The legal industry is undergoing a seismic shift. With technology evolving faster than ever and client expectations reaching new heights, law firms that resist change risk falling behind. Legal digital transformation is no longer a future ambition—it’s a present-day necessity.

But digital transformation isn’t just about upgrading software. It’s about fundamentally rethinking how law firms operate, deliver services, and interact with clients. From AI-powered legal research to automated workflows and real-time client communication, digital transformation is reshaping what success looks like in the modern legal landscape.

This guide explains legal digital transformation, why it matters now, and how to implement change at your firm to drive long-term growth and client satisfaction.

What is legal digital transformation?

Legal digital transformation refers to the strategic integration of digital technologies across every facet of a law firm’s operations. It involves reimagining how firms manage workflows, interact with clients, and handle firm finances.

Examples of digital law in action include:

Automated document generation

AI-assisted legal research and summarization

Centralized client portals with 24/7 access

Legal spend and accounting tools

Unlike one-off tech upgrades, true transformation affects the entire firm culture and business model. It aligns technology with long-term goals and delivers better outcomes for clients and teams.

Why digital transformation matters for today’s law firms

Across the legal industry, digital transformation has become mission-critical. Clients demand faster turnaround times, transparent billing, and easier ways to communicate. Competitors are investing in automation and analytics to improve productivity and margins. And regulatory pressures are rising.

Investing in digital transformation enables law firms to:

Provide personalized, always-available client experiences

Reduce manual workloads with automation

Deliver insights and outcomes faster

Improve business resilience and scalability

It’s more than adopting tools. It’s rethinking service delivery, firm structure, and value creation.

Key benefits of digital transformation in law firms

The benefits of digital transformation in law firms are clear:

1. Increased efficiency and productivity: Automation tools like time trackers, document automation, and e-signatures help firms do more in less time. Internal collaboration improves through shared calendars, task management, and real-time chat.

2. Enhanced client experience: Client portals, online intake, and two-way text messaging keep clients engaged and informed. Self-service options give them control and transparency.

3. Strengthened compliance and cybersecurity: Legal tech platforms can help ensure bank-grade data security, IOLTA-compliant trust accounting, and audit-ready financial reporting.

4. Improved cost management and profitability: Legal accounting software provides visibility into firm finances, helping leaders manage expenses, forecast cash flow, and make data-driven decisions.

Common challenges and how to overcome them

Despite its advantages, digital transformation in the legal industry can present significant hurdles. Many firms face barriers related to financial constraints, cultural resistance, cybersecurity risks, and outdated systems. Here’s how to tackle each challenge head-on with practical, actionable guidance.

Cost and resource barriers

The upfront costs of legal tech—including licenses, training, and migration—can feel overwhelming, particularly for smaller firms. However, the long-term return on investment often outweighs these initial expenses.

To manage costs effectively:

Start small and scale strategically. Prioritize tools that offer the highest immediate ROI, such as legal accounting software or case management platforms.

Leverage free trials and demos to evaluate effectiveness before committing.

Seek bundled solutions that consolidate features into one subscription.

Apply for legal tech grants or explore bar association discounts to reduce upfront spend.

A phased approach enables firms to modernize at a manageable pace without overwhelming budgets or resources.

Resistance to change

Technology alone doesn’t create transformation—people do. One of the most persistent challenges is internal resistance, often driven by fear, uncertainty, or lack of training.

To overcome resistance:

Secure leadership alignment early. Senior stakeholders must champion the vision and lead by example.

Involve the team during vendor selection to build ownership and confidence.

Invest in training tailored to different roles, ensuring everyone is equipped and supported.

Celebrate early wins to show progress and build momentum.

Fostering a culture of innovation takes time but is critical to successful digital transformation in the legal industry.

Cybersecurity and privacy concerns

Legal firms handle highly sensitive data, making cybersecurity a top concern. Moving to cloud-based platforms introduces perceived risks around privacy and data loss.

To protect your firm and clients:

Use legal-specific software that offers bank-grade encryption and IOLTA compliance.

Implement multi-factor authentication (MFA) and user access controls.

Establish written cybersecurity policies and conduct regular audits.

Educate your team about phishing, password hygiene, and secure data handling.

A secure digital foundation builds client trust and ensures compliance with evolving regulations.

H3: Legacy systems and skills gaps

Many firms still rely on outdated technology or disconnected systems that hinder efficiency and insight. A lack of digital fluency among staff compounds the issue.

To address this:

Audit your tech stack to identify tools that no longer serve your goals or create redundancy.

Create a modernization plan that outlines priorities, timelines, and benchmarks.

Provide hands-on training with new tools, and assign power users to assist others.

Consider hiring or contracting IT and legal tech specialists to accelerate progress.

Bridging the digital skills gap ensures your firm is future-ready and capable of sustaining transformation long-term.

Step-by-step roadmap to modernize your law firm

Successful digital transformation for law firms requires a phased, strategic roadmap. Rather than overhauling everything at once, take a structured approach to align technology with your business goals and improve outcomes at each step.

1. Assess current technology

Start by auditing your firm’s current technology environment. Evaluate your tools, workflows, and integrations to identify outdated systems, duplicative solutions, and manual processes that slow you down.

Look for:

Gaps in client communication or billing processes

Reliance on spreadsheets or paper-based methods

Tools that don’t integrate or require constant context switching

Understanding your current state allows you to prioritize upgrades that will yield the biggest impact on productivity and client experience.

2. Invest in staff training

Digital transformation is only successful when your team adopts new tools with confidence. Prioritize upskilling and digital fluency across your firm.

Create a training program that includes:

Onboarding for new tools, including walkthroughs and hands-on practice

On-demand resources like webinars and video tutorials

Internal champions or "superusers" who can support peer learning

Firm-wide training ensures consistent adoption, prevents burnout, and builds a culture that embraces innovation.

3. Implement cybersecurity and compliance measures

Before scaling your technology footprint, make sure your foundation is secure. Law firms are frequent targets of cyberattacks due to the sensitive data they handle.

Best practices include:

Implementing encryption and secure backups

Enforcing multi-factor authentication (MFA)

Assigning role-based access to client files and financial data

Performing regular risk assessments and compliance audits

Platforms like 8amTM MyCase include built-in bank-grade security and compliance with legal industry standards, making it easier to maintain data integrity.

4. Choose the right legal technology stack

With your needs identified and your team ready, it’s time to build your ideal tech stack. Choose solutions that offer flexibility, integration, and ease of use.

Look for platforms that consolidate:

Case management

Time tracking and billing

Legal accounting and spend management

AI-powered features like document summaries and smart time capture

5. Monitor and adapt with KPIs

Transformation doesn’t stop once the software is installed. To ensure continued improvement, set benchmarks and measure your progress over time.

Track key performance indicators (KPIs) such as:

Billable hours and realization rates

Time to payment and invoice status

Client satisfaction and communication response times

Software adoption rates across staff

Regularly review your data to refine strategies, address gaps, and scale what works.

Emerging trends and future outlook

The digital transformation in the legal industry will continue to expand over the next 3-5 years. According to the 2025 Legal Industry Report, law firms that embrace digital maturity are significantly more likely to see gains in profitability, client retention, and staff satisfaction.

Firms classified as "digitally mature" reported:

2.1x higher revenue growth compared to firms still in early stages of digital adoption.

38% greater client retention, due to enhanced communication and faster service delivery.

41% improvement in employee satisfaction, driven by reduced administrative burden and improved collaboration tools.

These trends suggest that investing in digital transformation is no longer a competitive edge—it’s a requirement for long-term success in an increasingly tech-forward legal environment.

Whether you're streamlining operations, integrating legal AI, or refining client billing, the firms that act now will be best positioned to lead in the years ahead.

Advanced spend management and expense tracking

Digital tools now allow law firms to track legal spend in real time, offering clear visibility into budget allocations, vendor costs, and matter-level expenses. Solutions like MyCase surface actionable insights by automatically flagging cost drivers, unusual charges, and areas of overspending.

Centralizing all spend data into a unified dashboard improves transparency for firm leaders and enhances client-facing reporting. Clients increasingly expect cost clarity and accountability, and digital systems help meet those expectations with data-backed reports.

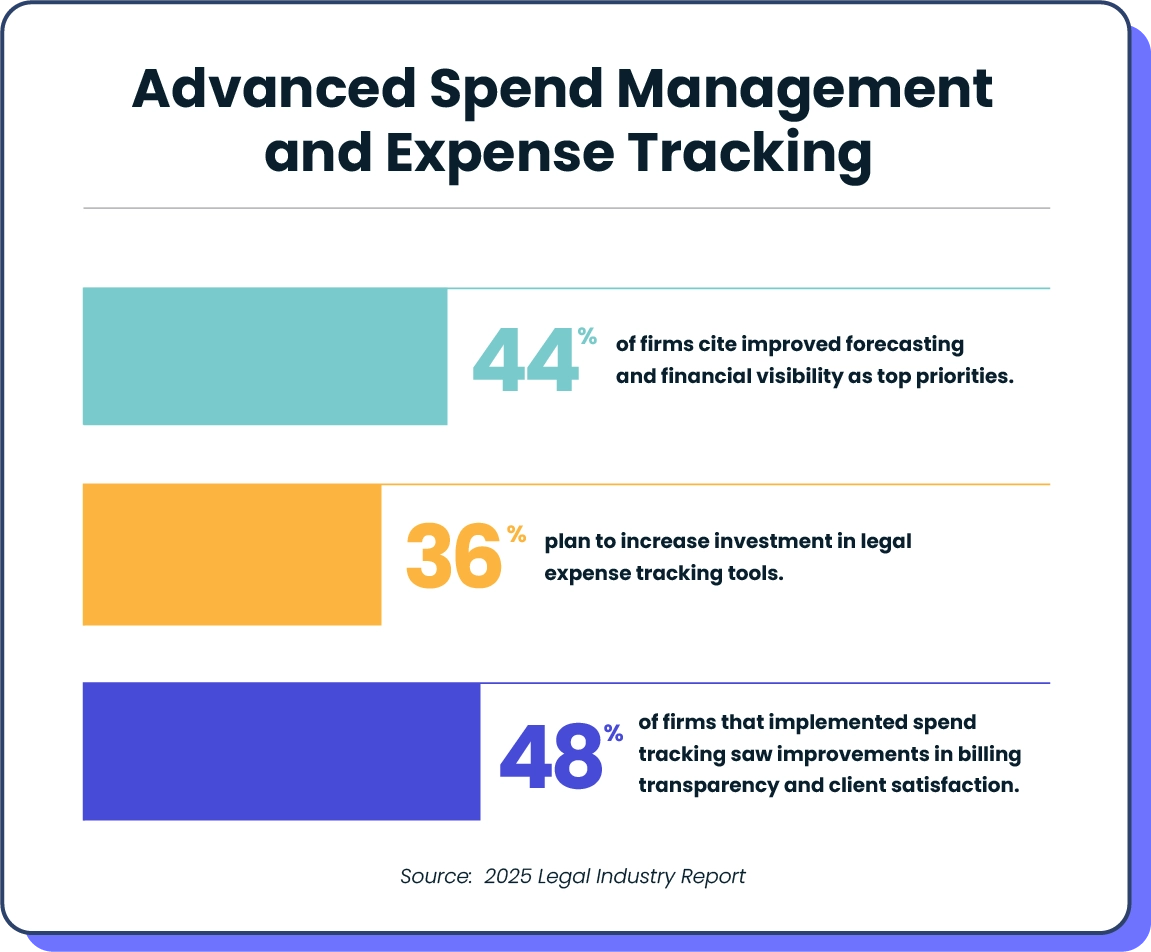

According to the 2025 Legal Industry Report:

44% of firms cite improved forecasting and financial visibility as top priorities.

36% plan to increase investment in legal expense tracking tools.

48% of firms that implemented spend tracking saw improvements in billing transparency and client satisfaction.

Integrated legal accounting and financial management

Cloud-based legal accounting platforms are transforming how firms manage finances, from billing and invoicing to trust accounting and compliance. With automatic reconciliation, batch billing, and audit-ready reports, these systems eliminate the need for manual entry and reduce human error.

Integrated accounting systems streamline workflows by syncing time tracking, expense capture, and payment processing in one place. This saves time, ensures IOLTA compliance, and enables better financial decision-making.

Key insights from the 2025 Legal Industry Report include:

47% of firms report fewer accounting errors after switching to integrated platforms.

52% of firms say modern accounting tools improve cash flow and payment collection.

39% of firms with integrated systems saw improved partner visibility into firm performance.

AI-powered firm operations

AI is becoming a cornerstone of operational efficiency in law firms. AI-driven tools can accelerate legal writing, automate contract review, analyze litigation risk, and streamline client intake and communication.

Generative AI specifically is helping firms:

Draft emails, memos, and pleadings faster

Summarize complex documents and case law

Analyze trends for predictive case strategy

To fully leverage AI, firms must invest in training teams to collaborate effectively with these technologies. Upskilling staff ensures ethical, secure, and strategic use of AI in legal workflows.

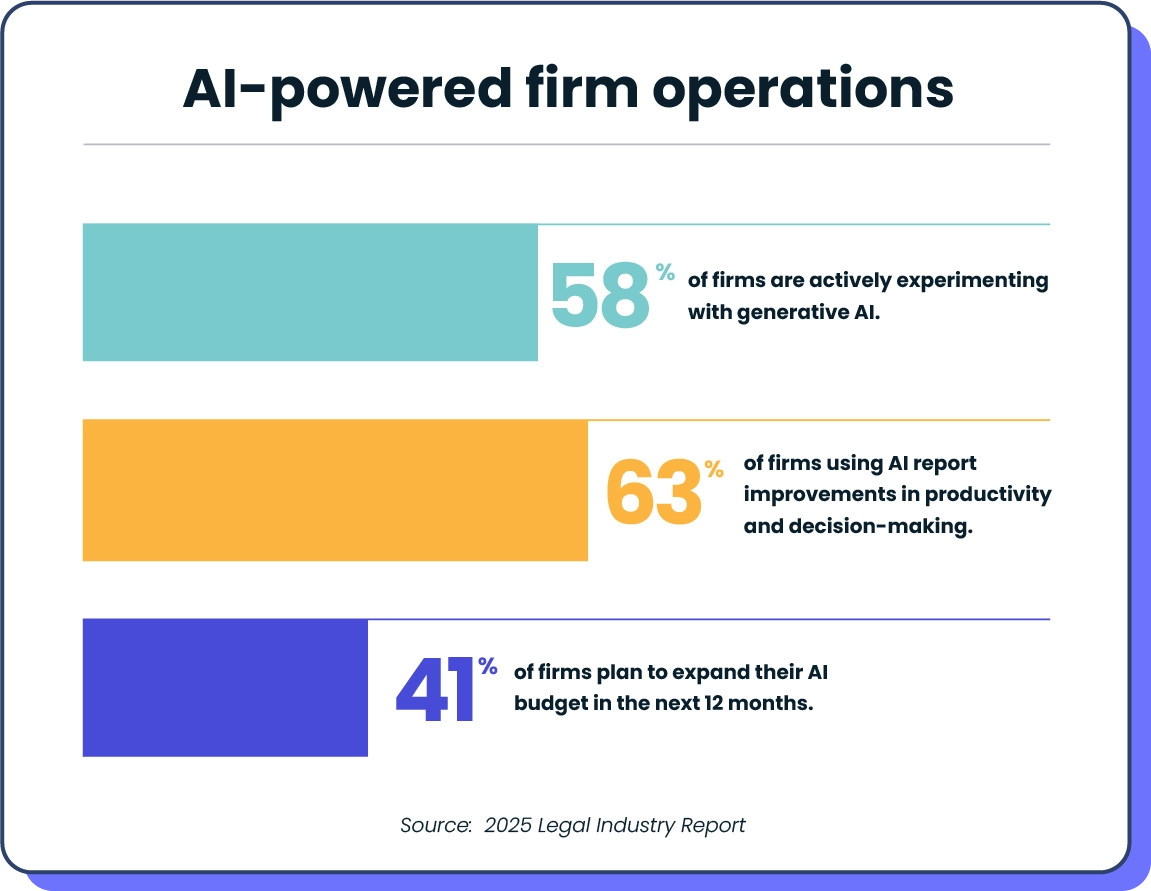

According to the 2025 Legal Industry Report:

58% of firms are actively experimenting with generative AI.

63% of firms using AI report improvements in productivity and decision-making.

41% of firms plan to expand their AI budget in the next 12 months.

Digitally transform your firm with MyCase

MyCase is purpose-built to help legal professionals run profitable, organized law practices. As a comprehensive legal practice management solution, it offers:

Legal AI software for document summarization and writing support

Legal accounting tools and legal spend management to optimize financial wellness

Case management, document automation, calendaring, and client communication in a centralized hub

From solo attorneys to mid-sized firms, MyCase makes digital transformation achievable, scalable, and secure.

Schedule a demo today to see how you can simplify operations, improve client service, and get paid faster.

About the author

Mary Elizabeth HammondSenior Content Strategist and Blog Specialist8am

Mary Elizabeth Hammond is a Senior Content Strategist and Blog Specialist for 8am, a leading professional business solution. She covers emerging legal technology, financial wellness for law firms, the latest industry trends, and more.