Whenever clients entrust you with money for work that hasn’t been done, such as a retainer payment, that money goes into a client trust account, usually called an IOLTA account. Funds sitting in a client trust account are subject to very strict and specific rules set by a state’s bar association.

Accidentally commingling or misusing those funds can have very serious consequences for lawyers, so maintaining IOLTA account compliance is top of mind for many law firms. Unfortunately, most law schools don’t spend enough time going into the practical ways this is done.

A three-way trust account reconciliation is the safest way to ensure your accounts are complete, accurate, and compliant. In most states, bar associations actually require law firms to do a three-way reconciliation for trust accounts on a monthly or quarterly basis. While it’s often overlooked, taking a moment to grasp the basics of three way reconciliation accounting could potentially save your practice a lot of trouble in the long run.

In this article, we’ll walk through the basics of a three-way reconciliation, the key components, and some examples of what it looks like in action.

What Is a Three-Way Reconciliation for Trust Accounts?

In basic accounting terms, reconciliation is done to ensure an account balance is complete and accurate by comparing it against another set of records. Many businesses use a two-way reconciliation process. In fact, you may have done a two-way reconciliation yourself when balancing a checkbook—making sure the amount of your various deposits and written checks matches the balance in your bank account.

Because legal client trust accounts are governed by much stricter rules than a typical business account, a third set of records is added to the reconciliation process. A three-way reconciliation accounting process makes it even easier to discover any unintentional or intentional errors, and ensure there is no commingling of earned and unearned funds. This process must be done with every trust account controlled by the practice.

What Are the Components of a Three-Way Trust Account Reconciliation?

As the name implies, a three-way reconciliation for trust accounts simply adds an additional layer of reconciliation to explain all disbursements and payments of client funds. There are three elements that go into a three-way reconciliation:

1. Trust Ledger

A trust ledger is the internal record of all transactions going in and out of a client trust account. Often, checks and deposits do not necessarily clear on the same day they are recorded, so will not perfectly match the account balance statement. This makes the trust ledger invaluable for ensuring accuracy in the reconciliation process.

2. Client Ledgers

Also referred to as “balance by matter,” a client ledger is a summary of client transactions grouped by each individual client. Maintaining the client ledger is also part of a firm’s internal accounting process. Added together, the amounts recorded for each client should match the amount in the trust. A client ledger also serves another purpose—it gives every client a transparent view of their trust account balance at any given time.

3. Trust Account Bank Statement

The final component of a three-way trust account reconciliation is the account statement generated by the bank. The trust account bank statement will show all deposits, withdrawals, and interest payments. Since the bank statement is provided by a third-party, it serves as a way to validate all transactions shown on the trust and client ledgers.

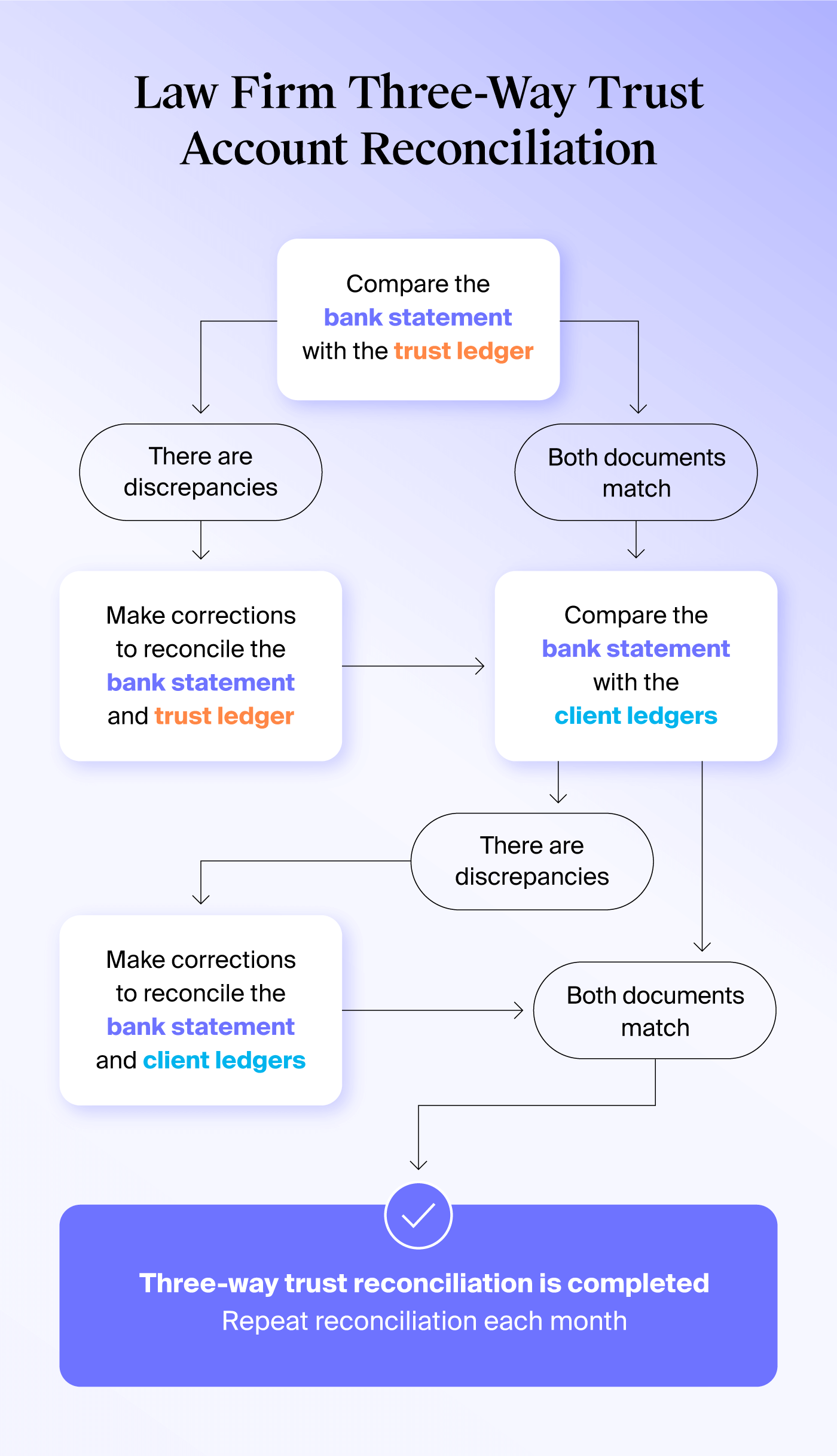

How to Perform a Three-Way Trust Account Reconciliation

Now that you understand the core components of a three-way trust account reconciliation, let’s walk through how to complete the process. Again, a friendly reminder: If you maintain multiple trust accounts, you must reconcile each trust account.

1. Bank Statement Reconciliation

First, reconcile your trust account bank statement with the internal records maintained by an accountant or in legal accounting software, such as MyCase’s end-to-end accounting solution. Comparing a third-party overview of the account with your internal records (receipts, checkbook register, disbursement journal) helps you spot and correct any discrepancies, including:

Deposits made after the statement closing date

Withdrawals made or checks deposited after the statement closing date

Bank or transaction fees that were incorrectly charged to the account

A quick note on bank fees: At no point should any transaction or bank fees be charged from a client trust account. Most banks or accounting software will automatically deduct those fees from a firm’s operating account instead, but mistakes can happen—yet another reason why performing regular reconciliation is so important.

2. Compare New Entries to the Reconciled Bank Statement

Once you’ve adjusted the bank statement to match the trust ledger, compare the reconciled bank statement with any new entries on your client ledgers. Many times, there are pending transactions on the books even though the funds haven’t cleared the bank. This could be due to receiving a check that hasn’t been deposited or a delay from electronic processing. Either way, it’s important to amend the statement to account for any missing transactions.

3. Repeat Monthly

The final step is one that is maybe the easiest to forget, which is to reconcile regularly. While some state bar associations only require attorneys to do a three-way reconciliation quarterly, it is always a good idea to stay on top of your finances by doing it monthly instead. Experts in trust accounting for law firms recommend that legal professionals do the reconciliation at the same time every month to coincide with when the bank statement becomes available.

Sample Three-Way Reconciliation for Trust Accounts

While three-way reconciliation may sound a little complex, there are many resources online that walk you through the process step by step and show examples.

Often, you’ll be able to find resources like these from your state bar association.

How Legal Accounting Software Can Help With Managing Trust Accounts

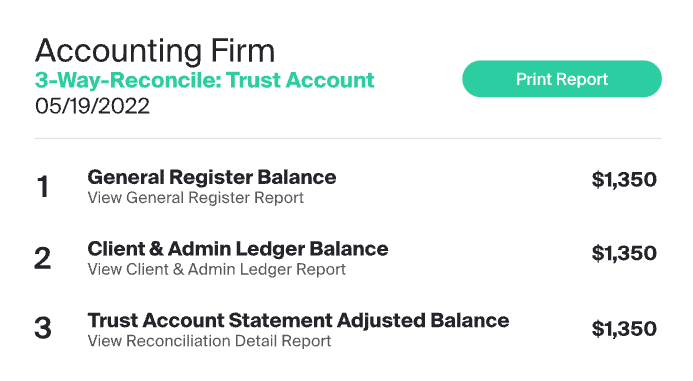

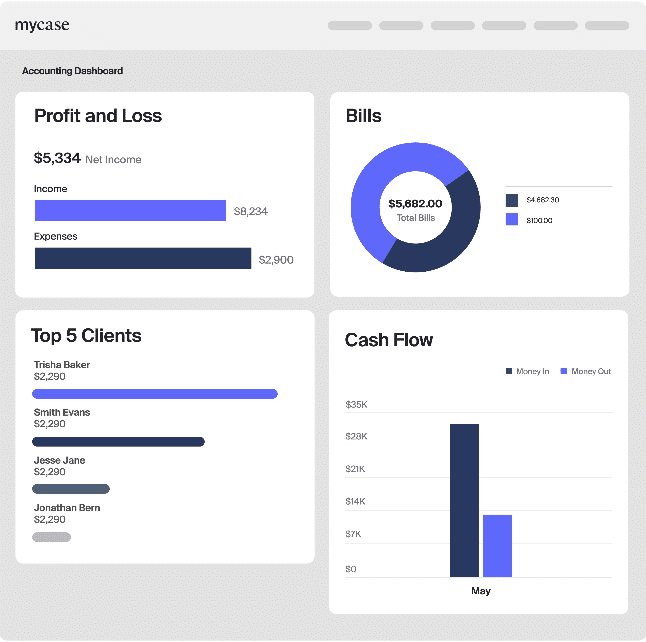

Accounting for attorneys can be incredibly complex, especially for law firms that don’t have the resources for a dedicated accounting team. That’s why leading law firms increasingly rely on legal accounting platforms like MyCase to modernize their legal accounting processes, streamline case management, and simplify reconciliation. Below are examples of how MyCase Accounting integrates into the MyCase platform to offer robust three-way account reconciliation that meets full compliance measures, as well as automatic generation of client ledgers.

MyCase Accounting Example One

MyCase Accounting Example Two

In addition to accounting, MyCase also provides legal financial software to track trust account balances, aging invoice reports, payplan insights, and more. For more information on profitability, read this article on how to set law firm financial benchmarks.

By leveraging a trusted case management solution with specialized IOLTA accounting features, attorneys can save time on complicated financial tasks and spend more time on client management and strategic goals.

Try MyCase for free to see how MyCase Accounting can help your firm streamline three-way reconciliation and stay compliant.

About the author

MyCase Team