Key takeaways

Legal data analytics helps turn case, billing, and operational data into insights that support better planning and decision-making for law firms.

Legal professionals can use AI-powered analytics to identify trends faster and detect risks earlier.

Customized reporting allows firms to focus on the metrics that align with how they actually work, rather than relying on one-size-fits-all reports.

Applying insights from legal analytics can improve firm efficiency, cash flow, and client service.

Law firms generate a steady stream of data through everyday business activities such as tracking time, collecting payments, opening and closing matters, communicating with clients, and managing tasks and deadlines. These activities produce measurable data on case timelines, utilization rates, billing realization, payment patterns, and workload distribution.

Much of this information is captured in case management and billing tools—but in some cases, firms might not be aware of how much data they already have access to. If legal professionals don’t tap into these insights, they may rely on incomplete views of performance when making important decisions about cases, staffing, and operations.

Legal data analytics offers a more structured way for firms to use the data they collect, once they know where to look. By applying consistent methods to gather and analyze information, lawyers can gain a deeper understanding of what’s happening across the practice and use that perspective to guide their decisions. This article breaks down how legal data analytics works, the different forms it takes, and how firms can apply it to improve efficiency, financial outcomes, and overall performance.

What is legal data analytics?

Legal data analytics is the practice of analyzing law firm data to identify patterns, trends, and measurable indicators across the business. It brings together information from multiple areas of the firm, including case activity, financial records, operational workflows, and client interactions, allowing performance to be reviewed in a structured and consistent manner.

Rather than looking at each data point in isolation, legal data analytics evaluates related information collectively. This approach helps firms see how work progresses, where delays tend to occur, and how resources are allocated across matters and teams, creating a foundation for more informed analysis.

Legal data collection vs. data analytics

Data collection and data analytics are closely related, but they serve different purposes within a law firm.

Legal data collection focuses on gathering information. This includes capturing details from case files, time entries, invoices, intake forms, communications, and operational systems. On its own, collected data is descriptive and often fragmented.

Legal data analytics focuses on interpretation and insight. Analytics examines collected data to uncover trends, correlations, and outliers that inform decisions about operations, finances, risk, and client strategy.

To put it simply, data collection answers the question of what information exists, while data analytics explores what that information means and how it can be used to improve performance.

Types of legal data analytics

Law firms use several types of legal data analytics, each focused on a different aspect of firm performance and decision-making.

Case analytics examines how matters move through the firm, analyzing timelines, outcomes, task completion, and workload distribution to identify delays, inefficiencies, and high-performing case types.

Operational analytics focuses on day-to-day firm operations, including staffing levels, utilization rates, task assignments, project management details, and turnaround times, helping firms balance workloads and improve internal processes.

Predictive analytics uses historical data to forecast future outcomes such as case duration, projected costs, or likely results, supporting more informed planning, budgeting, and risk assessment.

Legal research analytics analyzes data from prior cases, rulings, and research sources to identify patterns in judicial decisions or legal arguments, helping attorneys evaluate strategies and assess risk.

Billing and invoicing analytics, also called legal invoice analytics, evaluate billing practices, invoice performance, and payment timing to uncover write-down trends, delayed payments, and opportunities to improve cash flow.

Legal contract analytics scans large volumes of agreements to identify clauses, obligations, risks, and deviations from standard terms, enabling faster review and more consistent contract management.

Legal spend analytics examines how money is spent across matters, clients, vendors, and internal resources, giving firms clearer insight into cost drivers and supporting smarter budgeting and pricing decisions.

Intake and client behavior analytics analyze how prospects and clients engage with the firm across inquiries, intake, and ongoing communication, revealing which channels drive strong leads, where drop-off occurs, and how engagement relates to retention.

How data analytics helps law firms

Legal data analytics supports better planning by grounding decisions in real performance data. By tracking metrics on day-to-day operations, analytics helps leaders set priorities, forecast costs, evaluate hiring needs, and respond earlier when issues begin to surface.

Uncover trends in firm performance. Using law firm analytics software can help you detect and strategically respond to meaningful patterns related to your firm’s financial performance, such as payment delays or shifts in demand.

Support the decision-making process. Analytics provides objective insight that helps firms reduce guesswork, evaluate tradeoffs more clearly, and make decisions based on evidence rather than assumptions.

Highlight workflow bottlenecks. Reviewing task completion times, case phases, and handoffs helps firms pinpoint where work consistently slows and refine processes to keep matters moving forward.

Help allocate staff and resources more effectively. By comparing utilization rates, workloads, and turnaround times, firms can rebalance assignments, reduce burnout, and match the right people to the right work.

Strengthen client intake and retention efforts. Analytics reveals how prospects and clients find and engage with your firm, which can help you refine intake processes, improve follow-up, and deliver a more consistent client experience.

Flag patterns that may indicate litigation or financial risk. Tracking patterns such as repeated delays, unusual billing activity, or unexpected trends in case outcomes can help you spot early warning signs and address issues before they escalate.

Streamline pre-trial administrative work with e-discovery analytics. Some law firm analytics companies offer e-discovery tools that enable users to search for specific keywords within documents, filter for specific date ranges, and detect trends in large datasets.

Refine marketing efforts. Website and intake data helps firms understand which services attract interest, how visitors engage, and whether marketing efforts are reaching the right audience.

Improve the efficiency of business operations. By reviewing metrics like utilization, acquisition costs, and retention, firms can identify root causes of performance shifts and take targeted action to improve results.

Internal vs. external legal data

Legal data generally falls into two categories: internal data generated by your firm and external data sourced from outside organizations. Both play an important role in understanding performance and context.

Internal data

Internal data refers to information created through your firm’s own operations and client interactions. This data reflects how your business functions day to day and how clients engage with your services. Common examples include:

Traffic and engagement metrics from your website

Client intake data, such as location, practice area needs, and referral source

Utilization rates and workload distribution across attorneys and staff

Case-related details, including timelines, outcomes, and task completion

Accounting data, including billing records and invoice statuses

Communication activity, such as email volume or client portal usage

Financial reporting, including spend analytics

External data

External data comes from sources outside your firm and helps provide benchmarks, context, and a broader perspective. This type of data allows firms to compare internal performance against industry norms or legal trends. Examples include:

Research and reports from third-party legal or business organizations

External benchmarks, such as average case duration or settlement ranges

Publicly available data from court systems or other law firms

Government data, including legislative updates and public legal databases

Economic or demographic data that may influence client demand

Steps for collecting law firm data

Collecting legal data is most effective when firms follow a clear and intentional process. Without structure, information tends to live in silos, making it harder to trust the numbers or draw useful conclusions. These steps can help your firm move beyond ad hoc tracking and create datasets that support consistent analysis and better decision-making over time.

1. Identify your core data sources

The first step is understanding where your firm’s data originates. Common data sources include case files, billing and payment records, client intake forms, task and calendar systems, and communication logs. Knowing where this information lives helps ensure that key activity is captured and prevents gaps that can skew analysis later.

2. Centralize the data in one place

When data is scattered across spreadsheets, email inboxes, and disconnected tools, it becomes difficult to analyze accurately. Centralized data storage makes it easier to compare metrics, spot trends, and maintain consistency. It also reduces the risk of working with outdated or conflicting information, giving firms greater confidence in the insights they rely on.

3. Clean and verify the information

Before using data to guide decisions, you’ll need to make sure it’s accurate. Errors, duplicate entries, and outdated records can distort results and lead to faulty conclusions. Reviewing your data on a regular basis helps catch issues like missing fields, incorrect dates, or duplicated client information.

4. Organize data into clear categories

Grouping data into distinct categories, such as cases, clients, finances, and tasks, makes it easier to spot trends and answer key questions. Keeping a consistent structure also helps your firm compare similar matters, track progress over time, and avoid digging through unrelated information to find what you need.

5. Automate data collection where possible

Automated data collection reduces manual work and improves consistency. Digital intake forms can capture client information as soon as someone contacts your firm. Case management tools can automatically record task updates, deadlines, and status changes. Billing and payment systems can track invoices, payments, and outstanding balances as they occur. With fewer manual steps, your firm spends less time entering data and more time using it.

What is AI-powered legal analytics?

AI-powered legal analytics uses artificial intelligence, machine learning, and automation to analyze large amounts of legal, financial, and operational data quickly and consistently. Rather than relying on time-consuming manual reporting, these tools continuously evaluate data and surface insights as new information becomes available.

Machine learning tools analyze patterns across case activity, billing data, and client behavior to identify trends and outliers, helping attorneys anticipate issues such as prolonged case timelines, unusual billing activity, or shifts in client engagement.

Automation supports AI-powered legal analytics by consistently capturing and updating data from intake, billing, and case management systems, reducing manual effort and ensuring attorneys can rely on timely, complete information to guide decisions and client service.

How to leverage data analytics to improve law firm performance

Data analytics is most effective when firms apply it with intention. Rather than trying to analyze everything at once, firms can use analytics to answer specific questions, test assumptions, and make targeted improvements across operations, finances, and client service.

Below are some tips for how your firm can leverage data to make smarter choices and adjust course as needed.

Start with accessible data

The easiest place to begin is with the data you already collect. Many firms sit on valuable information without realizing its full potential. Common examples include:

Case statuses and timelines

Billing records and payment history

Client intake forms and consultation notes

Attorney utilization and workload data

Task completion and deadline tracking

Reviewing this existing data can quickly surface patterns or inconsistencies that point to opportunities for improvement.

Pick a specific question to answer

Focus your analysis on a single, well-defined question. Clear questions help avoid vague conclusions and make it easier to act on the results. Examples might include:

Which types of cases tend to take longer than expected?

Where do billing delays most often occur?

Are certain practice areas more profitable than others?

At what stage do potential clients most often disengage?

By tying analytics to a specific goal or problem, firms can translate insights into concrete changes rather than abstract reports.

Build a simple dashboard

Dashboards make data easier to understand at a glance. Rather than digging through spreadsheets or long reports, firms can use a simple visual view to track a small set of key metrics over time. Starting small keeps the focus on information that actually supports decision-making.

Depending on the firm’s goals, useful metrics might include:

Average case duration by practice area

Open matters by status or stage

Billing realization and collection rates

Attorney utilization or workload balance

Client intake volume and conversion rates

A clear dashboard helps teams spot changes quickly and measure whether adjustments are having the intended effect.

Share results internally

Sharing results with other attorneys and staff helps align priorities and creates a firm-wide understanding of what your data is showing. For example, you might review a monthly dashboard during a team meeting to discuss where cases are slowing down or where workloads feel uneven. By pairing data with open discussion, teams can agree on next steps and track progress together.

Improve processes using real insights

The real value of analytics comes from acting on what the data reveals. Even small adjustments can lead to meaningful gains over time. Here are some examples of how you might respond to certain issues detected with the help of legal analytics:

Insight: Cases consistently stall at the same stage. Adjustment: Review handoffs, task ownership, or approval steps at that point in the process and clarify responsibilities or timelines.

Insight: Certain attorneys are over capacity, while others have availability. Adjustment: Rebalance assignments or adjust staffing plans to spread work more evenly and reduce burnout.

Insight: Invoices are frequently paid late. Adjustment: Update billing schedules, clarify payment expectations during intake, or introduce earlier follow-up reminders.

Insight: Client drop-off increases after initial consultations. Adjustment: Refine intake workflows, improve follow-up timing, or adjust how next steps are communicated.

By revisiting insights regularly and adjusting processes as needed, firms can use analytics as an ongoing tool for improvement rather than a one-time exercise.

Ethical and data-quality considerations in legal data analytics

Legal data analytics is only as useful as the data behind it. To rely on analytics with confidence, law firms must ensure that their data is accurate, handled responsibly, and protected appropriately. That means paying close attention to privacy, ethical use, and governance so insights support sound decisions without creating compliance or risk concerns.

Data privacy and security requirements

Law firms handle highly sensitive client information, which makes privacy and security non-negotiable. Any use of data analytics must align with professional responsibility rules, confidentiality obligations, and applicable data protection laws. Firms should understand where data is stored, who can access it, and how it is protected, especially when analytics tools rely on cloud-based systems or third-party services.

Ensuring algorithm accuracy and fairness

Analytics tools and AI models rely on the data they are trained on. If that data is incomplete, outdated, or biased, the insights produced may be misleading. Firms should approach analytics as a decision-support tool, not an unquestionable authority, and remain aware of its limitations. Regular review of outputs helps ensure conclusions make sense in context and do not reinforce unfair assumptions or flawed patterns.

Establishing strong data governance practices

Data governance includes defining who owns different data sets, setting standards for data entry and updates, and documenting how analytics tools are used. With consistent governance processes in place, firms can maintain data quality, reduce errors, and ensure compliance.

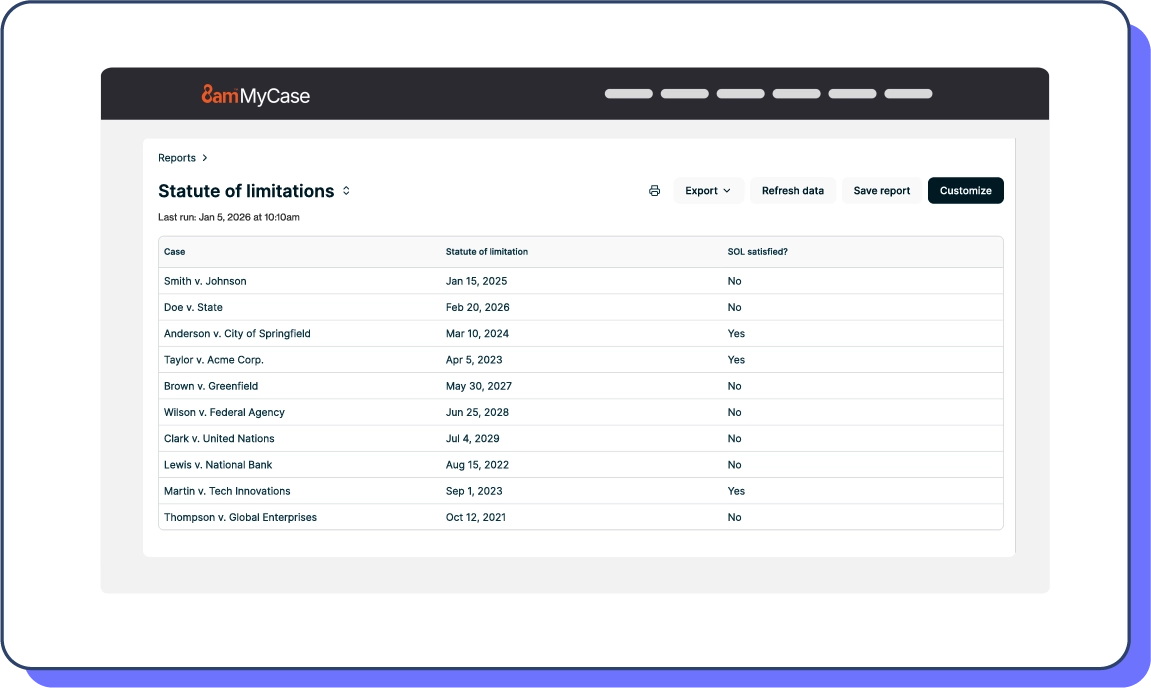

How to leverage customized reporting in case analytics

Customized reporting plays an important role in legal data analytics by helping firms organize and review data in ways that reflect their specific priorities and day-to-day operations. Standardized, one-size-fits-all reports often fail to accurately reflect how a firm actually tracks cases, workloads, or finances.

Key benefits of customized reporting include:

Flexible report views: Reorder columns to highlight the data points most useful to your firm’s operations.

Advanced filtering and grouping: Narrow reports and group data by date range, practice area, case type, or staff member.

Deeper financial insights: Review billed and unbilled time, track work in progress, and analyze performance without having to pull data into external spreadsheets.

Workload visibility: Monitor attorney and staff workload distribution to identify capacity issues before they affect timelines or client service.

Reporting that scales with your firm: As your reporting needs become more complex, customizable reports make it easier to adapt without rebuilding processes or relying on third-party tools.

By integrating customized reporting into your legal data analytics process, you gain more flexibility to use your data to address your firm’s unique needs.

How 8amTM MyCase analytics improves firm performance

Law firm data analytics software is most effective when it brings operational and financial information together in one place. With a unified approach to data analytics in law, firms can move beyond disconnected reports and develop a clearer understanding of how work is progressing across the practice. That visibility makes it easier to spot emerging issues, adjust plans as needed, and make decisions based on current conditions rather than assumptions.

8am MyCase supports this approach by bringing core analytics capabilities into a single solution:

Case analytics: Track matter activity to monitor timelines, identify delays, and understand how work is distributed across attorneys and practice areas.

Financial reporting: Review billing and payment data to monitor cash flow, find inconsistencies, and connect financial results to day-to-day work.

Client insights: Analyze data from intake forms and CRM tools to better understand client behavior, referral sources, and forecasted pipeline value.

Customized reports: Analyze data in formats that reflect how your firm operates, enabling deeper insight without having to export data to external tools and unwieldy spreadsheets.

Together, these tools give firms a more connected view of operations and profitability, helping teams plan more effectively, address issues earlier, and deliver a more consistent client experience.

To see how legal data analytics and customized reporting can support smarter decisions across your firm, sign up for a free trial of MyCase or schedule a demo today.

Legal data analytics FAQs

About the author

Rob HeidrickSenior Content Strategist8am

Rob Heidrick is a Senior Content Strategist for 8am, a leading professional business solution. He covers the latest advancements in legal technology, financial wellness for law firms, and key industry trends.