Gain Financial Confidence. Grow a More Profitable Firm.

You built your law firm to help clients, not to stress over invoices, budgets, or disjointed financial data. But without the right systems, managing your firm’s finances can feel overwhelming and it can hold your growth back.

It’s time to cut the friction, boost your cash flow, and run your firm with clarity and confidence.

Achieve Financial Peace of Mind

Billing delays, missed time entries, scattered data—sound familiar? Let’s tackle your biggest financial pain points so you can make confident decisions that drive success.

Keep Your Firm Compliant and In Control

Without clear visibility into your firm’s finances, oversights can escalate into cash flow gaps, compliance issues, or trust account mismanagement. Stay ahead of problems by tracking every dollar all in one place. With real-time visibility into finances, you can catch errors early, simplify compliance, and keep your firm healthy and profitable.

See Your Full Financial Picture

Disjointed or missing financial data makes it hard to plan, invest, or grow with certainty. When your firm’s revenue, expenses, and performance trends are all in one place, you gain the clarity needed to make smarter business decisions, backed by real-time insights—not guesswork.

Get Paid for Every Hour You Work

Unpaid invoices and missed time entries drain your firm’s cash flow. Switching between separate tools for time tracking, invoicing, and payments makes it easy for things to slip through the cracks. When you work in one place, you can track time as you work, send invoices faster, and get paid without delays.

Track the Full Financial Path of Every Case

Every case that enters your firm follows a financial path. With the right tools, you can guide that journey with clarity, confidence, and control.

Start Smart with Every Case

Set trust account, define fees, collect payment details, and save everything securely in the client file.

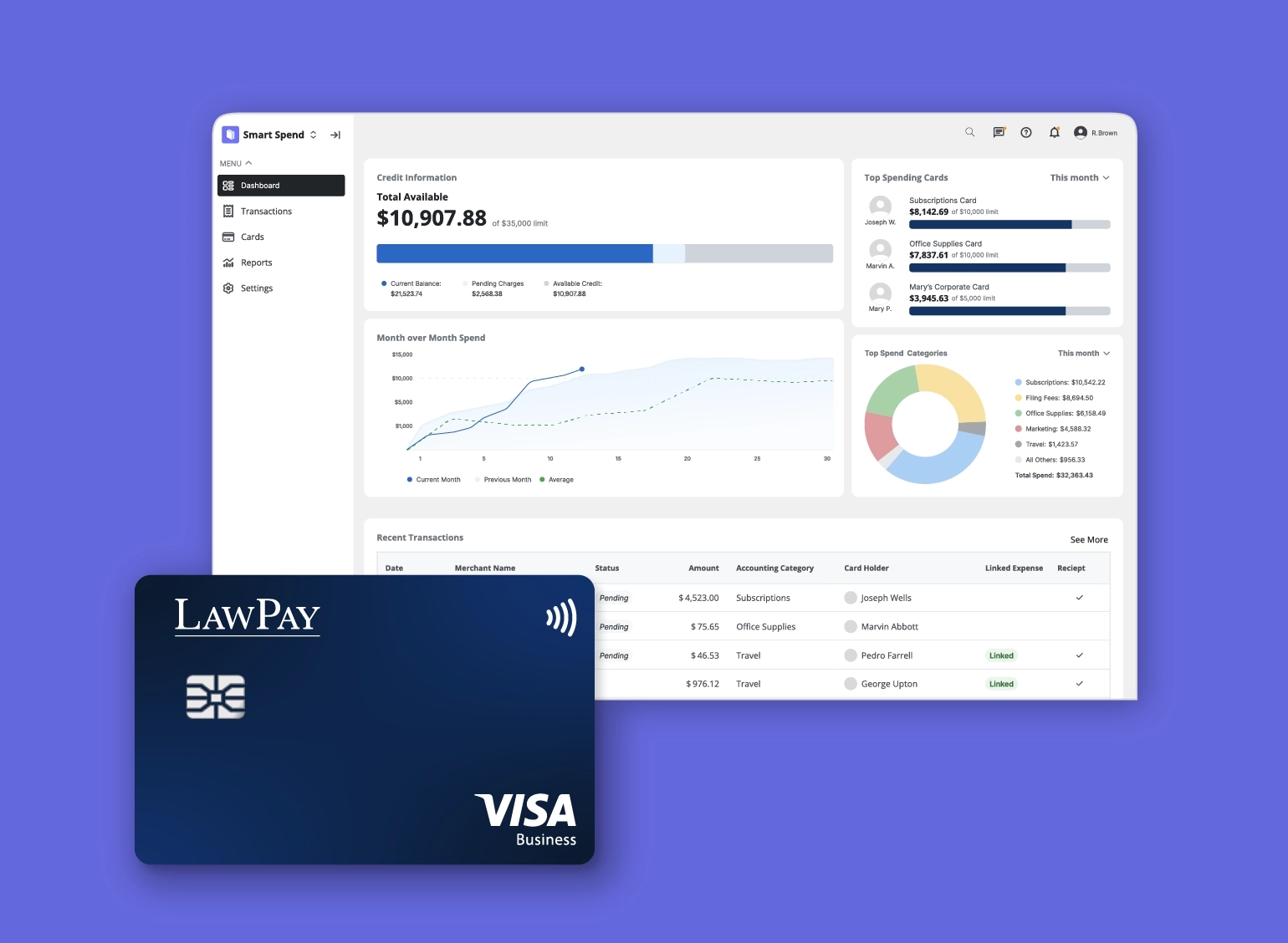

Log expenses with Smart Spend

Track advanced case costs in real-time and gain visibility into firm spend.

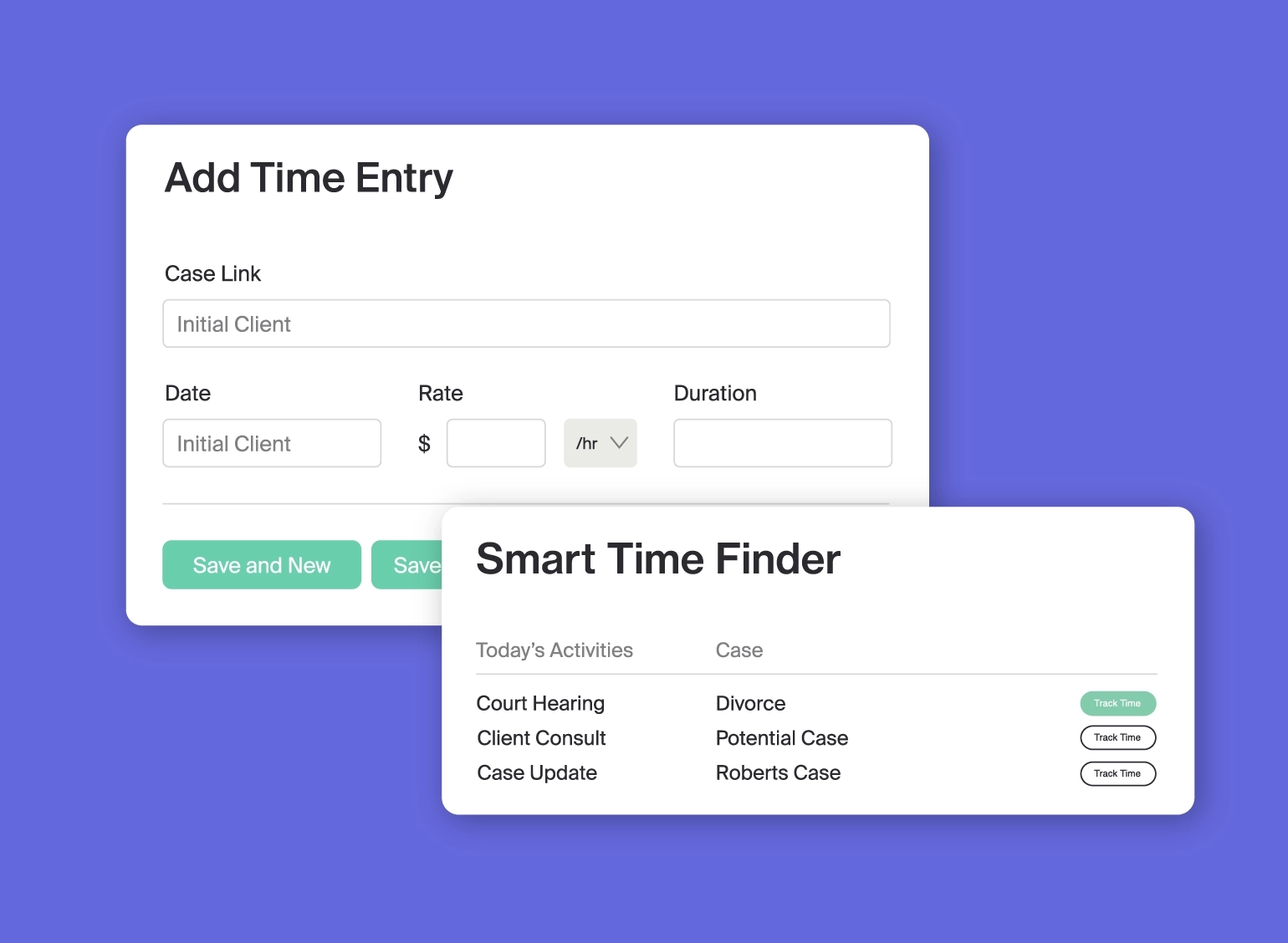

Automatically Track Every Hour You Work

Lost time is lost revenue. MyCase Smart Time Finder and built-in tracking help you bill accurately and automatically.

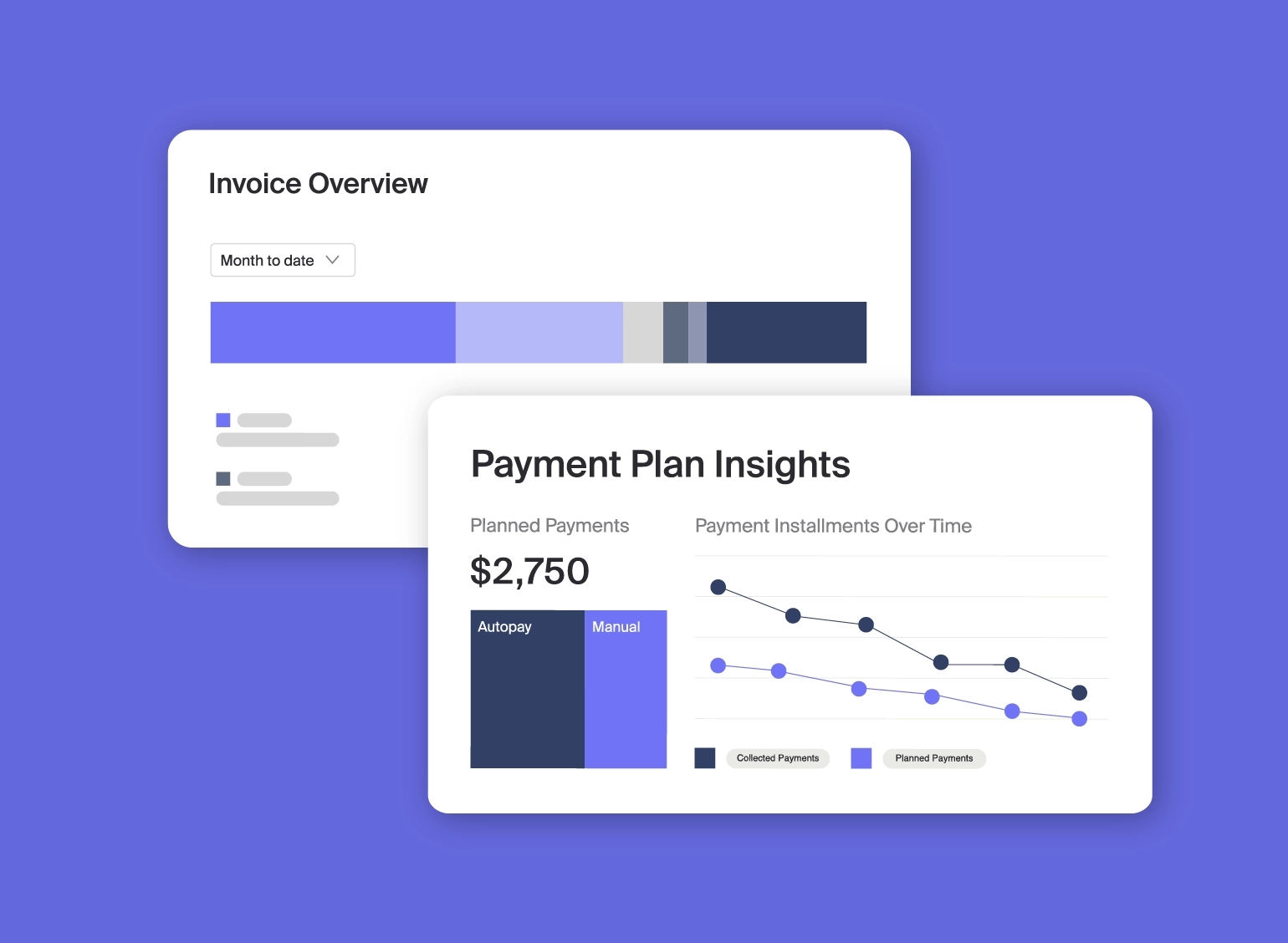

Send automated invoices and offer online payment plans

Simplify the billing process and give clients flexible ways to pay.

Receive Payments Fast

Don’t wait to get paid. With Next Day Funding and built-in payment tools, LawPay keeps your cash flow predictable and strong.

Stay IOLTA-compliant

Keep client funds separate and stay IOLTA-compliant without added complexity.

Reconcile accounts with MyCase Accounting

Automate transaction matching and skip the spreadsheet headaches.

Review profitability and performance

Review case revenue, expense trends, and firm-wide financial health in just a few clicks.

One Platform. Every Feature Your Firm Needs.

All the tools your firm needs to stay compliant, get paid faster, and grow with confidence.

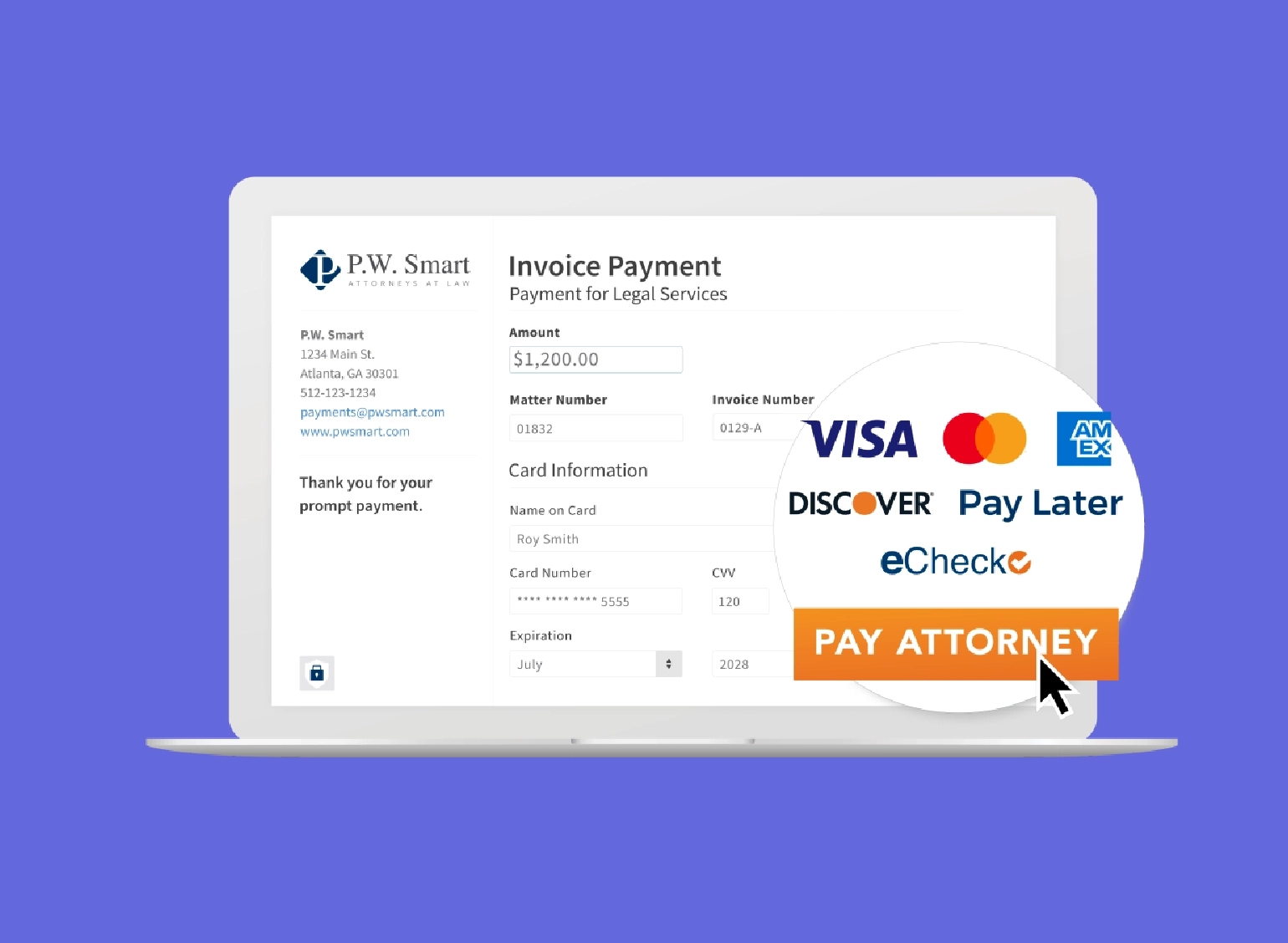

Accept Compliant Payments

Accept credit, debit, or ACH payments online and protect trust accounts with built-in safeguards to make it easy for clients to pay while staying compliant.

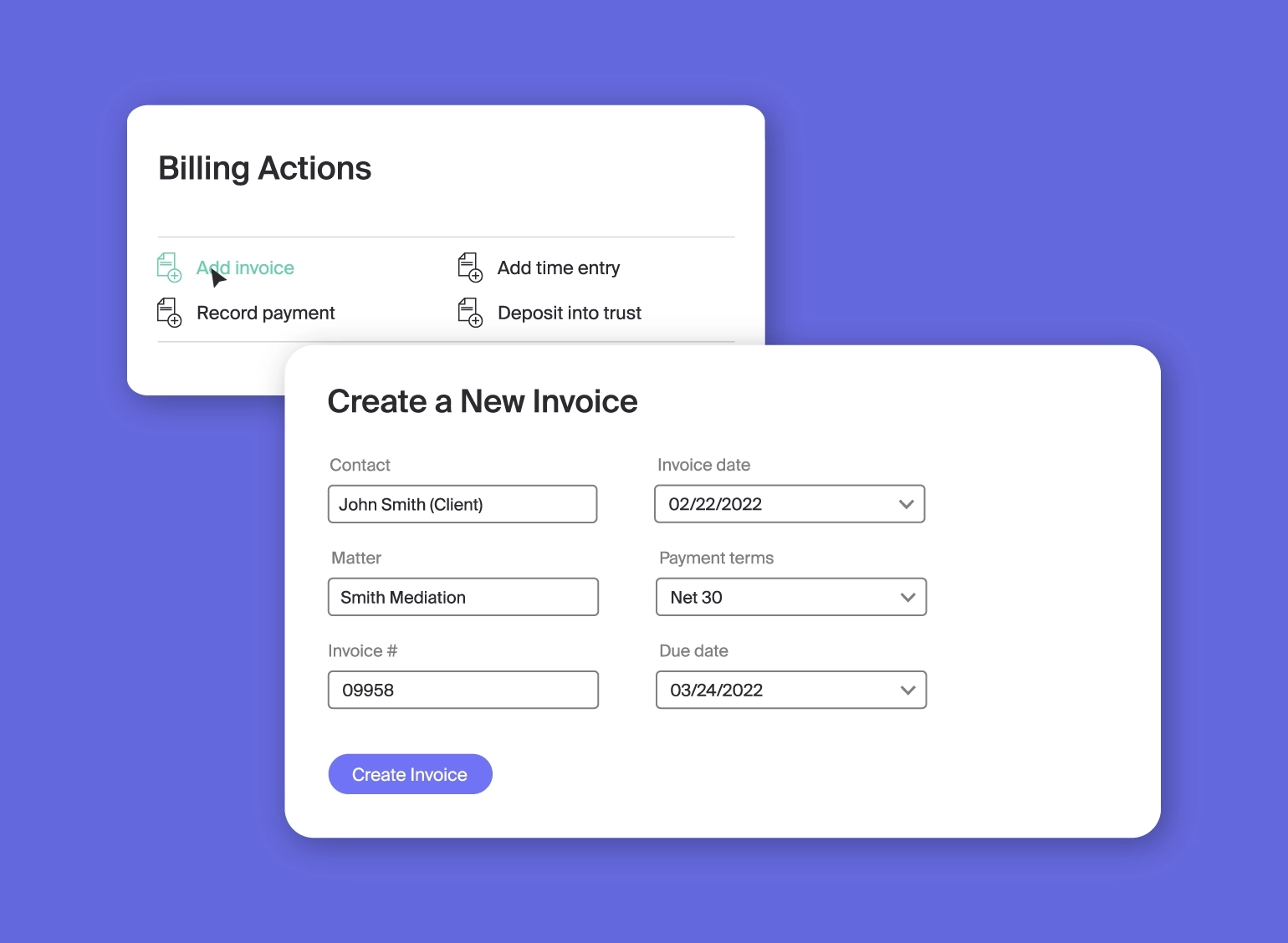

Simplify Billing

With easy-to-use invoicing tools and flexible payment plans, you can reduce administrative work and improve your firm’s cash flow.

Streamline Your Accounting

Track income, reconcile accounts, and manage trust funds with built-in accounting tools that reduce errors and keep your firm financially sound.

Control Case Expenses

With Smart Spend, you can track and categorize spending as it happens—giving you full visibility into firm finances and helping you stay on budget.

Never Miss a Billable Minute

Smart Time Finder helps you capture time entries you might have forgotten, so you can stop wasting money and boost your bottom line.

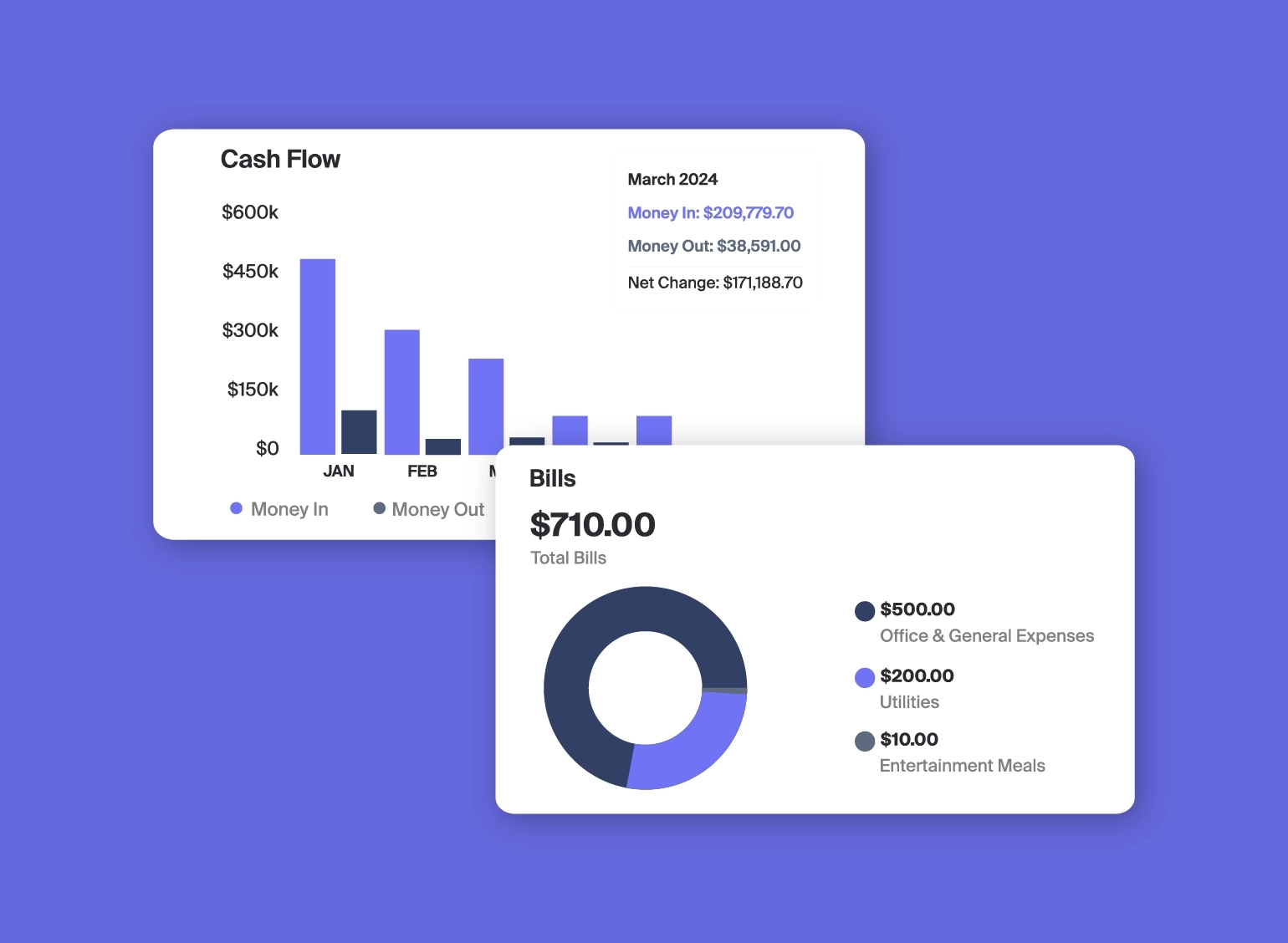

Turn Data Into Insights

Make confident business decisions with real-time financial reporting. Track profit, revenue, and even marketing ROI—all from one central dashboard.