Key takeaways

Estate planning firms benefit most from software that supports document-heavy workflows, detailed intake, and strong coordination between attorneys, staff, and clients.

No single tool fits every practice; the right setup depends on firm size, planning complexity, and the volume of probate work handled.

Specialized will and trust software for attorneys can strengthen drafting, intake, or probate administration, while practice management software provides structure across the entire firm.

Integrated systems reduce administrative overhead, improve data accuracy, and help matters move forward with fewer delays.

All-in-one solutions like 8am™ MyCase make it easier to coordinate intake, documents, communication, and billing in one place.

Estate planning attorneys spend much of their time preparing legal documents, navigating intricate tax rules, and guiding clients through decisions that are both technical and deeply personal. That mix of legal precision and client-specific nuance requires a tailored approach to every case.

Complex workflows add to the administrative burden. For example, inconsistencies in the drafting process can create bottlenecks as documents go through multiple layers of review and revisions. Intake details may come from several individuals at different times, increasing the risk of gaps and duplicated work. Billing can lag as firms wait for documents to be executed, putting added pressure on cash flow.

To manage all of these challenges, trust and estate law firms need reliable software that keeps information consistent, accessible, and easy to act on. The right platform brings client data, documents, scheduling, and financial tasks into one organized system, reducing friction that slows firms down.

This guide offers a curated list of the best estate planning software for attorneys in 2026, covering full practice management systems, specialized intake tools, drafting software, and probate-focused solutions. It also breaks down the key features to look for when deciding which solution is the best fit for your firm.

11 Best legal software options for estate planning attorneys

Estate planning software has evolved quickly in recent years. Firms are replacing general-purpose tools with more specialized legal platforms that are built to handle complex client records and document-heavy matters with less friction. The list below highlights the best estate planning software for law firms in 2026, based on how well each solution supports real-world workflows, data accuracy, client collaboration, and long-term scalability.

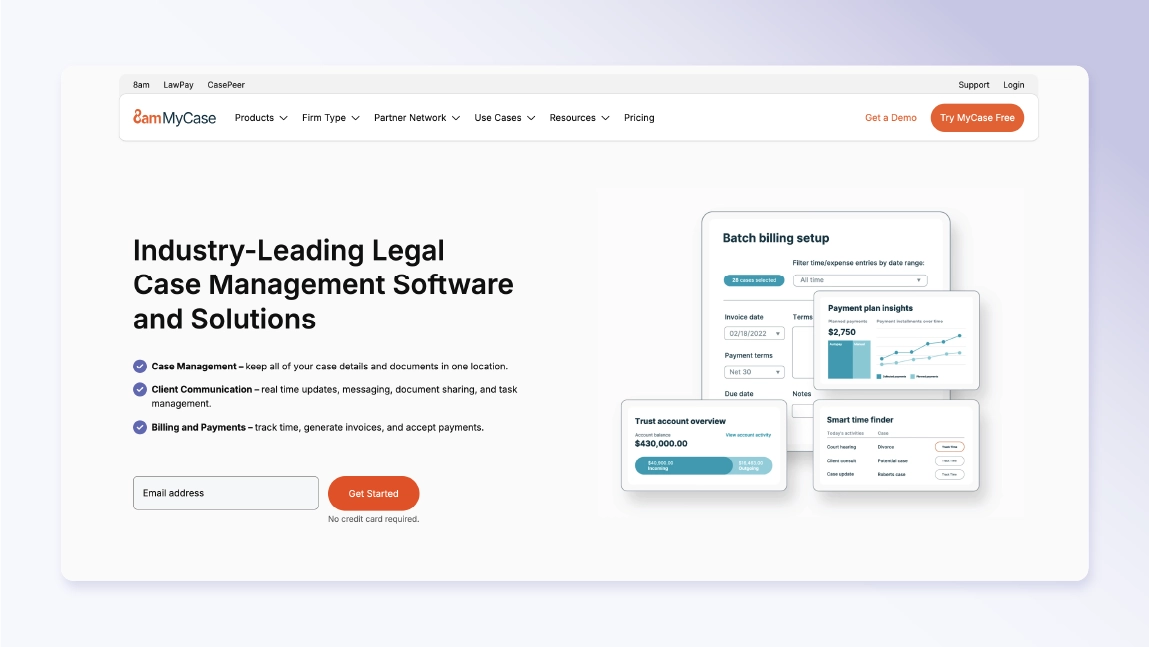

1. 8am MyCase

MyCase is a full legal practice management solution designed to support day-to-day operations across an entire firm. While it isn’t built exclusively for estate planning, it is widely used by trust and estate attorneys who need a single system to coordinate client information, matter activity, documents, communication, and billing. Its strength lies in bringing these functions together in one cloud-based workspace, which helps firms reduce reliance on disconnected tools as their caseload grows.

Core strengths:

Centralized document management with unlimited storage and auto-populating templates for wills, trusts, and related documents

Estate-specific intake and CRM capabilities, including dynamic forms and a DecisionVault integration for capturing information about heirs, beneficiaries, and assets

Automated workflows for routine drafting, deadline planning and management, and converting intake data directly into case files

2. Eternal Me

Eternal Me is a specialized estate planning intake and asset documentation platform designed to help firms gather complete, accurate information before drafting begins. Rather than replacing a full practice management system, it focuses on one narrow but critical stage of the workflow: organizing a client’s assets and related details in a clear, structured format. Law firms that use MyCase can integrate with Eternal Me to sync case data directly into active matters.

Core strengths:

Captures physical and digital assets in a single structured intake flow, reducing fragmented data collection

Clients have the flexibility and autonomy to decide what level of access to grant Eternal Me to manage their online profiles and digital assets

Manages a wide range of asset types securely, with unlimited matter scalability and direct syncing to MyCase for smoother onboarding

3. DecisionVault

DecisionVault is an intake-focused platform built specifically for estate planning and elder law practices that need clean, reliable client data before document drafting begins. It replaces traditional questionnaires and ad hoc forms with guided digital interviews that standardize how family, beneficiary, and financial information is collected. As a specialized solution, it’s typically paired with broader practice management software. Firms using MyCase can connect the two systems through the DecisionVault integration to move intake data directly into case files without re-entry.

Core strengths:

Structured intake workflows that capture complex family, beneficiary, and asset information with far fewer errors than manual forms

Direct integrations with MyCase and other platforms to prevent duplicate data entry and streamline handoffs between intake and drafting

Secure client portal that lets clients complete intake at their own pace, helping matters move forward sooner and with better preparation

4. WealthCounsel

WealthCounsel is an established drafting platform used by estate planning firms that handle complex scenarios and asset structures. Its primary role is document creation, not full practice management. Attorneys typically use it alongside separate systems for intake, communication, and billing. The platform is widely adopted by firms that prioritize technical depth in their estate planning documents and ongoing professional education tied to that work.

Core strengths:

Extensive drafting library covering wills, trusts, irrevocable life insurance trusts (ILITs), grantor retained annuity trusts (GRATs), and other advanced estate planning structures

Large catalog of continuing legal education (CLE) courses, bootcamps, and community resources

Strong reputation for document accuracy and technical depth

Key gaps:

Doesn’t provide a full suite of tools for practice management, billing, or lead intake

Drafting process for married couples requires separate spouse workflows, which some users find cumbersome

5. Interactive Legal

Interactive Legal is a document automation platform that provides detailed drafting support for complex estate planning matters. Like WealthCounsel, it focuses on the content and logic behind estate documents rather than on running broader firm operations. Its design centers on guided drafting workflows and embedded legal commentary, making it better suited for document creation than for intake management or client coordination.

Core strengths:

Expert-written templates with built-in legal guidance throughout the drafting process

Well suited for nuanced estate planning scenarios that require careful structuring

Efficient drafting workflows

Key gaps:

Limited flexibility to customize templates beyond preset structures

No built-in deed drafting, which many estate planning firms require

Requires add-on tools for CRM, billing, and client intake

6. Estateably

Estateably is a specialized platform for firms whose estate planning work extends deeply into probate and estate administration. Unlike drafting tools or general practice management systems, it centers on automating post-death workflows, court reporting, and fiduciary accounting. The platform includes many features associated with full practice management software, such as intake, contacts, task tracking, reporting, and document automation, but it’s designed specifically for estate, trust, and probate practices rather than multi-discipline firms.

Core strengths:

Automates probate workflows, including executor and beneficiary setup and court reporting

Offers advanced fiduciary accounting with one-click financial reports

Key gaps:

Not designed for drafting wills or trusts; focuses primarily on the administrative side of managing these documents

Best fit for firms with a substantial probate caseload rather than planning-only practices

Uses a layered pricing model with a base subscription plus additional fees for individual filings and extra jurisdictions

7. Clio

Clio is a general legal practice management platform used across many practice areas, including estate planning. It provides core tools for matter tracking, client communication, and firm administration, with estate-specific functionality largely delivered through third-party integrations. Firms often pair Clio with specialized estate planning and probate tools to create a more complete workflow.

Core strengths:

Custom data fields tailored to estate planning, including dates of birth and death, fiduciary roles, and spousal information

Integrates with WealthCounsel, Estateably, DecisionVault, and other platforms focused on estate planning

Secure client portal for sharing documents and communicating with family members and representatives

Key gaps:

Accounting features require a paid add-on and still lack functionality many firms expect at that price point

Relies heavily on integrations for estate-specific capabilities, which can increase overall cost and system complexity

Requires manual steps to associate client emails with case files, while platforms like MyCase automatically link emails to cases after a one-time setup

8. Lawgic

Lawgic is a document automation platform built specifically for estate planning and family law attorneys. It focuses narrowly on guiding legal professionals through the drafting process, in contrast to intake-focused software such as DecisionVault or Eternal Me. It’s a specialized solution rather than a full practice management system, so firms typically pair it with separate software for intake, billing, and case administration.

Core strengths:

Produces high-quality final documents with consistent formatting

Popular among attorneys migrating from Adapt due to formatting issues

Offers detailed configuration options for wills, trusts, and advanced clauses

Key gaps:

Interface feels dated and can take longer to learn, according to some users

Windows-only, with no native Mac support

Doesn’t include practice management, billing, or CRM features

Supports estate planning for only 12 U.S. states, which limits usability for firms with clients outside these jurisdictions

9. Smokeball

Smokeball is a general practice management platform with automation features and built-in time tracking. It’s used by firms across multiple practice areas, including estate planning, and is often chosen for its workflow structure and document automation tools. While it covers core firm operations, its billing tools may feel limiting for firms managing more complex estate planning workflows.

Core strengths:

Automatic time tracking for both flat-fee and hourly estate planning work

Solid document automation paired with task-based workflows

Clean interface and responsive customer support

Key gaps:

Available only on Windows; doesn’t support macOS or Google Workspace environments

Billing tools are frequently cited as difficult to use, particularly for guardians ad litem (GAL) matters

10. LEAP

LEAP is a legal practice management platform that combines firm administration with document automation in a single system. It supports estate planning firms that want integrated tools for matters, accounting, and document handling, along with a large built-in forms library. While it isn’t designed exclusively for trust and estate work, many firms pair it with specialized drafting platforms. LEAP integrates with WealthCounsel to support estate-specific document creation within a broader practice management setup.

Core strengths:

Matter tracking, invoicing, trust accounting, and document storage in one platform

Large library of automated legal forms that populate with client data

High level of customization for workflows and firm preferences

Key gaps:

Interface feels dated compared with newer cloud-native platforms, according to some users

Requires multi-year contracts, which can limit flexibility for growing firms

11. PracticePanther

PracticePanther is a general practice management platform known for its straightforward interface and billing tools. The software is designed for day-to-day firm administration rather than for tasks specific to estate planning law. It provides core functionality for running a practice and connects with several popular third-party tools used in trust and estate work.

Core strengths:

Simple, intuitive interface that requires minimal staff training

Strong billing, time tracking, and invoicing features with automated payment reminders

Integrations with commonly used tools such as LawPay, Dropbox, and Google Workspace

Key gaps:

Limited native document automation

No advanced estate planning–specific features, requiring firms to use separate software for drafting

Workflow and automation tools may not meet the needs of firms handling complex or high-volume estate planning matters

Key features to look for in the best estate planning software

Not all estate planning software solves the same problems. Some tools focus narrowly on drafting or intake, while others support the full lifecycle of a matter. When evaluating options, attorneys should look closely at how each platform handles the practical demands of trust and estate work, from managing records to coordinating client information and producing accurate documents.

The features below play a direct role in how efficiently a firm operates, how consistently work is completed, and how smoothly clients move through the planning process.

Feature | Description | Benefit for estate planning firms | Platforms with this feature |

Document management and drafting | Centralized storage, templates, and automated document creation | Faster drafting, fewer errors, and easier version control across wills, trusts, and related documents | MyCase, WealthCounsel, Interactive Legal, Lawgic, Smokeball, LEAP, PracticePanther |

Workflow and automation tools | Task triggers, step sequences, automated deadlines, and document generation | Reduces administrative work and keeps complex matters moving in a consistent order | MyCase, Estateably, Smokeball, LEAP, PracticePanther |

Client intake and CRM functionality | Structured digital intake forms and centralized client records | Shorter onboarding cycles, cleaner data, and fewer revisions before drafting begins | MyCase, Eternal Me, DecisionVault, Estateably, Clio, PracticePanther |

Billing and payments | Invoicing, reminders, and online payment processing | Faster collections and easier coordination when multiple family members are involved | MyCase, Smokeball, LEAP, PracticePanther, Clio |

Client communication and portal access | Secure portals for messaging and document sharing | Fewer missed updates and clearer communication with clients and families | MyCase, Clio, Smokeball, LEAP, PracticePanther |

Document management and drafting capabilities

Estate planning involves a large volume of documents, including wills, trusts, powers of attorney, deeds, and supporting tax records. The best estate planning software supports both digital files and scanned physical records so each document is easy to find, review, and revise.

Look for platforms that provide unlimited storage, strong search functionality, document templates, and tools that auto-populate forms with client data. These features shorten drafting cycles and minimize the risk of missing or inaccurate information. Support for jurisdictional variations and state-specific contracts is especially important for firms serving clients across multiple regions.

Workflow and automation tools

Some attorney estate planning software offers tools that automate task sequences, deadline scheduling, and document creation. Estate-specific workflows—such as setting up a trust, adding beneficiaries, reviewing documents, and preparing for signing—help add structure and prevent missed steps as matters progress. This makes it easier to spot what’s been completed and what still needs attention. Over time, automation reduces routine administrative work and helps firms deliver a more consistent experience across cases, even as volume grows.

Client intake and CRM functionality

Estate planning requires collecting detailed information about family relationships, assets, fiduciaries, and beneficiaries, often from multiple sources. CRM software for estate planning helps firms organize those relationships and contact records in one place. Rather than static questionnaires, modern client intake software for estate planning includes dynamic digital forms that sync client data directly into case files and CRM tools. The result is a faster onboarding process, fewer errors, and cleaner records throughout the life of the matter.

Billing and payments

Estate planning matters often rely on flat fees, retainers, and ongoing coordination with family members. Software that supports batch invoicing, automated reminders, and online payments helps firms shorten collection timelines and reduce manual follow-up. Platforms that offer invoice management for estate planning also reduce friction when extended families are involved in the financial side of an estate plan.

Client communication and portal access

Trust and estate work frequently includes communication with adult children, spouses, executors, and outside advisors. Some estate planning practice management software provides secure client portals that allow everyone to view updates, exchange files, and track next steps in a single location at any time of day. This helps prevent confusion and builds confidence in how matters are handled.

MyCase helps streamline trust, will, and estate planning law

To find the best software for wills and estate planning, consider your practice’s specific needs. A solo practitioner handling basic estate matters will evaluate tools differently than a multi-attorney practice that manages complex trusts and a steady volume of probate matters. Drafting requirements, staffing structure, client volume, and internal workflows all shape what works best for each firm’s day-to-day operations.

Offering seamless integrations with leading estate planning software, MyCase brings intake, matter management, document handling, communication, and billing into one solution. That makes it stand out as the best all-in-one practice management solution for estate planning firms that want to consolidate their work into a single system.

MyCase supports estate planning firms with:

Tools for full-firm management to organize matters, contacts, tasks, and deadlines in one unified workspace

Online intake that captures client details and documents through customizable, dynamic forms that reduce manual data entry

Automated workflows that standardize recurring steps across trusts, wills, and probate matters to keep cases moving and on track

Unlimited document storage for drafts, signed records, and supporting files, making it easy to find what you need

Client portals that centralize communication and document sharing for stronger privacy and added client convenience

Faster billing through built-in invoicing, reminders, and next-day payments

Start your free trial today and simplify your estate planning workflows with MyCase.

Legal estate planning software FAQs

About the author

Rob Heidrick is a Senior Content Strategist for 8am, a leading professional business solution. He covers the latest advancements in legal technology, financial wellness for law firms, and key industry trends.