55

%of firms report expense tracking as a challenge.

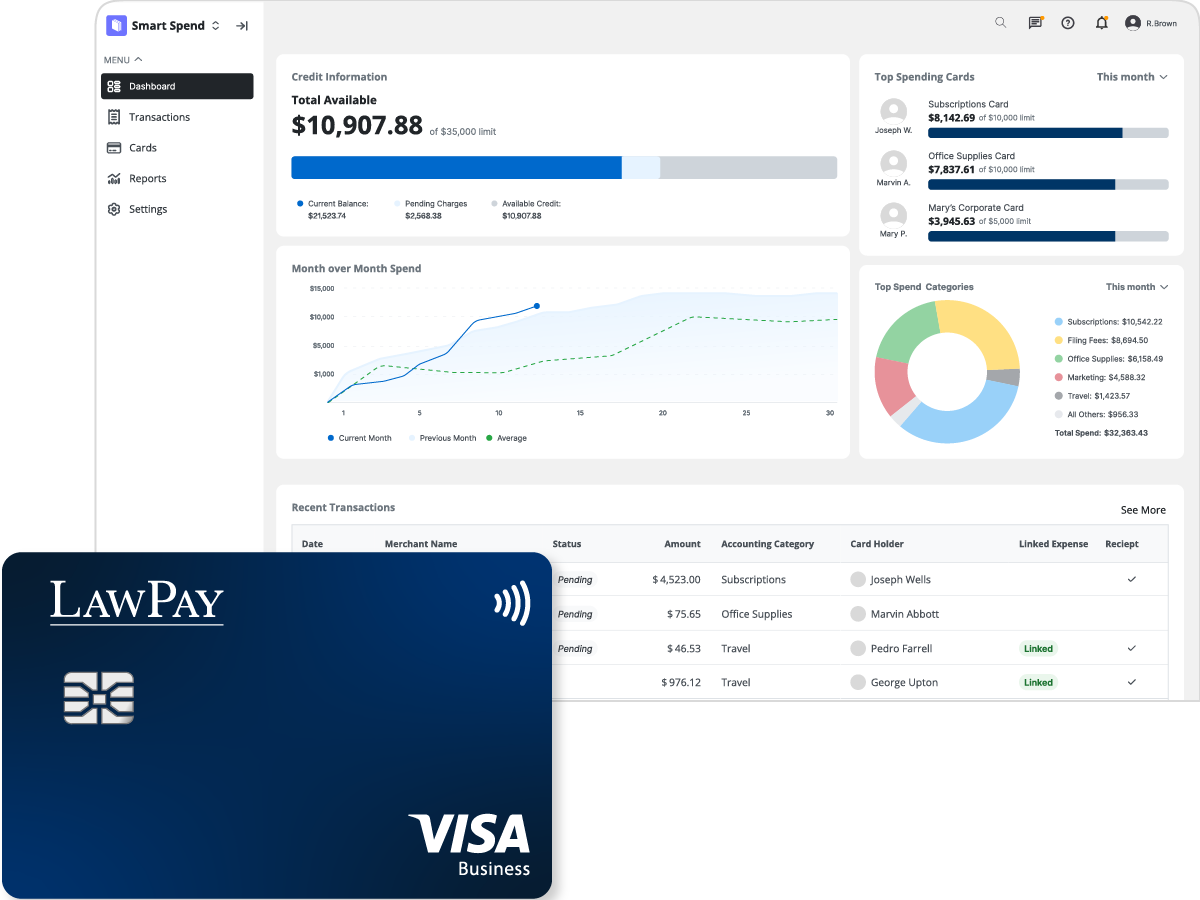

Tracking firm expenses is a headache—lost receipts, unbilled costs, and month-end reconciliation chaos drain your bottom line and your time. Smart Spend automates it all.

With a LawPay Visa® Business Card integrated into MyCase, law firm expenses are instantly tracked, linked to cases, and added to invoices, so you recover 100% of advanced costs—effortlessly. It’s the first business credit card designed for the unique needs of SMB law firms.

WITH SMART SPEND | WITHOUT SMART SPEND | |

|---|---|---|

No More Missed Expenses Every dollar is tracked effortlessly. Use Smart Spend to link expenses to cases and automatically add those expenses to the next client invoices. | Lost Billable Expenses and Revenue Missed expenses mean lost client reimbursements. Without a reliable expense tracking system, law firms leave money on the table. | |

Faster, Easier Month-End Reconciliation Since expenses are already categorized and linked, staff can close books faster with less chance of missing transactions. | Hours Wasted on Manual Reconciliations At month’s end, staff scramble to find receipts, match expenses, and reconcile accounts manually. | |

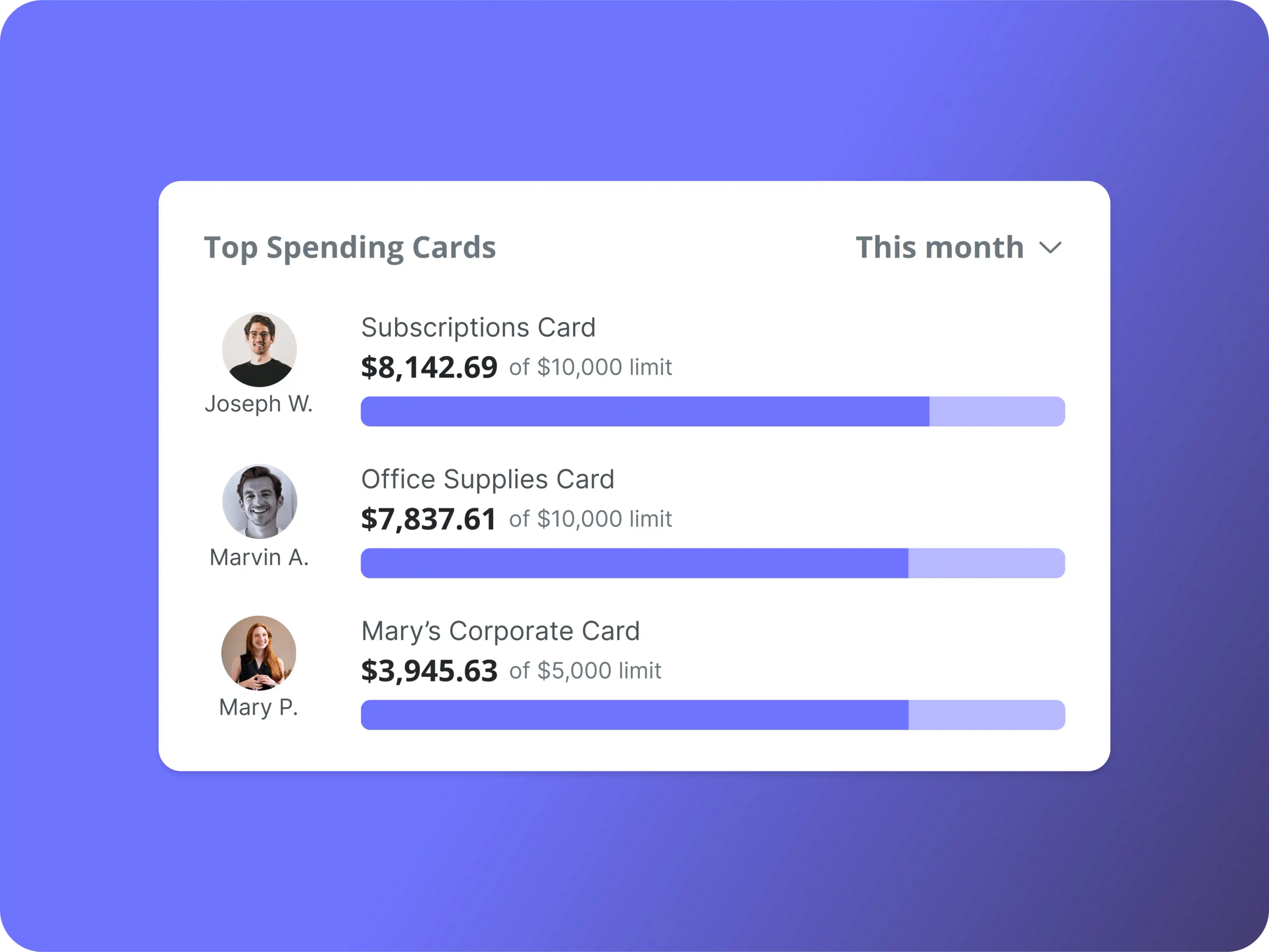

Full Visibility & Spend Control Smart Spend’s dashboard shows every transaction while spend limits for individual cards prevent overspending. Cards can be locked or paused instantly. | Limited Control Over Card Spend Firms don’t know what’s been spent until the statement arrives. Firms can’t set individual card limits, issue dedicated cards, or lock and pause cards. | |

Smarter Cash Flow & Firm Credit Benefits Strengthen your firm’s credit profile with the LawPay Visa® Business Card, the only credit card that integrates with practice management to meet the unique financial needs of law firms. | Cash Flow Challenges When cash isn’t coming in, it can be difficult to make purchases or pay bills. Mixing personal and business finances complicates reconciliations and results in higher personal credit utilization. |

55

%of firms report expense tracking as a challenge.

57

%of firms struggle with reimbursable expense collection.

61

%of firms cite accounting as a challenge.

I love this. This is the best thing ever. This is going to save so much time for my staff

Emily McFarling / Managing Partner, McFarling Law

Seamless spend management for law firms, built right into MyCase’s platform—where you already handle your cases, billing, and business operations.

Lawyers have spoken—we listened. MyCase Smart Spend delivers exactly what law firms need: a smarter way to track expenses, manage budgets, and simplify client billing.

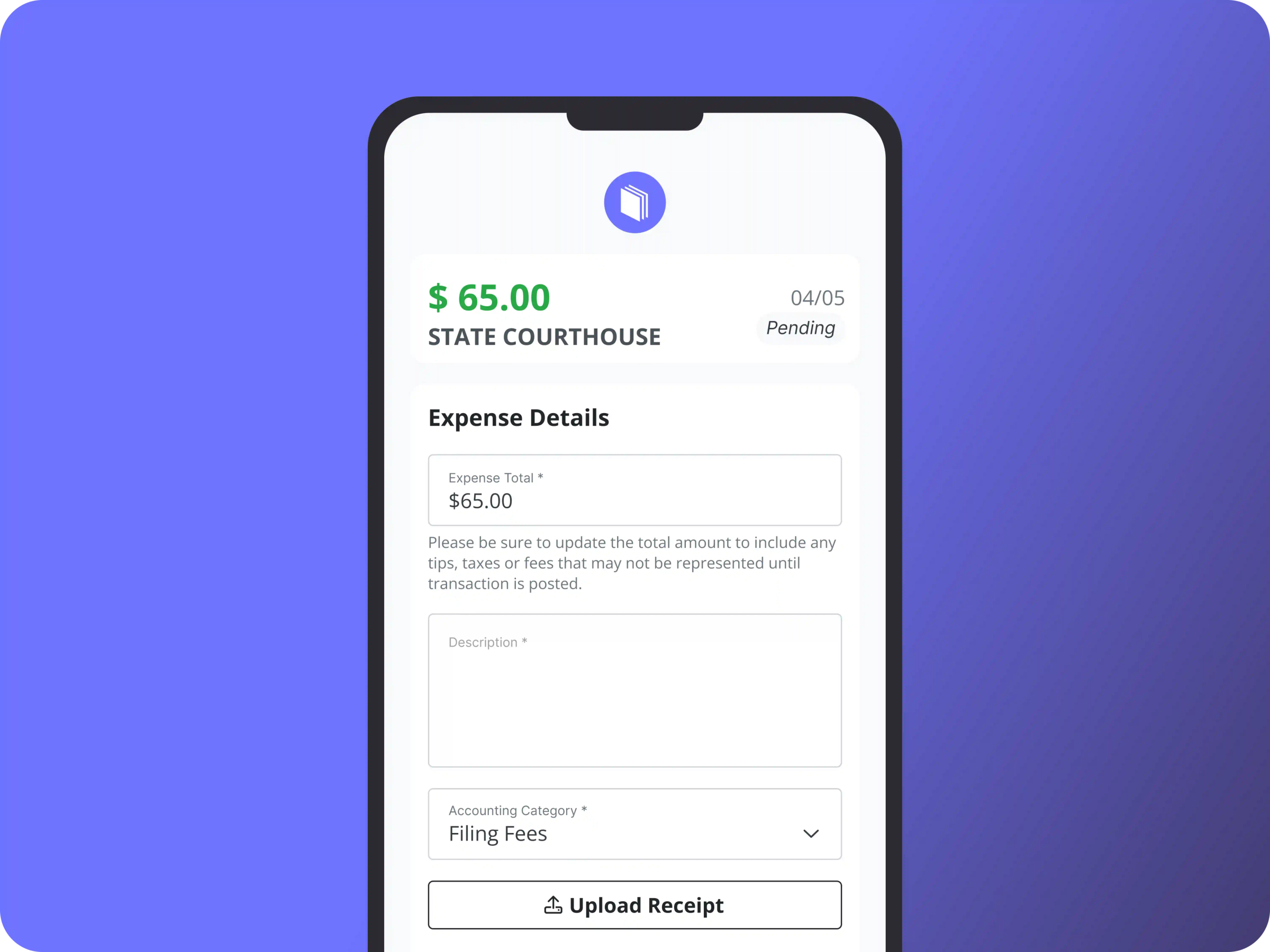

Ensure every reimbursable expense is accounted for—no more losing revenue to unbilled client costs.

Automate expense tracking for case expenses like transcripts, depositions, and court filing fees

Link expenses and receipts directly to client cases

Add case expenses automatically to invoices for seamless billing

Stay in control of your firm’s finances with real-time expense insights and reporting.

Know exactly what’s being spent at any point in time

Track purchases by card from a comprehensive spend dashboard

Avoid end-of-month surprises with full visibility into firm spend

Ditch the piles of receipts with automated receipt tracking and case linking.

Link expense details to cases at time of purchase

Every time the card is used, there’s one less expense to reconcile

Simplify accounting and bookkeeping with automated expense reporting

Reduce financial risk by managing firm spend before it happens.

Set spending limits by card to prevent overspending

Instantly pause or lock cards when misplaced or misused

Assign virtual or physical cards to staff for controlled purchasing