. Once established, firms are typically required to report the new IOLTA account to their local Bar Association.

Interest earned from these accounts is sent to local Bar Associations to support nearby charitable legal work. Banks will typically handle the process of transferring interest to local Bar Associations.

In addition, IOLTA accounts usually hold funds from most of a law firm’s clients. This helps simplify account management while allowing the account to maximize its interest-earning potential.

We’ll explain how IOLTA accounts differ from other common accounts below.

IOLTA Account vs. Escrow Account

A third party manages an escrow account to hold funds before the parties involved meet the requirements to disburse the funds. For example, if your law firm is acquiring another law firm, the funds for that transaction may be held in an escrow account until the deal is complete.

Some financial institutions may use the terms “escrow account” and “trust account” interchangeably since they function similarly.

To ensure that you open an IOLTA trust account rather than an escrow account, confirm that the organization participates in the IOLTA program

Client Trust Account vs. IOLTA Account

An IOLTA account is a type of client trust account.

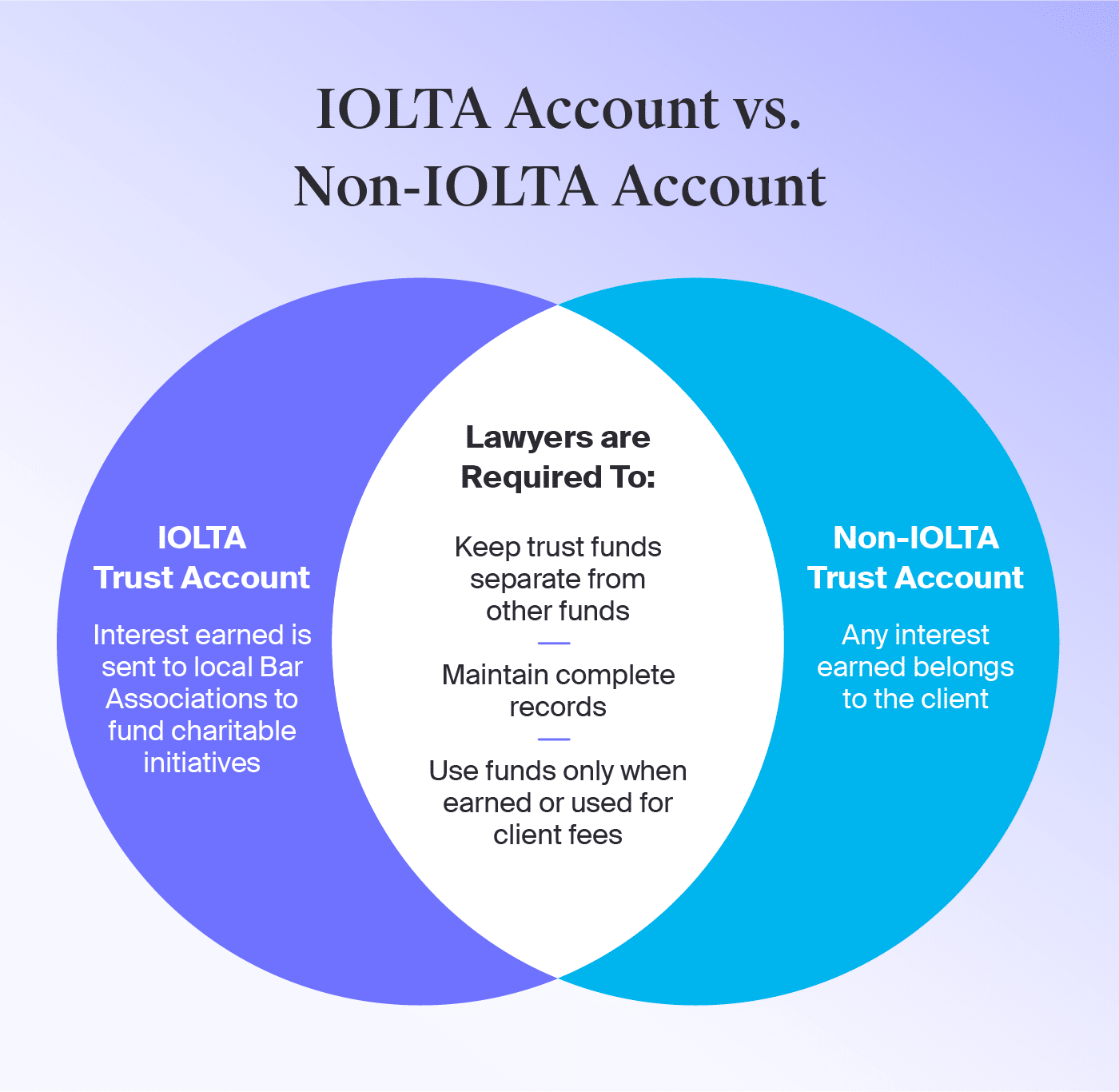

Lawyers generally must deposit client funds in IOLTA trust accounts if the potential interest they could earn wouldn’t exceed the costs of holding those funds in that account.

Law firms may potentially choose to use non-IOLTA trust accounts if they’re holding a large sum of the client’s money or holding it for a long period. In these scenarios, clients may earn more money from interest or investments in a non-IOLTA than if it were held in an IOLTA account. Interest earned in non-IOLTA trust accounts belongs to the client.

Before opening a non-IOLTA trust account, check your local jurisdiction’s laws and the local Bar Association’s requirements to confirm this is allowed. Since you’re acting as a fiduciary on behalf of your client, you must also disclose information related to the non-IOLTA account to clients, like interest rates and fees.

IOLA Account vs. IOLTA Account

An Interest on Lawyer Accounts (IOLA) account is the same as an IOLTA account. The term “IOLA” is most commonly used in New York.

IOLTA Trust Account Rules

The ABA’s Rule 1.15 covers guidelines for trust accounting and managing client funds.

Below is a summary of these rules:

House client funds that are paid in advance in an account separate from other funds.

Only deposit non-client funds if it’s the exact amount needed to cover that account’s bank fees.

Withdraw funds only when earned or if the client has incurred expenses that those funds will cover.

Quickly notify the client or third party when they’ve received funds or property that they have an interest in.

Promptly disburse funds or property that a client or third party is entitled to receive.

Share records of funds or property upon request by the client or third party.

Hold property in a dispute until the issue is resolved.

Maintain complete records of account funds and keep them for five years after services are complete.

Each local jurisdiction also has rules for managing client trust accounts, and many require lawyers to use IOLTA accounts. Rules for managing IOLTA accounts also vary by state. For example, many states require law firms to clearly label these accounts as client trust accounts.

Refer to the ABA’s state directory of IOLTA programs to learn more about requirements in your area.

Failure to abide by the ABA’s and your local Bar Association’s rules can lead to reprimand, suspension, fines, or—in extreme cases—disbarment.

Check out the replay of our Accounting 101 Webinar with Charles E. Ducloux to learn about the basics of trust accounting and how software can help your law firm stay compliant.

Learn the basics of law firm accounting with Claude E. Ducloux of Lawpay.

Watch Now

How Does an IOLTA Account Work?

Lawyers must deposit unearned client funds and funds belonging to the client into the IOLTA account and only withdraw them once the funds are earned or needed for client-related fees. The bank handles interest and automatically transfers interest earned from IOLTA trust accounts to local Bar Associations.

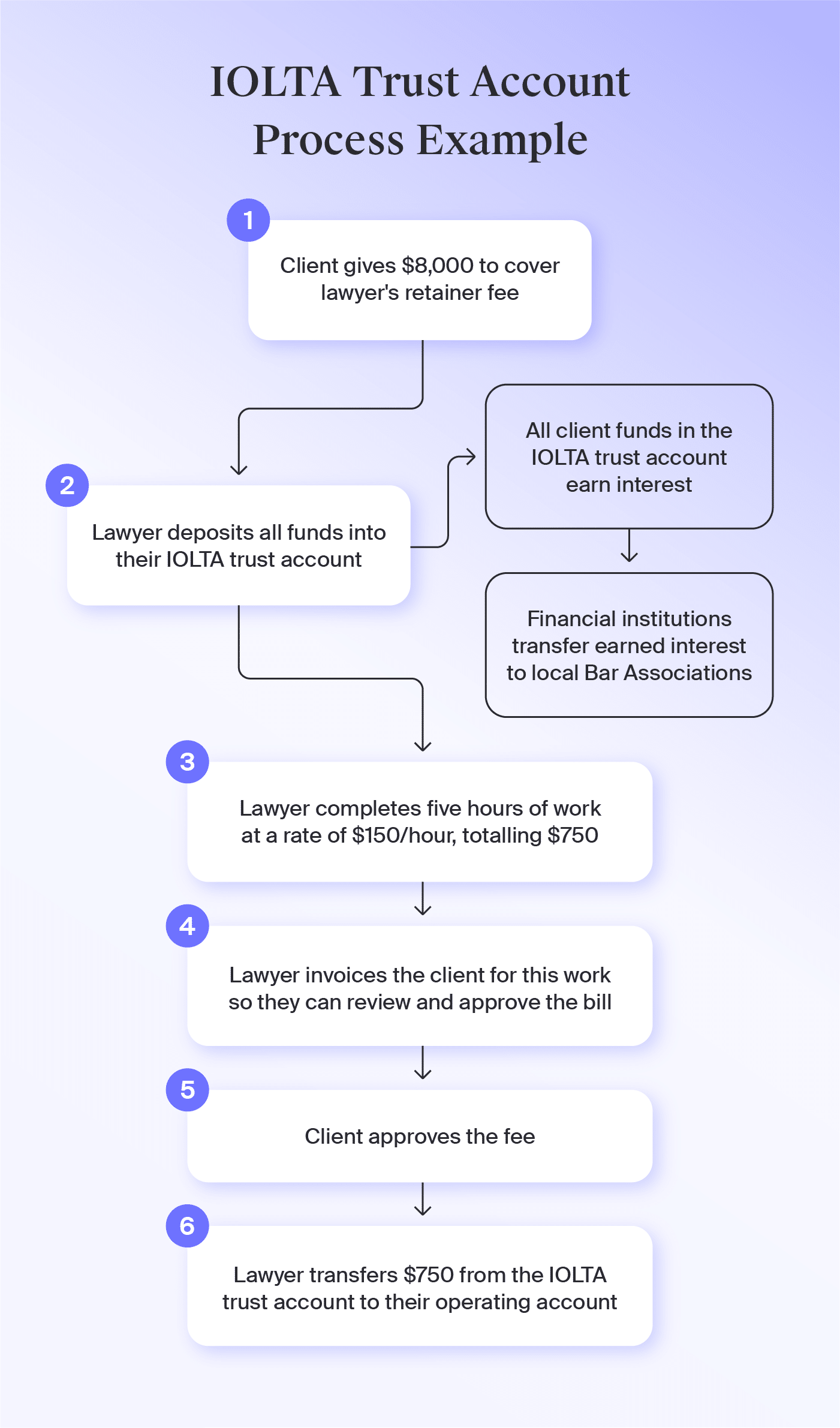

We’ll use a simple hypothetical example to illustrate what this can look like. We’ll say that you’re representing a business to help them draft and review contracts.

The client gives you $8,000 to cover your retainer fee.

Your law firm deposits all funds into your IOLTA trust account.

You complete five hours of work at a rate of $150/hour, which comes out to $750.

You send an invoice to the client for this work so they can review and approve the bill.

The client approves the fee.

You transfer $750 from your IOLTA trust account to your operating account since the money has now been earned.

If you completed all services and paid all expenses, you will return the remaining unused $7,250 to the client.

IOLTA Account Best Practices

IOLTA trust accounting requires law firms to maintain and constantly update records for all transactions related to that account. However, keeping track of data for multiple clients can quickly feel overwhelming. Below, we’ll review best practices to help your law firm stay organized while managing IOLTA accounts.

Bank With Recommended Institutions

Local Bar Associations typically have lists of IOLTA-eligible banks and “Leadership Banks” to choose from. Leadership Banks are institutions that generally waive fees and grant good interest rates for IOLTA accounts.

Start your search by checking those lists. You can also narrow down your vetting process by getting recommendations from colleagues.

Qualities to look for in an IOLTA-compliant bank include:

Familiarity and experience with the IOLTA program

Favorable interest rates for IOLTA accounts

Ability to share comprehensive reports and documentation necessary for your state’s reconciliation requirements

Not charging bank fees for IOLTA accounts or providing an easy way for firms to cover fees without violating IOLTA requirements

Keep Client and Business Funds Separate

The ABA requires firms to keep client funds separate from business funds. This distinction helps prevent law firms from accidentally misappropriating client funds for non-client expenses.

Examples of commingling client and business funds include:

Using one client’s funds for another client’s expenses

Depositing client funds into an operating account instead of a trust account

Paying bills with unearned client funds, even if you plan to replenish the funds

Charging bank fees to the trust account, including payment processing fees

Leaving earned client trust funds in the client trust account, as that money no longer belongs to the client and is considered business funds

Law firms should minimize the use of client trust accounts until it’s absolutely necessary to deposit or withdraw funds. Keeping client trust account-related records, receipts, and checks physically separate can also help prevent accidental commingling.

Software like MyCase’s legal accounting solution makes this easy by assigning trust account funds to specific clients. By doing so, our platform can monitor balances and prevent you from withdrawing more funds than a client has in their account. You’ll also receive a notification when balances are low.

Regularly Reconcile and Audit Accounts

Routine three-way trust reconciliation helps law firms confirm that all financial records relating to their IOLTA accounts are accurate.

This process generally looks like this:

Compare the balance and transactions from your bank statement with your trust account ledger.

Correct the bank statement (if required) to ensure it matches the trust account ledger.

Confirm transactions and balances from the updated bank statement match each client’s trust ledger that documents all transactions for each client.

Correct the bank statement (if required) to ensure it matches each client’s trust ledger.

Reconciliation requirements, including frequency, can vary between states. In addition to meeting compliance, regular three-way trust reconciliation can help ensure records are complete and ready to send to your local Bar Association or to your client—if requested.

MyCase Accounting allows you to easily perform three-way trust reconciliation within the platform by housing information in one platform and eliminating redundancies that happen when working in multiple spreadsheets and solutions. You can also connect your bank account directly to our platform to see the status of your accounts in real-time.

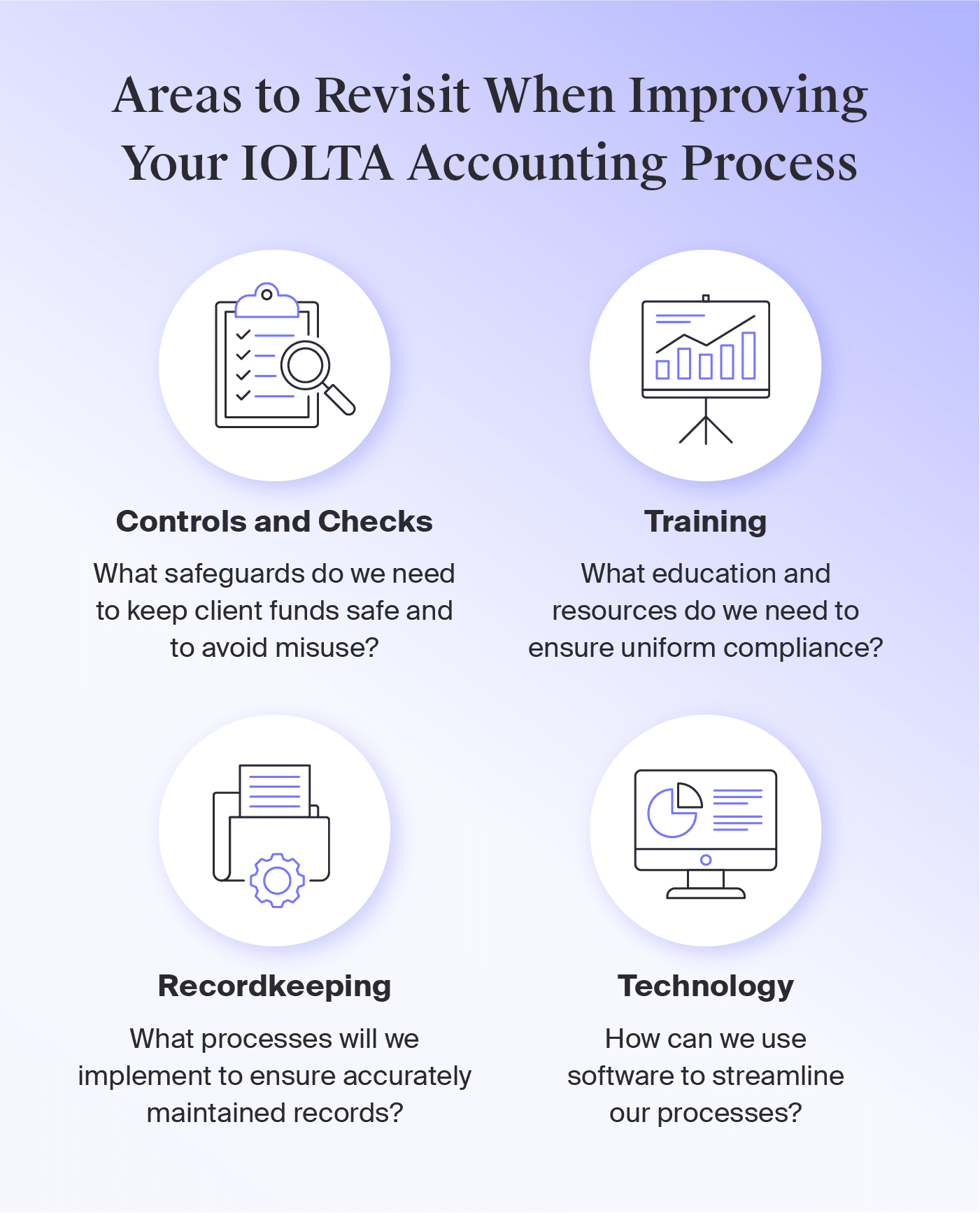

Establish Clear Internal Processes

The law firm accounting process is complex and can become frustrating if you haven’t established standardized guidelines.

Below are examples of questions to answer when formalizing accounting processes for your team:

What checks and balances do we need to establish before making IOLTA account deposits or withdrawals?

How often will we perform three-way trust account reconciliation? Who is responsible for this?

How are we tracking and maintaining our trust ledger(s) and client ledgers?

Where can we standardize our recordkeeping processes to minimize errors and non-billable hours?

What areas of this process does the team need more training on? Who is responsible for this training?

Does everyone in the firm understand what they’re responsible for when handling client trust funds?

What software should our team consider to streamline the accounting process? How do we ensure IOLTA compliance with our tools?

What systems can we replace or enhance with more updated technology?

Maintain Complete Records

Although specifics vary by state, IOLTA trust accounting generally requires firms to maintain up-to-date records of each trust account’s transactions and ledgers for every client.

Firms must be able to promptly share these records when requested by clients or their local Bar Association. Related to this, law firms should also deposit physical checks immediately to ensure balances are always accurate.

Detailed records help your firm maintain transparency for each client and ensure they can access funds right away. They also help your firm avoid reconciliation issues by properly recording transactions in real time.Furthermore, firms must ensure transactions are accurately recorded. For example, client trust fund deposits should not be logged as income. Clients own these funds until the law firm earns them through billable work.

MyCase Accounting allows law firms to centralize client and financial data in one platform. You can view details about client trust account transactions and balances and easily generate invoices and reports with our solution.

Our platform also makes it easy for your clients to see the status of their accounts. When enabled, Case Balance Summary automatically adds a client’s account balance to the bottom of invoices. Clients can also easily access account statements, invoices, and other information through our secure client portal.

Use IOLTA-Compliant Software

There are several accounting solutions available for all businesses. However, not all platforms are IOLTA-compliant or equipped to meet the unique needs of law firms.Software like MyCase’s legal accounting solution is IOLTA-compliant and created with law firms in mind. With features like trust fund attribution, automatic bank account reconciliation, and banking integration, MyCase provides any law firm with full visibility and control to help maintain compliance.

Stay Compliant with IOLTA Account Rules with MyCase

Maintaining IOLTA account compliance requires accurate data, streamlined processes, and powerful tools to keep the entire trust accounting system operational.

Manually recording transactions or using multiple financial platforms can take hours to track and reconcile. In addition to lost time, disorganized accounting systems can lead to unhappy clients, misappropriation of funds, and disciplinary action if mistakes are made.

MyCase’s legal accounting software simplifies the IOLTA trust accounting process by housing case data and financial information in one IOLTA-compliant system. Save time and have peace of mind by automating bank reconciliations, maintaining up-to-date records, and preventing the commingling of funds.

Schedule a free demo with MyCase to learn how we can help you more easily manage your IOLTA accounts.

About the author

Esther ParkContent Writer

Esther Park is a content writer and Senior SEO Manager for leading legal software companies, including MyCase, Docketwise, and CASEpeer, as well as LawPay, the #1 legal payment processor. Her expertise lies in writing about emerging legal technologies and financial wellness strategies for law firms, among other topics.