Key takeaways

What is Small Law Firm Accounting Software?

Small law firm accounting software is a tailored solution that optimizes financial management workflows for small teams. Legal-specific accounting solutions offer features like automated bank reconciliation and IOLTA compliance to meet law firms’ compliance needs.

By expediting and automating legal accounting tasks, growing firms gain more financial control and free valuable time for more billable work.

Managing a small law firm is an exciting yet demanding journey. As you expand, you’ll tackle increasingly complex cases and a diverse client base—all while navigating the intricacies of a growing law practice. Law firm accounting is a major area that presents difficulties for many firms.

According to our 2025 Legal Industry Report, 61% of lawyers say that accounting is a financial management challenge they face in their firm, making it the second-most significant financial management challenge among law firms. Legal fee collection was the top financial management challenge, with 68% of law firms saying that it was an issue.

For solo and small firms, every hour counts—and every dollar saved on admin goes straight into your bottom line. Therefore, small law firm accounting software can help your team meet growing administrative demands by streamlining tasks. These solutions can help simplify time and expense tracking, automate tedious bank reconciliation, and ensure compliance every step of the way.

In this guide, we’ll go over key features to look for when choosing the best accounting software for small law firms and the steps to evaluate different platforms.

Important Features for Small Law Firm Accounting Software

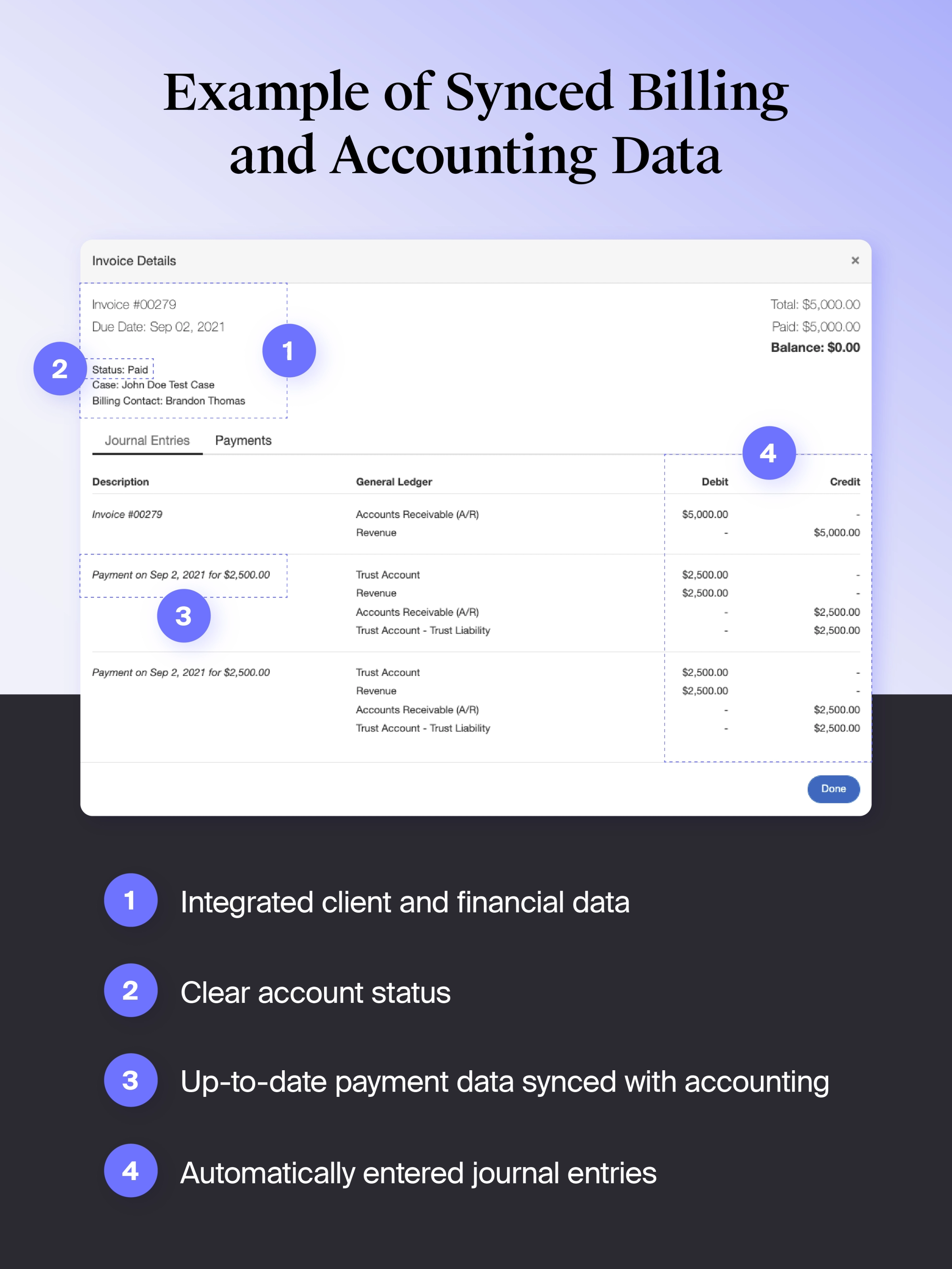

Small law firm accounting software often includes comprehensive trust account management, tailored time tracking solutions for lawyers, and automated legal invoicing workflows to reduce the time and effort required for complex accounting tasks.

For small law firms with limited resources and accounting expertise, these features enable them to reclaim non-billable hours that they’d otherwise spend on manually managing data or navigating the legal accounting process. Automation can also help minimize data entry errors and ensure compliance.

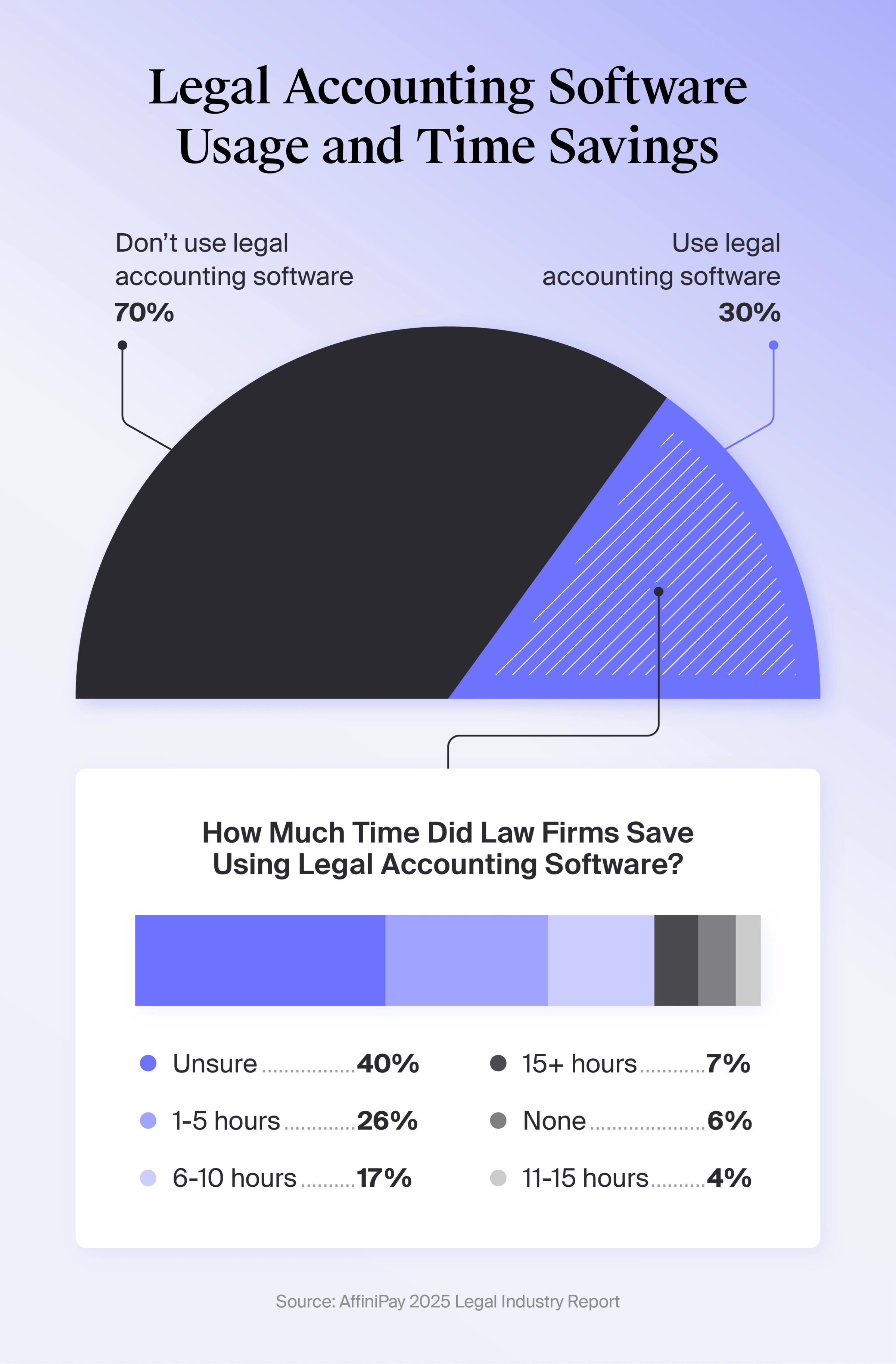

Unlike generic accounting platforms, legal accounting software includes features that help law firms meet compliance requirements set by the American Bar Association (ABA) and local jurisdictions. These platforms also save time. Our 2025 Legal Industry Report found that 43% of law firms saved up to 10 hours using legal-specific accounting software.

Below are key features that will help your team search for the best small law firm accounting solution.

Trust Account Management

Trust account management prohibits law firms from commingling earned and unearned client funds. To maintain Interest on Lawyer Trust Accounts (IOLTA) compliance, lawyers must keep meticulous records of all transactions. Law firm accounting software helps small teams save time by automatically logging all transactions and maintaining a high-level overview of all accounts.

Many law firms have found success using trust accounting software. Our 2025 Legal Industry Report found that 37% of law firms use trust accounting software. Of those who use it, 50% reported saving up to 10 hours each month.

Below are a few examples of trust account management features that can benefit small law firms:

Automatically deposit unearned funds in trust accounts.

Assign funds to clients in pooled trust accounts to prevent commingling and overdrawing accounts.

Receive notifications for low trust balances.

Record all trust account transactions in real time to maintain complete and up-to-date records.

Periodically perform three-way trust and bank reconciliation to reconcile trust and client ledgers with bank records.

Integrate with other finance solutions to centralize financial data in one platform.

Time Tracking

Organizing time-tracking data from multiple lawyers with inconsistent tracking methods can quickly become unmanageable. Some law firm accounting platforms offer legal time tracking features to centralize data and help streamline the process.

Passive time tracking, in particular, is a worthwhile tool—especially for small law firms that typically need to wear multiple hats. Our 2025 Legal Industry Report found that 24% use passive time-tracking platforms. Of those who use these tools, 45% reported saving up to 10 hours per month.

Below are a few examples of how legal time tracking features can benefit small law firms:

Track both billable and non-billable time to monitor utilization and realization rates.

Capture billable hours in real time with passive time trackers that run in the background.

Start multiple timers at one time when working on complex tasks.

Set up default activity descriptions for routine tasks.

Receive prompts to track time for routine tasks, including uploading documents and sending emails.

Access multiple timesheet views for real-time insight into time tracked by a team member, case, and other categories.

Record time via desktop or mobile devices.

Link time data with case information for streamlined billing and financial reporting.

Expense Tracking

Legal accounting software can also include legal spend management solutions to help law firms manage billable and non-billable financial transactions. These tools help lawyers easily log client-related expenses and automatically link them to client invoices. Law firms can also use spend management features to keep track of administrative expenses and find ways to minimize costs.

Below are a few examples of legal expense and spend management features:

Log expenses via desktop or mobile app.

Link expenses and receipts with case data for streamlined billing and financial reporting.

Assign virtual or physical cards to team members.

Set spending limits, locks, and access to prevent misuse or overspending for cards.

View financial dashboards for real-time insights into spending by team members, spend category, and other criteria.

Legal Invoicing

Law firm accounting software that contains legal invoicing features are popular among small law firms. According to our 2025 Legal Trends Report, 80% of law firms use invoicing features. Of those using them, 43% saved up to 10 hours each month.

Below are a few examples of legal invoice features that help streamline the legal billing process:

Automatically link time tracking, expense, and case data to quickly generate invoices.

Create multiple invoices at one time.

Use UTBMS codes, LEDES billing, or custom billing codes.

Divide legal costs between multiple clients to create accurate invoices.

Deliver invoices electronically or through physical mail.

Payment Processing

Choosing legal accounting software with user-friendly legal payment processing features can help your law firm meet customer needs, get paid faster, and ensure compliance.

For example, online payments are an increasingly popular and effective method of collecting funds from clients. In our 2025 Legal Trend Report, we learned that 82% of law firms accept card payments through online payment processing software. Separately, 59% said that accepting card payments increased their firm’s collection rates. Below are a few examples of legal payment processing features that can benefit your small law firm:

Accept multiple payment methods, including credit or debit card, eCheck, physical check, and ACH transfer.

Accept payments through custom payment web pages, QR codes, a mobile app, and in-person POS systems.

Set up scheduled payments, payment plans, and other alternative fee arrangements.

Ensure compliance with ABA guidelines, IOLTA guidelines, Payment Card Industry Data Security Standard (PCI DSS), and other mandatory privacy and security standards.

Accounts Receivable Management

Tracking account statuses and repeatedly following up on payments can create time-intensive challenges for small law firms, but accounting software for attorneys can help save time by standardizing the accounts receivable process for your law firm.

Below are a few examples of accounts receivable management features that can benefit small law firms:

Real-time status of accounts, including days delinquent

Notifications when clients view or take action on invoices

The ability to schedule automated payment reminders

Improved access to invoice information via client portals

Financial Reporting

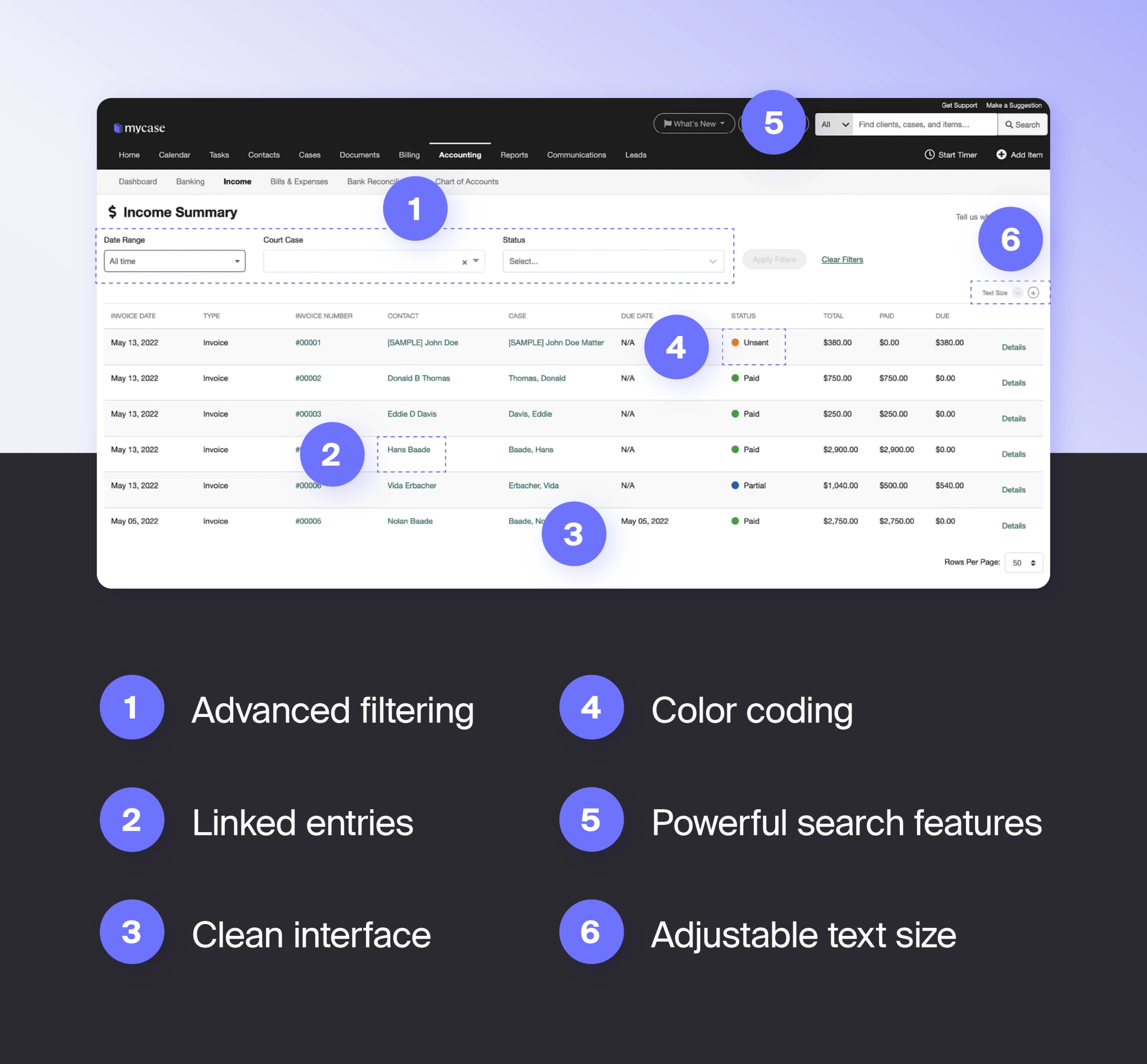

Accounting software with legal financial reporting features can help expedite analysis with automation and access to live data. Accessing financial information via user-friendly dashboards can also enable more informed, data-driven decisions for your small law firm.

Below are a few examples of financial reporting features:

Multiple dashboard views and reporting options, including accounts receivable, general ledger, and case revenue

Real-time data synchronization with automated calculations and categorization

Tailored data insights with advanced filtering

Robust Security

Although security may not be the first feature on your small law firm’s accounting software wishlist, it’s a crucial part of any legal practice’s information security policy. The best solutions use powerful security technology to limit access to financial data and minimize overall risk.

Below are a few examples of security features:

Strong encryption for connections and stored data

Options to restrict user permissions to limit unauthorized access

The ability to view file activity and access history

Routine data backups to avoid lost data

Adherence to mandatory security standards

How To Choose the Best Accounting Software for Your Small Law Firm

Understanding key features is the first step in choosing the best accounting software for your attorneys. Below are the next steps that can help you select the best software option.

1. Evaluate Your Firm’s Current Accounting Challenges and Needs

To make the best decision for your law firm, start by digging into the root causes of your law firm’s accounting challenges. For example, does your law firm spend a lot of time manually reconciling accounts each month? This challenge can indicate a strong need for automated trust account reconciliation.

On the other hand, if your lawyers have file versioning issues or inconsistently log expense data, you may need a solution with mobile access and cloud capability. These features allow your team to keep their information up-to-date while on the go.

2. Review Your Firm’s Financial Goals and Budget

In addition to your law firm’s challenges, consider how this new platform will support your law firm’s short- and long-term growth. If your firm’s immediate goal is to improve cash flow, you may want a solution that includes real-time financial reporting. However, you may also want to consider how well it can scale as your law firm takes on more clients.

It’s also helpful to consider your budget and the return on investment (ROI) you can expect. This includes assessing:

Subscription cost

Implementation fees and other additional costs

Time needed from your staff to onboard and learn the new tool

3. Compare Your Tech Stack and Consider Integrations

A new legal accounting solution can hinder your team if it doesn’t work well with your existing tech stack. Review your current tools and decide what’s worth keeping and what you can remove in favor of a more affordable or robust accounting solution.

This is also a good time to decide whether it's best to consolidate tools with an end-to-end solution. Rather than integrating a separate payment, accounting, and time-tracking solution into a new tool, you can use a platform like MyCase to manage your law firm’s financial management tools in one platform.

4. Consider User-Friendliness, Onboarding Requirements, and Ongoing Support Needed

Beyond features, it’s also helpful to consider the platform’s ease of use for your staff. Start by evaluating the platform’s design and support options. Does it seem intuitive to use, or would your team need dedicated onboarding time to get familiar with the tool? Do they provide dedicated account managers or robust support websites?

Accessibility is another aspect to consider on behalf of your team. For example, if you have a team member with visual impairments, does the platform offer high-contrast color schemes or adjustable font sizes?

5. Take Advantage of Demos and Trials

Demos are a great way to see the platform in action and learn how it can support your law firm’s specific needs. Before attending a demo, prepare a list of questions and workflows you’d like their team to address to ensure your firm can see the most relevant features.

Trial periods are also helpful to get your team’s input on the platform. To avoid disrupting your full team’s workflow, you can designate one or two tech-savvy team members to test-run the tool and provide feedback.

Leverage Small Law Firm Accounting Software to Streamline Your Finances

Small law firm accounting software can save your firm from hours of administrative work.

MyCase’s legal accounting software helps small law firms optimize their legal accounting process with features that assist with complex processes like three-way trust reconciliation and case revenue allocation and reporting. MyCase’s platform also centralizes your financial data to provide comprehensive financial reporting.

Running a small firm means juggling everything—from client work to collections. Schedule a demo of MyCase today to see how you can streamline your legal accounting process and dedicate more time to cases.

About the author

Esther Park is a Content Writer and Senior SEO Manager at 8am. Her expertise lies in writing about emerging legal technologies and financial wellness strategies for law firms, among other topics.