Many attorneys who excel at practicing law find the business side of running a firm more difficult to manage. Tasks related to revenue tracking, budgeting, and law firm marketing are all important—but they’re also time-consuming and can pull your focus away from client matters.

A thoughtful, well-organized business plan helps you stay proactive, prioritize your time in a way that aligns with overall business objectives, and create room for more focused, effective legal work. It also serves as a practical roadmap that helps you shape your firm’s future direction and plan for sustainable growth.

In this article, we’ll walk through each step of creating a law firm business plan that supports long-term success, operational clarity, and better outcomes for your team and your clients.

Why every law firm needs a business plan

Running a law firm involves countless moving parts—client work, team management, operations, finances, and more. Without a clear plan, it’s easy to lose sight of your higher-level goals while juggling daily demands.

A strong attorney business plan brings order to daily operations, clarifies expectations for everyone on your team, and helps ensure lasting stability. It also creates a shared reference point that keeps decisions aligned with your mission and goals.

Thorough planning can also lay a foundation for scalable growth. For example, a small firm might use its business plan to evaluate local market conditions, identify which services to prioritize, and budget for future hiring needs. They may also set annual revenue targets and estimate the case volume needed to reach those benchmarks. With a clearer sense of direction, it becomes easier to set meaningful goals and grow at a manageable pace.

Overview of the core business plan components

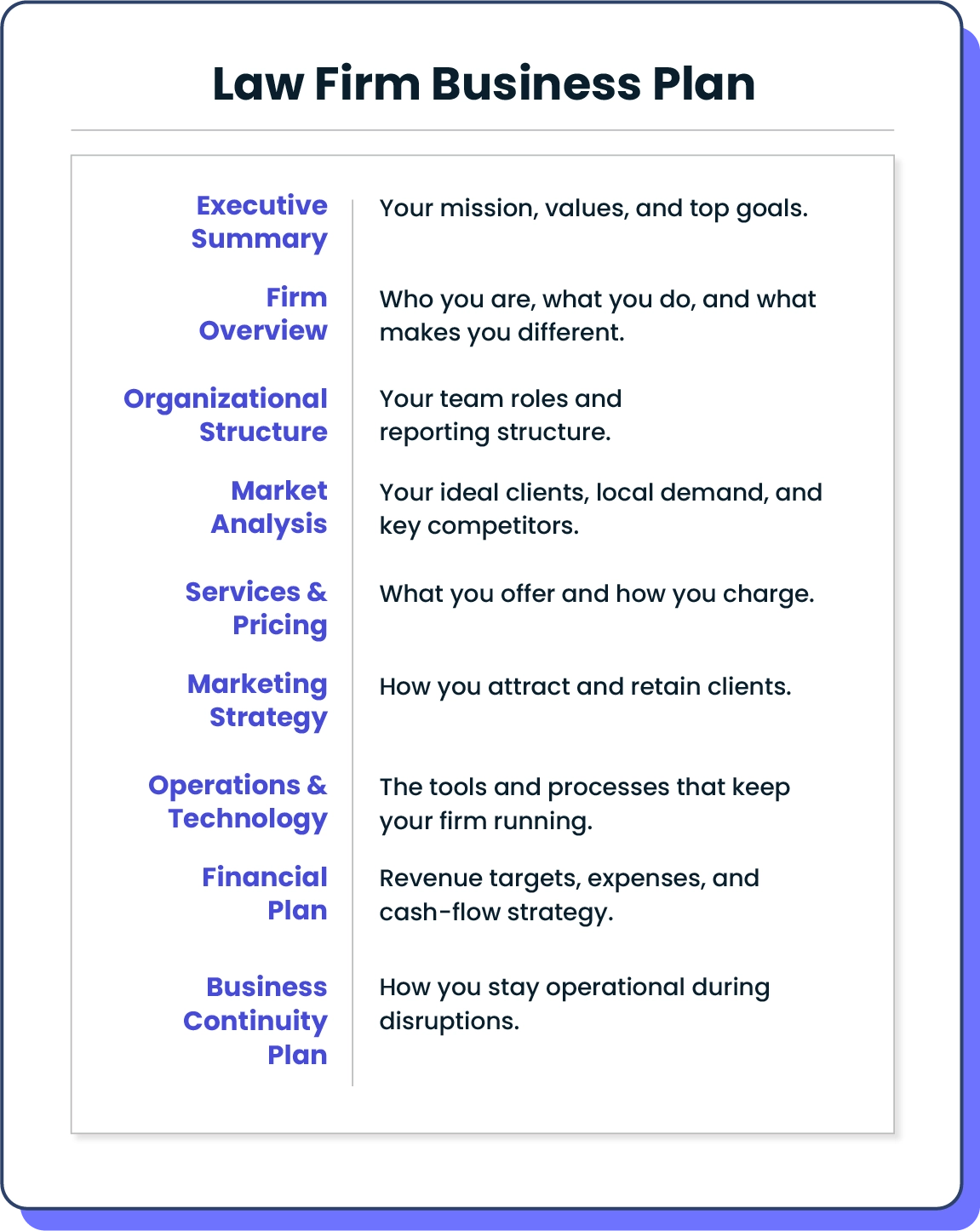

A well-organized business plan includes elements that define different aspects of how your firm operates, who you serve, and the goals you’re working toward. Below is an overview of the key components of a law firm business plan—we will explore each of them in more detail in the next section.

Executive summary: A brief snapshot of your firm’s mission, values, and key objectives

Firm overview: Basic details about your firm, including your legal structure, practice areas, and what sets you apart from others in the market

Organizational structure: A framework for your firm’s leadership roles, reporting lines, and how responsibilities are distributed across your team

Market analysis: An overview of your ideal clients, local demand for your services, and how your competitors are positioned

Services and pricing: A clear outline of the legal services you offer, how they’re packaged, and how your pricing is structured

Marketing strategy: A description of how you plan to attract and retain clients, including the channels and tactics you’ll prioritize in marketing campaigns

Operations and technology: A summary of the systems, tools, and processes you’ll use to keep your firm running efficiently

Financial plan: A breakdown of your revenue goals, projected expenses, and strategies for maintaining cash flow and profitability

Business continuity plan: A set of procedures to help your firm stay operational during unexpected events or disruptions

Each of these elements plays an important role in setting the stage for your firm to stay focused, organized, and prepared to scale.

Steps for writing a law firm business plan

From defining your mission to evaluating your growth strategy, each step plays a role in shaping a plan that supports both the day-to-day and long-term success of your firm. Whether you’re starting your firm from scratch or refining an existing plan, following this process will help you move forward with clarity and purpose.

Step 1: Define your firm’s mission, vision, and goals

Every attorney’s business plan should begin with a clear sense of direction. A well-defined mission and vision help ground your firm’s purpose, while specific goals create a structure for measuring progress. Together, these elements shape how you operate, who you serve, and what you’re working to achieve.

When drafting this section of your plan, start by answering these key questions:

What is our purpose?

Who do we serve?

What impact do we want to make in our community or practice area?

What does success look like in one, three, and five years?

This is also the place to write a short mission statement—one that’s specific enough to guide your decisions, but flexible enough to grow with your firm. You might also outline a handful of concrete goals tied to revenue, case volume, client satisfaction, or professional development. Make sure these goals align not only with your business objectives, but with the needs and expectations of the clients you aim to serve.

Step 2: Identify your ideal clients and market opportunities

A strong business plan is built on a clear understanding of your target audience and the environment in which you’re operating. Defining your ideal clients and identifying market opportunities allows you to focus your marketing, set appropriate pricing, and position your firm for growth in the right areas.

To get started, consider these questions:

Who are our ideal clients?

What specific problems or legal needs do they have?

How do they typically search for and choose legal services?

Who are our main competitors, and how do we compare?

You may want to create basic client personas to summarize the characteristics, motivations, and pain points of the clients you want to reach most effectively. This section can also include an overview of market trends in your geographic area or practice focus, along with any gaps or underserved niches your firm is uniquely positioned to fill. A thoughtful analysis here will help you make more informed decisions throughout the rest of your business plan.

Step 3: Outline your legal services and pricing model

Your services and pricing communicate both the value your firm offers and the type of clients you aim to serve. When you clearly define what you offer and how much it costs, as well as legal fee structures, you can set client expectations, support sustainable revenue, and create pricing structures that reflect the quality of your work.

As you write this section of your business plan, consider:

Which practice areas will we focus on?

What specific services will we offer within each area?

How will we price those services—hourly, flat fee, contingency, or a mix?

How does our pricing compare to other firms in our region or practice niche?

It can be helpful to include examples of your pricing tiers or service packages, especially if you plan to offer different levels of support or bundling. If you work on contingency or offer unbundled legal services, clarify how those structures are presented to clients. Wherever possible, look for ways to build pricing transparency into your process—this not only builds trust with clients but also reduces friction during intake and billing.

Step 4: Define your organizational hierarchy

Clearly documenting your firm’s organizational hierarchy—including its leadership structure, staff roles, and reporting lines—helps ensure everyone understands who is responsible for what, how decisions are made, and how each role contributes to the firm’s overall goals.

As you build out this section, consider:

Who handles leadership and strategic decision-making?

What are the core responsibilities of attorneys, paralegals, and support staff?

How are new hires onboarded and integrated into the team?

What systems are in place for accountability and communication?

You might choose to include a simple org chart or list of titles with brief descriptions. This section can also outline how roles may evolve over time or how responsibilities will shift as new team members are added. Defining this structure helps guide firm growth while creating a more cohesive work environment.

Step 5: Create a marketing and business development strategy

A business plan without a client pipeline is just a document. Your marketing strategy is what brings visibility to your firm, builds credibility in your community, and creates opportunities to bring in new work over time. A clear, well-structured approach to marketing and business development keeps your firm on a path to consistent growth.

Key questions to answer in this section include:

Where do our ideal clients go to find legal help?

Which marketing channels should we focus on—search engines, social media, community events, referrals?

What sets us apart from other firms offering similar services?

This section outlines both short-term marketing tactics and longer-term branding strategies. For example, you might include plans for content creation, local advertising, attorney referral networks, or SEO improvements. It’s also helpful to note how you’ll track the performance of these efforts—through lead tracking, intake conversion rates, or client feedback—so you can adapt your strategy as your firm evolves.

Step 6: Build your operations and technology plan

Strong operations are the foundation of a well-run law firm. When your internal systems are efficient, your team collaborates more effectively, deadlines are easier to manage, and clients receive more consistent service. Technology plays a central role in making this happen—streamlining administrative tasks, improving communication, and giving you better oversight of daily work.

A detailed technology plan is especially important for virtual law firms that will serve clients remotely. A virtual law firm business plan should place special emphasis on the systems they will use to enable secure communication, document sharing, and daily operations without a physical office.

As you develop this part of your plan, consider the following questions:

What tools will we use for case management, billing, and client communication?

Where can we reduce manual work through automation?

How will we ensure that client data and firm documents are secure?

Solutions like 8amTM MyCase bring together many of these needs in one system, helping you manage cases, track billable time, communicate with clients, and automate key workflows. You can also use this section to document your core processes—for example, how new cases are assigned, how deadlines are tracked, or how documents are shared internally. Don’t forget to include data security practices and permissions controls, especially if your firm plans to operate remotely or use cloud-based tools.

Step 7: Develop a realistic financial and growth plan

Your business plan should include a clear financial strategy. Setting goals for revenue, tracking performance, and planning for future investments can help your firm stay stable and profitable—even during slower seasons

Start by answering these key questions:

What are our monthly and annual revenue targets?

What expenses do we expect to incur, and how will we manage them?

What resources—such as staffing, marketing, or technology—will we need to grow responsibly?

This section might include a working law firm budget, revenue projections, or benchmarks for profitability. You can also outline which financial metrics you’ll track regularly, such as billable hours, cost per case, or collection rate. Separating short-term financial priorities (like building cash reserves) from larger goals (such as expanding into a new market) can help your firm stay focused and adaptable as conditions change.

Step 8: Create a business continuity process

Even the best-laid plans can be disrupted by unexpected events. A law firm business continuity plan helps you stay prepared—minimizing downtime and ensuring clients continue to receive support during emergencies. From power outages and natural disasters to cyber threats or health-related closures, having a clear set of procedures in place can make a meaningful difference.

As you create this part of your business plan, ask:

How will we access case files, documents, and communication tools remotely?

Do you have adequate backup and recovery systems?

Who is responsible for leading the firm’s response in a crisis?

It’s important to document data security protocols, remote work procedures, and client communication plans. You may also want to outline your disaster recovery tools—such as cloud-based document storage, encrypted email, and alternative contact methods. Planning ahead means your firm can reduce risk, protect client trust, and maintain continuity when it matters most.

Step 9: Track, evaluate, and update your plan

Regularly reviewing your goals, systems, and performance data ensures that your firm stays aligned with current needs and market conditions. This step is about creating a feedback loop, using insights from your daily operations to improve and evolve your strategy.

Consider tracking the following indicators:

Billable hours and productivity

Client satisfaction and referral rates

Source of new leads or inquiries

Collection rates and other financial metrics

In this section, outline how often your team will review the plan—quarterly, semiannually, or annually—and what tools you'll use to monitor progress. KPI dashboards and reporting features like those available in MyCase can make it easier to evaluate your efforts and adjust accordingly. This ongoing process helps keep your plan practical and ensures your firm continues to grow with intention.

Law firm business plan examples

Seeing how other attorneys structure their business plans can make it easier to visualize what your own should include. While every firm has unique needs, the following resources offer helpful starting points—ranging from editable worksheets to fully written sample plans. They can give you a sense of what to include, how to organize your plan, and which areas deserve the most focus as your firm grows.

Rankings.io: How to write a business plan for a law firm (with sample + template). This article offers a detailed breakdown of each section of a business plan, with guidance tailored specifically for law firms. The overview includes a sample format, along with descriptions of how to approach sections like the executive summary, market analysis, organizational structure, and financial projections.

Oregon State Bar: Law office business plan worksheet. This free worksheet from the Oregon State Bar Professional Liability Fund (PLF) is designed to help solo and small firm lawyers build a complete business plan from the ground up. Because it’s structured as a worksheet with fill-in-the-blank templates for each section, this resource can serve as a hands-on tool for attorneys who prefer a guided, step-by-step approach to building a personalized plan.

New York City Bar Association: Business plans for lawyers. This article from the New York City Bar’s Small Law Firm Center outlines key elements of a business plan for solo attorneys and small firms. It provides a detailed framework for sections, including the executive summary, market analysis, financial review, and strategy—as well as prompts and planning questions to help lawyers clarify their goals and structure their plan.

One Legal: A business plan for lawyers. This article from One Legal offers a practical guide to creating a business plan, including examples of language that attorneys can adapt for their own practice. Sample law firm business plan sections include firm overviews, target client definitions, and financial planning details, making this resource especially useful for lawyers who want more than just a checklist.

How technology shapes modern law firm business planning

Legal technology plays a central role in turning a law firm’s business plan from a static document into a living, working strategy. From setting measurable goals to managing cases and tracking financial performance, the right tools help translate big-picture planning into daily execution.

Modern legal practice management solutions like MyCase bring together essential functions—case management, billing, communication, and reporting—within a single system. This kind of integration makes it easier to stay organized, reduce inefficiencies, and ensure that critical details don’t fall through the cracks. Whether you’re tracking billable hours, sharing documents with clients, or reviewing firmwide performance metrics, legal tech can simplify complex processes and keep your team aligned.

Tools for legal workflow automation, performance dashboards, and secure cloud access give firms the flexibility to respond to change, whether that means shifting internal priorities or adapting to external disruptions. And because many of these tools provide real-time visibility into business data, they make it easier to identify trends, adjust goals, and keep your plan up to date as your practice evolves.

MyCase helps support law firm growth

A well-crafted business plan can help you stay focused on your goals, use your resources effectively, and consistently provide high-quality client service.

MyCase turns law firm business plans into action by giving you a clear view of your priorities and the tools to follow through on them as your practice evolves. With that foundation in place, it’s easier to stay on course, make informed decisions, and build lasting momentum.

Ready to put your plan into action? Start your free trial or schedule a demo to see how MyCase can support your next stage of growth.

FAQs about law firm business plans

About the author

Rob HeidrickSenior Content Strategist8am

Rob Heidrick is a Senior Content Strategist for 8am, a leading professional business solution. He covers the latest advancements in legal technology, financial wellness for law firms, and key industry trends.