Billing, expense tracking, and trust accounting may not be the most visible aspects of running a law firm, but they’re among the most important. Every payment, disbursement, and time entry needs to be recorded accurately to maintain financial stability and stay compliant with legal and ethical guidelines.

Many law firms use QuickBooks for invoicing, expense tracking, and financial reporting. While the platform handles core accounting tasks effectively, it isn’t built with legal workflows in mind. With the right setup, though, it can still play a valuable role in a firm’s overall financial system.

In this guide, we’ll walk through how to set up and use QuickBooks for legal accounting, including key features, best practices, and common mistakes to avoid. We’ll also explore how integrating QuickBooks with a legal practice management solution can help reduce manual data entry and strengthen financial oversight.

If you’re looking to improve your current accounting setup, this article will help you build a more complete system for managing your firm’s finances.

Why law firms use QuickBooks for accounting

So, what do law firms use QuickBooks for? While QuickBooks wasn’t built specifically for legal work, it’s become a popular option for attorneys who need a flexible system to keep track of revenue, expenses, and billing. In many cases, a firm’s accountant or bookkeeper already uses QuickBooks and recommends it as an easy way to manage the firm’s financial records. When configured properly, it can help firms stay organized and maintain oversight of their financial operations.

QuickBooks strengths for law firms

QuickBooks offers several features that align well with the accounting needs of law practices, including:

Automated bank syncing: QuickBooks can link directly to bank and credit card accounts, automatically importing transactions for review and categorization.

Expense tracking: The software allows you to assign costs as client-billable or firm-operating, while sorting third-party vendor expenses and internal overhead.

Real-time financial reporting: Firms can generate profit and loss statements, balance sheets, law firm cash-flow snapshots, and reports on profitability by client or matter.

Billing tools: QuickBooks allows firms to create and send professional invoices, apply payments, and monitor outstanding balances.

Splitting hard and soft costs: QuickBooks can separate hard costs (expenses paid on behalf of the client) from soft costs (internal assets or indirect costs), helping ensure billing accuracy.

QuickBooks limitations for law firms

While QuickBooks offers strong core accounting features, it isn’t tailored to the unique financial needs of legal professionals. At its core, QuickBooks is a general-purpose accounting tool—built for small businesses across a wide range of industries, not the specialized compliance, billing, and reporting requirements of law firms.

That distinction matters when it comes to legal workflows. QuickBooks doesn’t include built-in tools for full-scale client matter management, automated billing directly tied to case activity, or features that help enforce legal trust accounting rules. It also doesn’t support three-way reconciliation—the required process of matching a firm’s bank account, accounting books, and each case and client’s trust ledger—to ensure complete financial accuracy and compliance. While QuickBooks can integrate with other systems to fill in some of these gaps, but it isn’t a standalone legal accounting solution.

One of the more significant limitations relates to managing trust accounts in accordance with Interest on Lawyers’ Trust Account (IOLTA) rules. QuickBooks doesn’t provide native safeguards to separate client money from operating revenue or prevent misuse of trust funds. Any firm relying solely on QuickBooks to manage trust activity must configure the system manually, which can increase the risk of errors. This means that attorneys who use the platform for trust accounting should have reliable workflows in place to avoid compliance issues.

Common mistakes for law firms to avoid when using QuickBooks

Using QuickBooks as a standalone solution without adapting it to the needs of a law practice can lead to a number of potential errors. Some common examples include:

Mixing trust and operating funds in the same account

Failing to reconcile trust accounts monthly to verify balances against client ledgers

Using a generic chart of accounts that doesn’t reflect legal-specific income categories or trust liabilities

Overlooking billable expenses, especially when splitting hard and soft costs

Relying on manual data entry, which increases the likelihood of inconsistencies or missed transactions

Legal-specific solutions like 8amTM MyCase include automated safeguards that can help reduce these risks. For example, MyCase can automatically separate trust and operating funds, sync transactions to the right accounts, and generate reports that flag inconsistencies before they become serious problems.

Here’s a quick compliance checklist to consult if your firm uses QuickBooks:

Keep trust and operating accounts separate to prevent commingling of client funds

Reconcile accounts monthly to ensure trust balances match client ledgers and bank statements

Use a legal-specific chart of accounts tailored for retainers, client costs, and trust liabilities

Leverage automation to sync transactions, reconcile trust funds, and flag compliance issues automatically

QuickBooks plans for lawyers

QuickBooks Online offers several subscription plan options. For lawyers, QuickBooks Essentials and Plus tiers include core accounting features that can help manage finances, track expenses, and bill clients. If you need more advanced tools—like custom roles, batch invoicing, or deeper analytics—QuickBooks Advanced may be worth considering. The right choice comes down to your firm’s size, billing complexity, and how many people need access.

Key QuickBooks features

Both the Essentials and Plus plans include tools that can simplify law firm accounting, including:

Expense tracking: Automatically import and categorize transactions by syncing QuickBooks with your bank and credit card accounts.

Invoicing and payments: Create custom invoices and accept online payments directly from clients.

Multi-user access: The Essentials plan includes access for up to three users, while Plus expands that to five.

Reporting: Both versions include standard reports, but Plus offer more detailed financial tracking, including class and location-based reports.

Managing billable expenses: With Plus, you can mark expenses as billable to ensure client costs don’t fall through the cracks.

QuickBooks considerations for lawyers by firm size

Solo attorneys and small law firms using QuickBooks Online may find that the Essentials plan covers their basic billing needs. It’s a good starting point if you need to track expenses, send invoices, and keep tabs on firm finances without adding multiple users or custom reports.

For firms with larger case volumes—or those that need to give multiple people access—QuickBooks Plus may be a better fit. It provides more flexibility for assigning time entries, managing billable costs, and generating detailed financial reports across cases or practice areas.

Larger firms, or those with more complex internal operations, may eventually outgrow both Essentials and Plus. QuickBooks Advanced adds features like workflow automation, customizable permissions, and enhanced reporting tools designed to help firms manage growing teams and caseloads more efficiently.

Each plan builds on the last, so the decision ultimately comes down to how much functionality your firm needs—and how much time you’re willing to spend working around missing features.

Can QuickBooks track billable hours for lawyers?

QuickBooks can track billable hours for lawyers—but not out of the box. To log hours and connect them to invoices, you’ll need to add a separate subscription to QuickBooks Time.

That setup is not necessarily the most efficient option. Without legal-specific tools in place, you may end up entering time manually, juggling spreadsheets, or trying to piece together data from different systems.

Next, we’ll look at the experience of tracking time within the standalone version of QuickBooks compared to using an integration with a legal practice management solution like MyCase.

Tracking time in QuickBooks

If you’re using QuickBooks on its own, tracking time usually means entering hours manually—either by creating time entries inside the application or logging hours elsewhere and transferring them in. You can assign hours to clients and mark them as billable, but there’s no automatic link to matters or built-in tools to track your time as you work.

This can create a few challenges:

It’s easy to miss billable hours if you forget to log time right away

You might enter the same hours in multiple places, which increases the risk of errors

It takes extra effort to keep everything organized by case, especially if you’re handling a high volume of matters

For solo attorneys or firms with lighter billing needs, this approach might be manageable. But as your caseload grows, so does the risk that time slips through the cracks.

Tracking time with a legal billing software integration

Integrating QuickBooks with a practice management or legal billing solution can make time tracking significantly easier and more efficient. For example, firms using the MyCase QuickBooks integration can log time directly for each case, and those entries automatically sync with QuickBooks—no manual input or guesswork required.

This kind of integration helps you:

Capture time as you work, so nothing gets lost

Turn billable hours into invoices without re-entering the same data

Stay organized by keeping time entries connected to the right matters from the start

If your firm bills by the hour—or if you're just looking to cut down on manual work—pairing QuickBooks with an integrated legal billing solution makes it easier to ensure accuracy and get paid faster.

Steps for law firms to set up QuickBooks

To use QuickBooks for legal accounting, attorneys need to take steps to ensure it’s set up in a way that adheres to industry best practices, especially those related to compliance with IOLTA guidelines.

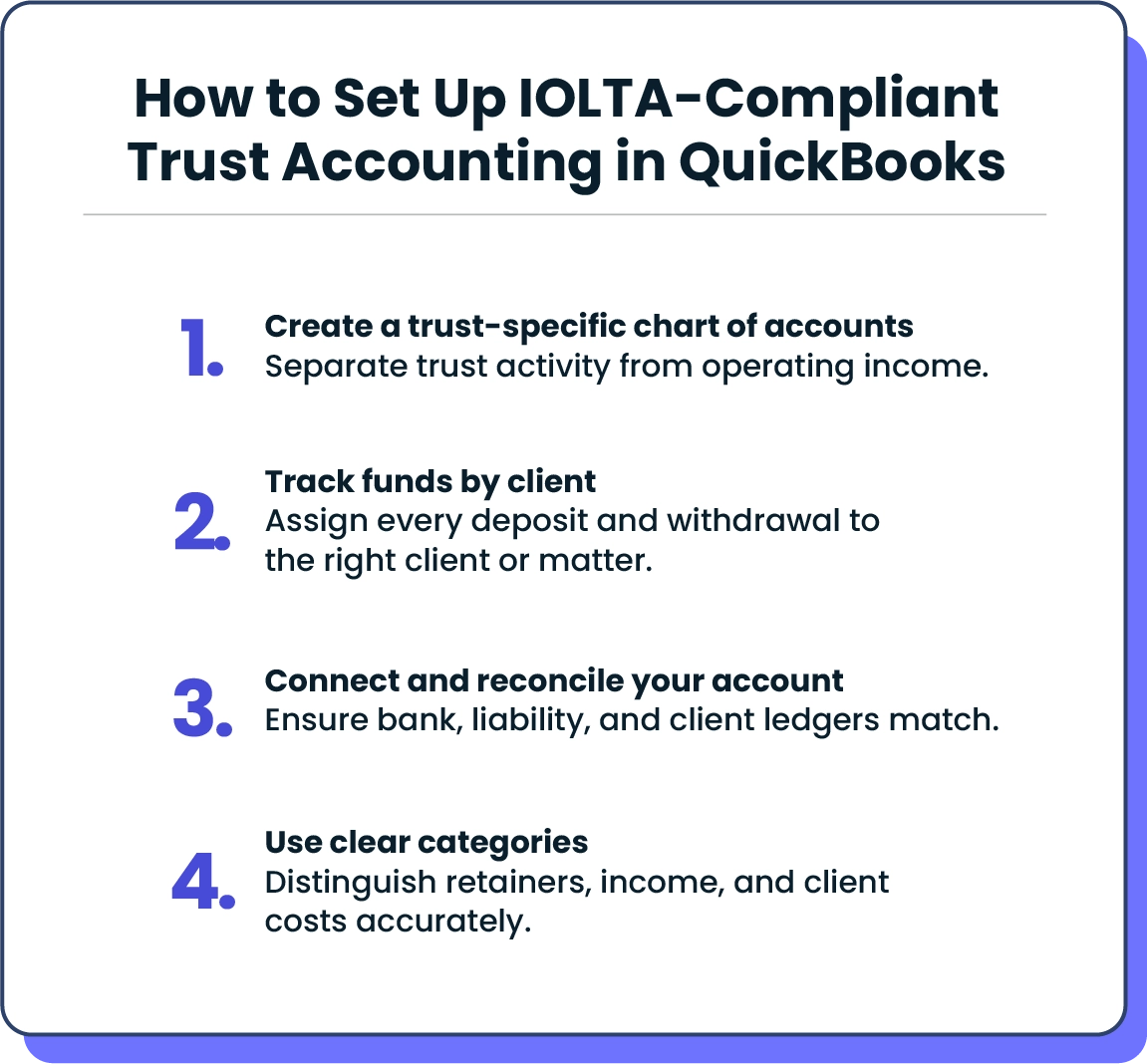

How to set up IOLTA-compliant trust accounting in QuickBooks

Using QuickBooks to manage trust accounting requires careful manual configuration and ongoing monitoring. Here is an overview of how to set up IOLTA-compliant QuickBooks trust accounting for lawyers:

1. Create a trust-specific chart of accounts

Add a bank account labeled as your IOLTA trust account.

Create a liability account to track client funds held in trust.

Keep all trust-related activity separate from operating income.

2. Track funds by client

Assign each deposit and withdrawal to the appropriate client or matter.

Only move funds from trust to income when services are completed and billed.

3. Connect and reconcile your trust account

Link your trust bank account to QuickBooks to import transactions.

Reconcile monthly to confirm that client ledgers, the liability account, and the bank balance all match.

4. Use clear categories for income and costs

Set up categories for retainers, earned income, hard costs, and soft costs.

Avoid recognizing income too early, and keep client costs distinct from firm overhead.

QuickBooks Online vs. desktop

If you’re deciding between QuickBooks Online and the desktop version, the right choice depends on how your firm works and what you prioritize in terms of access, features, and integrations.

QuickBooks Online is the more flexible option for most modern law firms. It allows you to log in from anywhere, on any device, which is especially helpful if you’re working remotely or managing multiple locations. It also integrates more easily with other legal solutions, including MyCase, making it a better fit for firms that want to automate their workflows.

QuickBooks Desktop, on the other hand, may appeal to firms that prefer to store everything locally or want more control over certain types of data. This version requires installation on a specific computer or server, which can limit accessibility and team collaboration.

For most law firms—especially those that plan to integrate with case management software or access financials on the go—QuickBooks Online is likely the more practical choice.

Integrating QuickBooks Online with MyCase

If your firm already uses QuickBooks Online, connecting it with MyCase can help reduce manual work and give you a more complete picture of your practice’s financial health. Once the integration is set up, information flows automatically between the two solutions. That means:

Invoices created in MyCase sync with QuickBooks

Online payments are tracked in both systems

Trust transactions are recorded and updated in real time

The result is a simplified workflow where legal billing, payments, and accounting stay aligned without duplicate data entry or extra steps.

Setting up the MyCase QuickBooks integration is easy—here’s a step-by-step overview of the setup process. Once connected, your team can spend less time toggling between systems and more time focusing on your clients.

Transform the way you manage legal accounting

Accurate, organized accounting is essential for running a successful law firm. And when you're managing trust accounts, even small mistakes can lead to serious consequences. That’s why the tools you choose for billing and financial management are so important.

While QuickBooks provides a solid foundation for general accounting, it offers limited visibility into the true financial performance of your law firm. It’s built for small businesses across many industries—not for legal practices with complex billing structures, realization rates, or partner compensation needs. True profitability insight requires tailored accounting for law firms that maps income, expenses, and collections back to specific cases and practice areas. Law firms need a complete view of performance through detailed reports—like cash flow, profit and loss, and balance sheets—that show how each matter impacts the bottom line. The right legal accounting system doesn’t just show what came in; it helps you see which cases and clients truly drive profitability, giving you the clarity to make smarter business decisions.

For firms already using QuickBooks, integrating with MyCase can help streamline day-to-day tasks. The integration ties your billing, payments, and accounting workflows together, reducing manual entry and making it easier to stay on top of your finances.

If your firm needs a complete legal accounting solution, 8am MyCase Legal Accounting offers a full suite of tools designed specifically for legal professionals, covering everything from trust accounting and IOLTA compliance to case-based billing, expense tracking, and real-time financial reports.

Start a free trial of MyCase today and simplify your firm’s accounting process.

About the author

Rob Heidrick is a Senior Content Strategist for 8am, a leading professional business solution. He covers the latest advancements in legal technology, financial wellness for law firms, and key industry trends.