The only business credit card that works for law firms

Make every firm expense count with the 8am™ Visa® Business Card. Track expenses, sync receipts, and automatically add case-related spending to client invoices, all in MyCase.

Designed for the unique needs of law firms

Whether you're a team of one or one hundred, the 8am™ Visa® Business Card was built to support the way modern law firms work.

Firm Owners

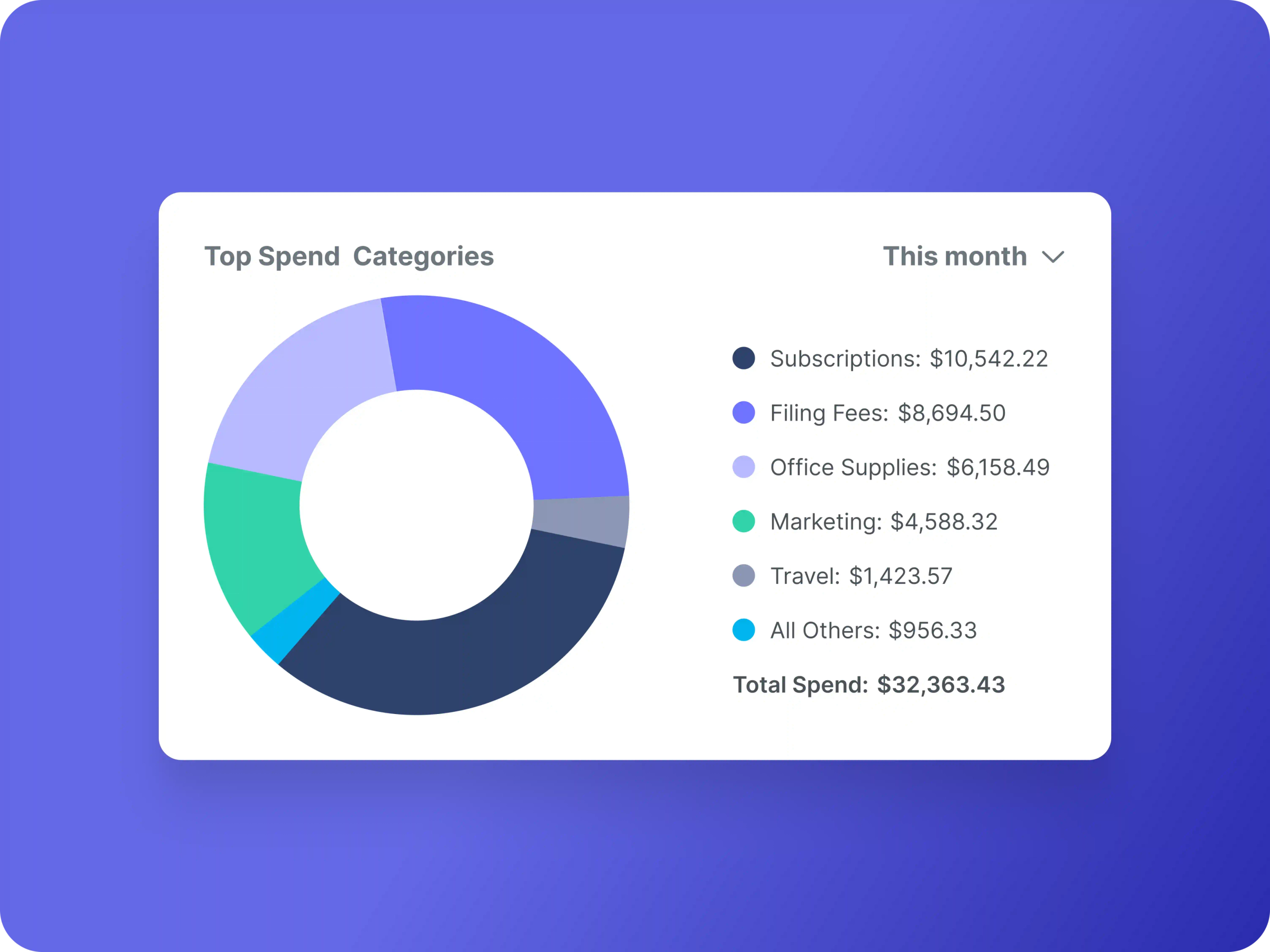

Simplify case cost tracking and maximize your margins. The 8am Visa® Business Card works seamlessly with 8am Smart Spend* for MyCase to give firm owners better visibility into expenses. With automatic categorization and direct integration, it’s easier to capture reimbursable costs, recover more, and make smarter financial decisions from day one.

Office managers

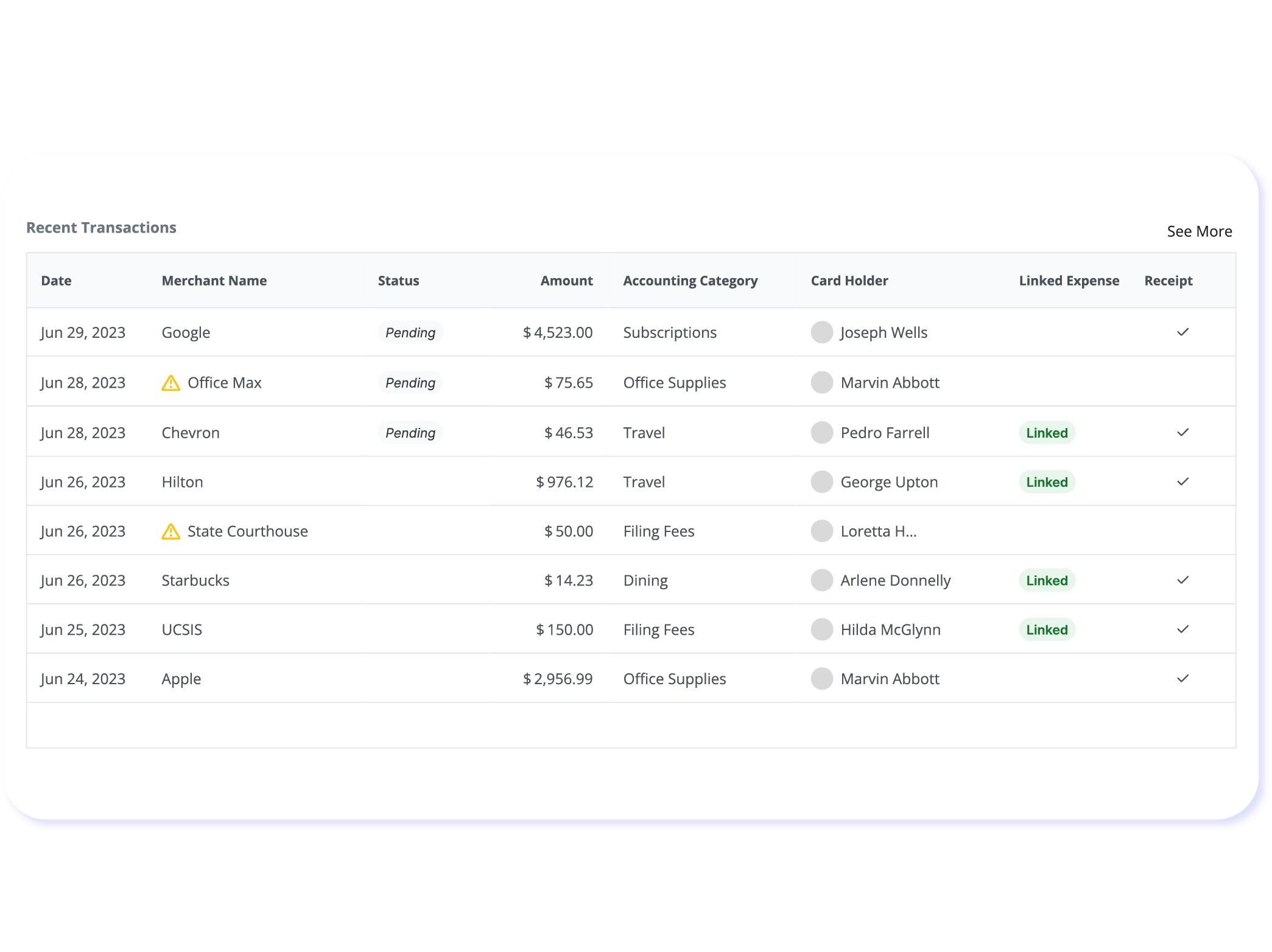

Simplify spending without slowing down. The 8am Visa® Business Card helps office managers keep purchases organized and easy to reconcile. Transactions flow directly into MyCase, reducing the need for manual entry and minimizing errors. The result? More time to focus on what keeps the firm running smoothly.

Finance teams

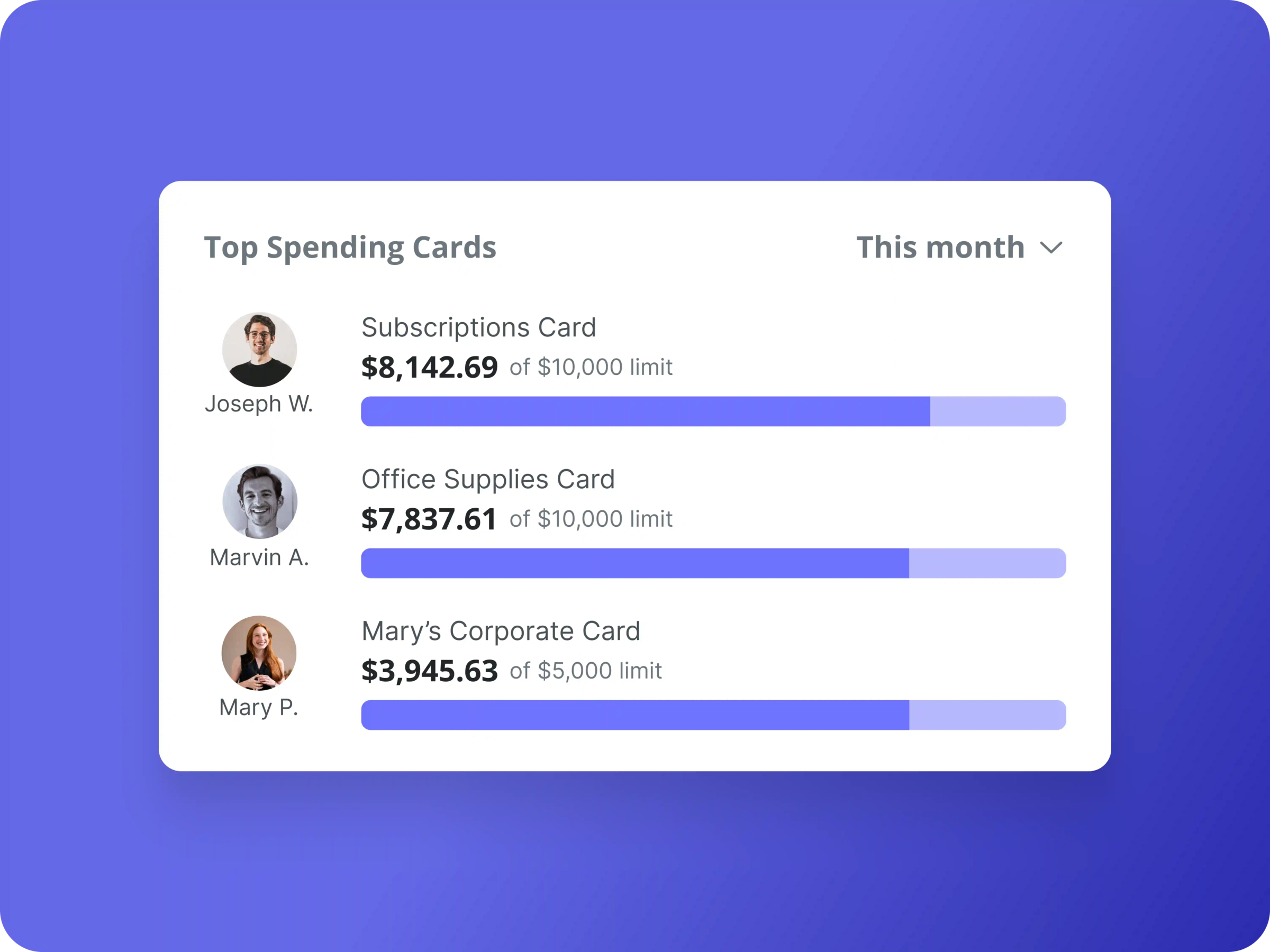

Make smarter, faster financial decisions. With the 8am Visa® Business Card, finance teams can track expenses by case, department, or team member, making it easier to stay on track. Real-time alerts, built-in controls, and seamless expense syncing into MyCase allow for quicker reconciliations and more informed financial planning.

More than a card

The 8am Visa® Business Card goes beyond everyday purchases. It gives lawyers the tools to manage spending with precision, stay organized, and keep every transaction accountable.

Enforce spend controls

Take the guesswork out of firm spending. Set custom limits on each card by person, department, or expense type to stay on budget and in control.

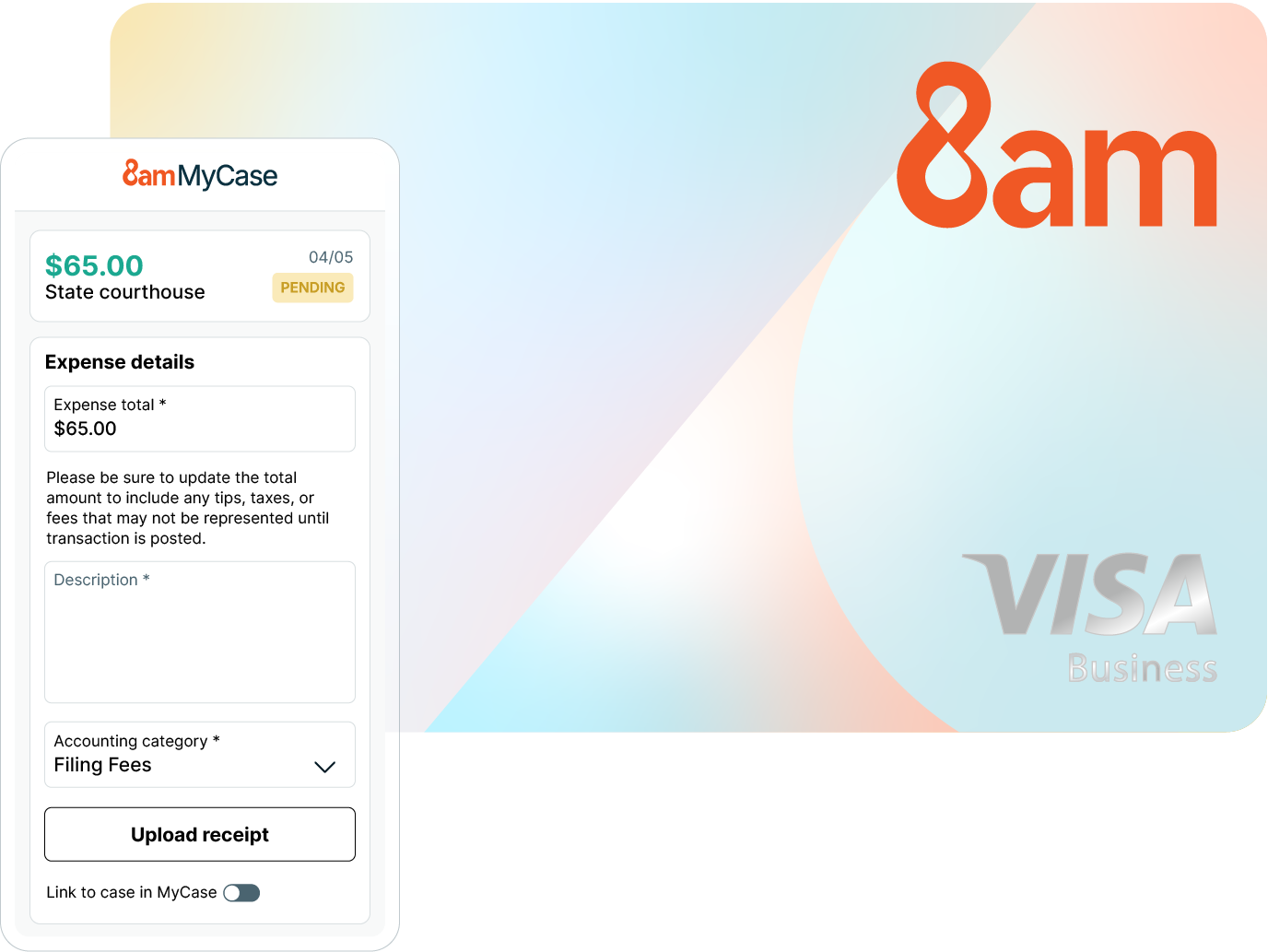

Track receipts with ease

At the time of purchase, cardholders are prompted to upload a receipt to MyCase, making expense tracking accurate and effortless. Each transaction can be linked directly to a case, so you never lose track of reimbursable costs or miss a billing opportunity.

Flexible card issuance

Need to separate spending by role or category? Easily issue virtual or physical business credit cards to individuals, teams, or for specific purposes like marketing or travel. It’s a smarter, more flexible way to manage firm-wide spending at scale.

Get More from every transaction

$0 annual fee

Visa SavingsEdge® Discounts+

Save automatically on qualifying business purchases. +Terms and conditions apply.

Built-In Controls & Alerts

Manage spending in real time

MyCase Integration

Auto-categorize expenses and assign to cases

Smart Spend Eligibility Requirements

If your firm meets the following criteria, you’re encouraged to apply:

In business for at least 12 months

Annual revenue between $50K–$10M (previous 12 months)

If revenue is under $500K, a personal credit score of 660+ is required

U.S.-based owners who are U.S. citizens

Make sure your credit is not frozen before applying.

8am Visa® Credit Card FAQs

Terms and conditions

*Smart Spend is provided by 8am. Emprise Bank is not affiliated with and does not endorse or promote Smart Spend. All questions or concerns should be directed to 8am at 844-335-3373 or lawpaycard@support.lawpay.com.

** Bonus Cash Rewards Offer. You will qualify for a $500 statement credit if you use your 8am™ Visa® Business Card account to make any combination of purchase transactions totaling at least $7,000 (excluding any interest or fees) that post to your account within 90 calendar days of the account activation date. Returns, credits, and adjustments to this card will be deducted from purchases, even if this card was not the original payment method. Cash Advances, Balance Transfers, traveler’s checks, foreign currency, money orders or wire transfers, lottery tickets, casino gaming chips, race track wagers, or similar betting transactions, and pending, unauthorized, or fraudulent charges are not considered purchases and do not apply for purposes of this offer. Limit 1 bonus cash rewards offer per new account. This one-time promotion is limited to new customers opening a new account in response to this offer and will not apply to requests to convert existing accounts or for existing customers who already have an account. Your account must be open and in good standing in order to receive this offer. If you qualify, your statement credit will be posted to your account within ninety (90) calendar days after you earn it. The value of this reward may constitute taxable income to you. You may be issued an Internal Revenue Service Form 1099 (or other appropriate form) that reflects the value of such reward. Please consult your tax advisor, as neither we, nor our affiliates or service providers, provide tax advice. Additional terms and conditions may apply. This offer is subject to change at any time.

⨥ Discounts provided as credits on future account statements. Visa SavingsEdge is a Small Business loyalty and discount program offered by Visa U.S.A. Inc. to eligible businesses and their authorized cardholders that hold an eligible Visa Business card. Visa Small Business cardholders can receive savings through two types of discount offers: Instant Coupons and Cashback. With Instant Coupons cardholders may receive a discount at the time of purchase by using an applicable coupon code or link from a participating merchant. A linked card is not required for cardholders to use Instant Coupons. With Cashback offers, cardholders must link (enroll) their eligible card in the program and use their linked card to make qualifying purchases of goods or services pursuant to an active cashback offer provided by a participating merchant, and that transaction must be processed or submitted through the Visa payment system (a “Qualifying Purchase”). Visa may modify, restrict, limit or change the program in any way and at any time. Visa reserves the right at any time to cancel the program. Visa also reserves the right to suspend or cancel any cardholder’s participation in the program. Cardholders will only receive discounts for qualifying purchases that are in full compliance with the terms of the applicable discount offer. Discount offers may be subject to additional terms and conditions. Discount offers may be removed from the program at any time and are subject to availability. Discount offers are also subject to any applicable law or regulation that may restrict or prohibit certain sales. Discounts will not appear on a cardholder’s receipt at the point of sale. For Cashback offers, discounts are provided in the form of credits posted to the cardholder’s applicable Visa Business card account. Please visit www.visasavingsedge.com for complete details on the program, including the program terms and conditions.

©2024 Visa. All rights reserved.