Key takeaways

Legal spend management is a framework for controlling, tracking, and analyzing firm spending.

Legal spend management software automates and supports this framework with real-time data and controls.

Better visibility into spending helps firms protect profitability and plan with confidence.

Spend management supports economic resilience by reducing waste, capturing billable expenses, and enhancing forecasting accuracy.

Law firms that invest in spend analytics are better equipped to handle margin pressure and client volatility.

Legal spend management helps law firms maintain clarity and control over firm finances—especially during periods of economic uncertainty. As inflation, client cost sensitivity, and unpredictable payment cycles continue to pressure margins, firm leaders need better visibility into where money is going and how spending decisions affect long-term viability.

At its core, legal spend management gives firms a structured way to monitor, control, and analyze expenses. When paired with the right technology, it becomes a practical strategy for strengthening financial confidence, supporting smarter planning, and maintaining stability even when external conditions feel uncertain.

This guide explains what legal spend management is, how it works for law firms, and how software and analytics support stronger financial decision-making.

What is legal spend management?

Legal spend management is the process law firms use to track, control, and analyze money spent across the business—from operational costs and vendor invoices to client-related expenses. It provides a structured framework for understanding where firm dollars are allocated and how spending affects profitability.

Legal spend management software is the technology that supports and automates this process. It centralizes expense capture, enforces spending rules, and provides reporting and analytics, enabling firms to make informed decisions without relying on manual tracking.

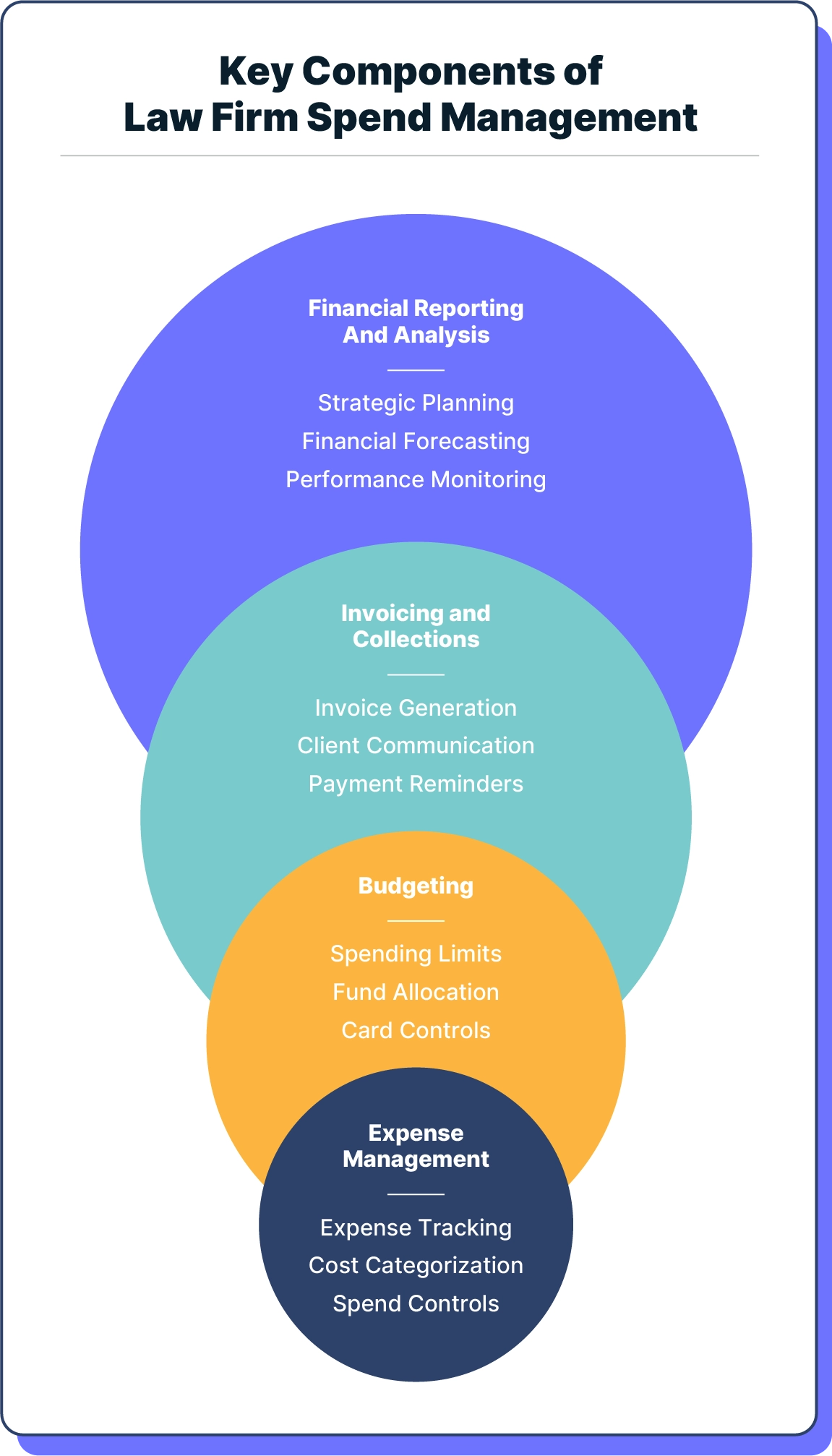

Legal spend management encompasses several key components and helps law firms:

Track and manage expenses by categorizing hard and soft costs, logging and capturing receipts, and billing clients accordingly for reimbursable expenses.

Establish process controls and oversight by creating pre-approval processes and post-spending analysis.

Implement effective budgets by setting limits for spending categories and company cards.

Enforce timely invoicing and collections by automating invoice generation, setting clear client expectations, and regularly sending reminders.

Generate and analyze financial reports by setting benchmarks, identifying trends, and monitoring ongoing financial performance.

Forecast future financial performance by analyzing profitability, cash flow, and outstanding accounts receivable.

Spend management for in-house legal teams

For in-house legal teams, spend management involves managing and controlling costs associated with outside counsel, firms, and alternative legal service providers.

Spend management helps legal departments:

Centralize and organize their spend data.

Track and monitor legal costs to inform decision-making.

Streamline operations by automating tasks such as invoices and workflows.

Spend management for law firms

For law firms, spend management extends beyond internal costs. It also ensures that client-related expenses are accurately captured, efficiently approved, and billed correctly.

Example: A litigation firm uses spend management software to track filing fees, expert invoices, and travel expenses in real time. Expenses are reviewed automatically, linked to the correct matter, and included on client invoices—reducing write-offs and improving cash flow.

How spend management differs from expense management

While these concepts may seem similar, expense management and spend management have different scopes and objectives.

Expense management is a key aspect of spend management, typically focusing on individual employee spending.

Spend management oversees the company’s total spending and the strategy behind maintaining the business’s financial health.

Financial challenges that spend management helps law firms overcome

Legal spend management serves as a solution to many common financial challenges that law firms face today.

Financial challenge | Impact on firms | Economic insight |

Rising operational and legal costs | Inflation increases overhead while clients resist higher fees | 46% of small businesses cite inflation as their biggest challenge (U.S. Chamber of Commerce) |

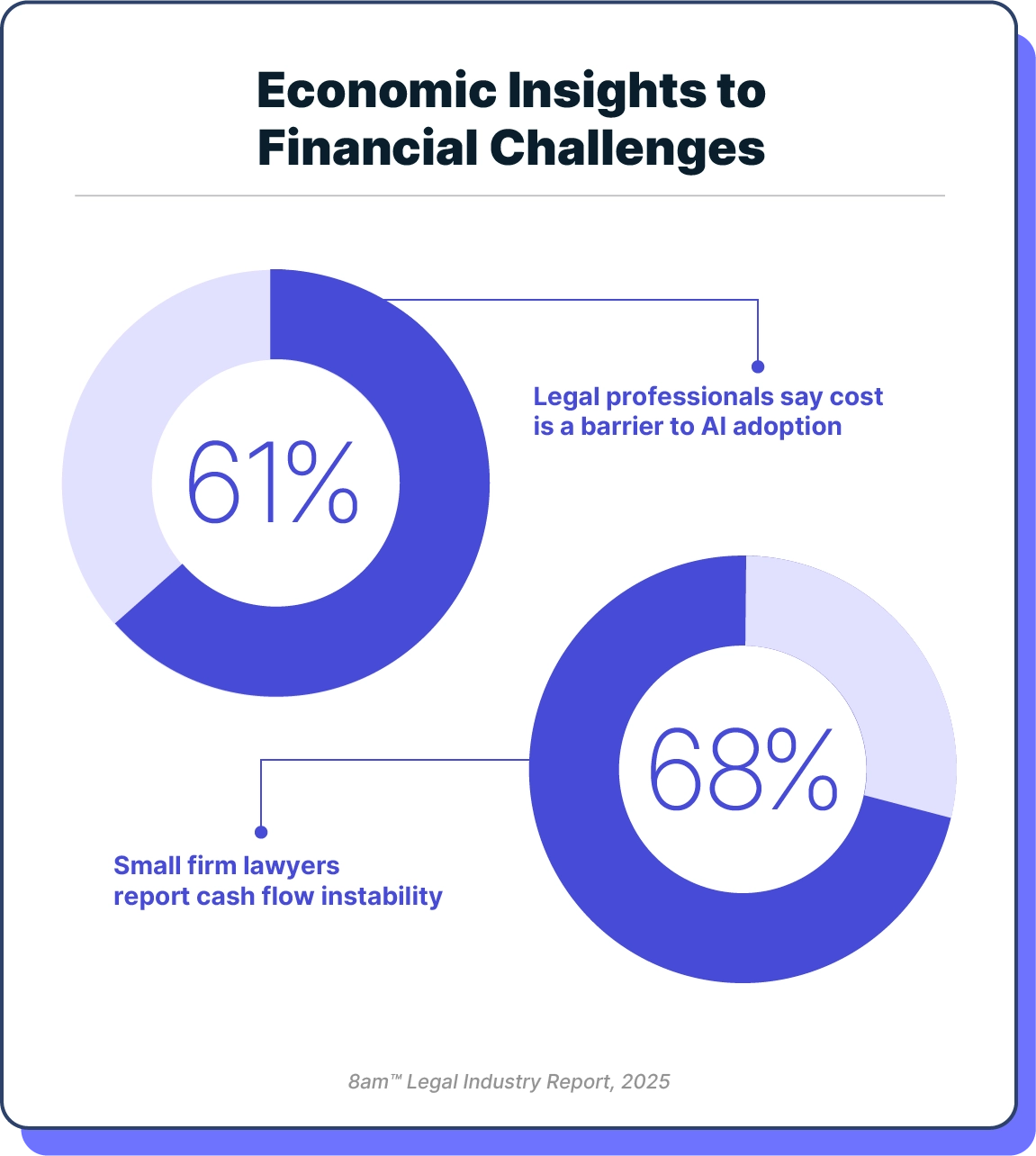

Uncertain 2026 outlook fuels tech hesitation | Firms delay investments, increasing planning stress and inefficiency | 61% of legal professionals say cost is a barrier to AI adoption (8am™ Legal Industry Report, 2025) |

Client business volatility | Tighter client budgets and payment delays strain firm liquidity. | 75% of small businesses say rising prices have significantly impacted them in the past year (U.S. Chamber of Commerce) |

Untracked client expenses | Lost revenue worsens cash flow gaps | 68% of small firm lawyers report cash flow instability (8am™ Legal Industry Report, 2025) |

Benefits of legal spend management software for law firm economic resilience

Legal spend management solutions provide firms with greater visibility and control over their finances, giving them a comprehensive view of all business spending. Below are just a few of the benefits of adopting this technology.

Improved firm profitability

Law firm spend management software protects your profit margins and cash flow by accurately tracking case-related expenses. For example, these tools can capture digital receipts, automatically add case expenses, and instantly generate client invoices.

With 8am Smart Spend, you can track and organize transactions in a few simple steps:

Spend: Make a purchase.

Snap: Take a photo of the receipt.

Submit: Add relevant expense details.

Sync: Expenses are automatically linked to the correct matter in MyCase.

Repeat.

By automating this process, your law firm can minimize revenue leakage and gain better control over spending.

Increased operational efficiency

With law firm spend management software, your firm can say goodbye to manual receipt tracking and tedious expense entry tasks. The software automatically tracks your case-related expenses to streamline accounting processes and simplify end-of-month reconciliation.

This helps your law firm:

Reduce time spent on repetitive tasks.

Minimize manual entry errors.

Ensure a more accurate financial overview.

Free up time to focus more on what really matters: serving clients.

Better visibility into firm spending

Legal spend analytics offer law firms a clear, real-time view of where money is being spent and how spending patterns affect their overall financial health. Instead of relying on delayed reports or manual reviews, firm leaders can spot issues early and make informed adjustments.

Tracking legal spend analytics helps firms:

Monitor spending trends by matter, vendor, or category to understand which cases, clients, or cost centers are driving expenses over time.

Identify cost overruns early by flagging unusual or out-of-policy spending before it impacts profitability.

Forecast budgets with greater accuracy using historical spend data and emerging trends to plan for upcoming months or quarters.

Support data-backed leadership decisions by giving partners and administrators reliable insights to guide budgeting, staffing, and technology investments.

This level of visibility is especially valuable in uncertain economic conditions, helping firms stay in control of costs while planning with greater confidence.

How to improve legal spend management

Improving your law firm spend management strategy can help you build a more profitable practice. Below are a few steps that can help you optimize your law firm cost management and ensure more informed, data-driven decisions.

1. Evaluate your firm’s expenses and operating costs

Running the business side of your firm involves many moving pieces, and tracking your operating costs is the first step to tracking expenditures and optimizing profitability.

Start by identifying each law firm expense category within your firm and calculating the total spend for each category in the past month. Legal spend analytics can expedite this process by automatically categorizing all logged expenses. Otherwise, you may need to set aside time to compile and review past spreadsheets, receipts, and other legal expense tracking logs.

For categories, you can broadly group expenses into two types: operational costs and case-related costs.

Operational costs are essential business expenses. Categories may include:

Office space rent or lease

Utilities

Office supplies

Software subscriptions

Hardware

Marketing and advertising

Staff salaries and benefits

Insurance for property, malpractice, and other areas

Case-related costs can vary and may be reimbursable by the client (depending on the fee agreement). Example attorney fees may include:

Travel and parking fees

Court filing fees

Expert witness fees

Legal research fees

Laboratory fees

After you’ve established your expense categories and mapped out their costs, review your firm’s spending trends to find areas for improvement.

Analyze yearly and monthly average spending for each category. Then, compare those numbers to your law firm’s budget. From there, you can more closely assess line items to identify where you may need to allocate additional resources or reduce expenses.

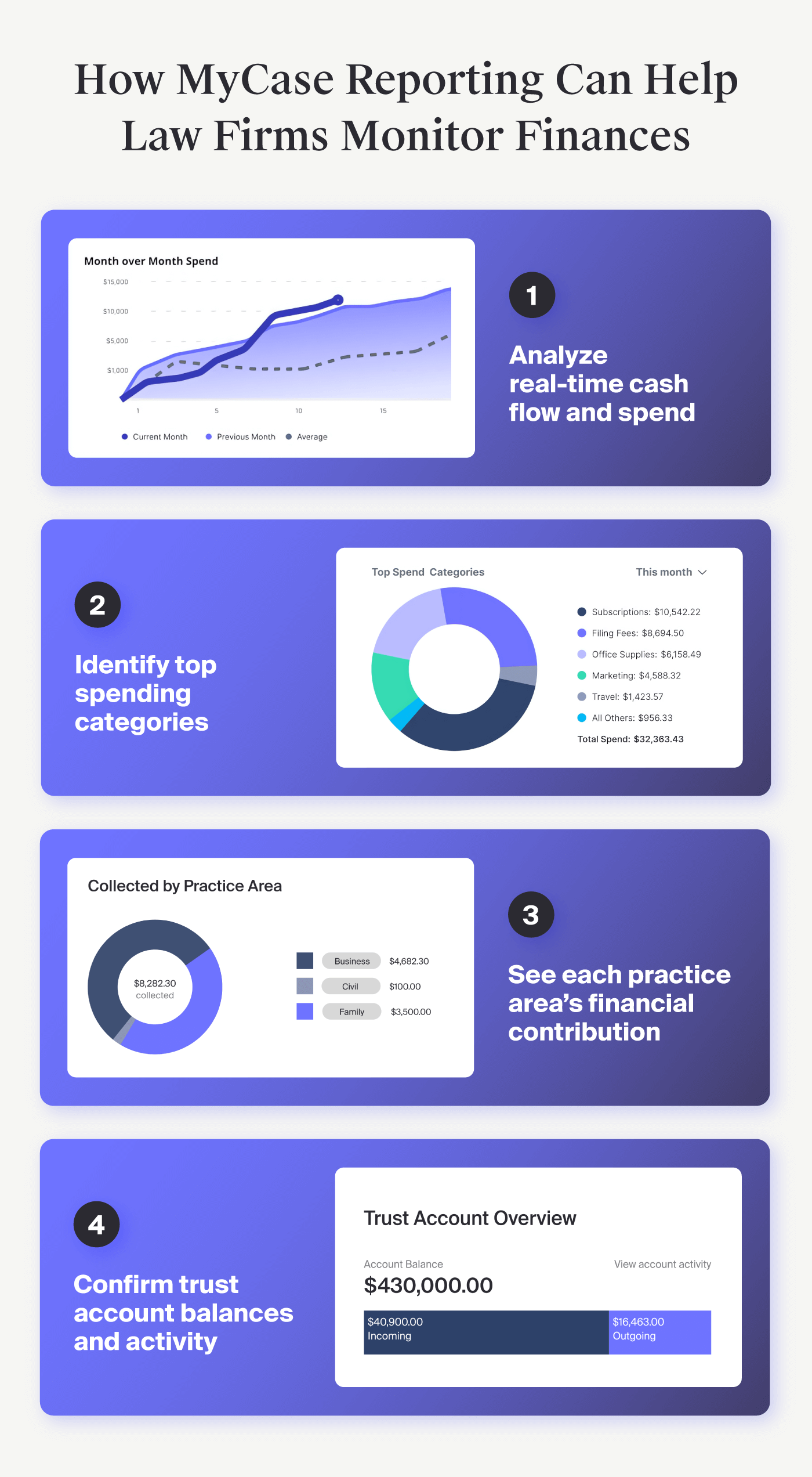

Many firms also use software to quickly identify these trends and provide real-time insight into their financial health. For example, MyCase Financial Reporting helps firms filter their spending data by generating numerous reports to provide a holistic view of a firm’s overall performance.

2. Establish goals and key performance indicators (KPIs)

Once you have your baseline data, you can begin setting financial goals and KPIs.

For example, your data may reveal that case costs are higher than anticipated, or that expenses aren’t being tracked consistently, leading to missed or incomplete reimbursements. You may also learn that some clients have disputed these charges, leaving the firm unable to recover certain costs.

To address these issues, you could set a goal to reduce case-related costs by 10% within six months by clearly communicating reimbursable expense policies to clients and establishing a more reliable expense tracking process.

In addition to goal-setting, you can also establish measurable law firm KPIs to keep track of progress.

For the above goal, relevant KPIs could include:

Billing dispute rate for reimbursable expenses: Track the percentage of invoices with disputed expense charges each quarter and compare it to the prior period to measure improvement.

Time spent on expense tracking per employee: Monitor non-billable hours spent logging and managing expenses each month to assess changes in efficiency.

Case profit margins: Measure the difference between total case revenue and case-related expenses on a monthly basis to evaluate overall profitability.

3. Develop and train on clear spend management policies

Providing standardized training and establishing clear workplace policies can help guide your firm toward achieving its financial goals. These initiatives can help everyone learn how to manage their spending accurately and efficiently.

When building an invoicing and expensing policy, be sure to include:

Roles and responsibilities: Explain each team member’s duties related to spend management and who oversees certain tasks.

Approval processes: Create a step-by-step process for submitting, approving, and finalizing expenses.

Legal expense tracking requirements: Define what expenses are reimbursable, outline how staff should record expenses, and specify the supporting documentation required for each expense.

Invoicing procedures: Specify invoice formatting, reimbursable expenses, and delivery methods.

Timing requirements: Establish a standardized timeline for invoice reviews, delivery, and payment follow-ups.

Client policies: Decide billing frequency, late payment fees, accepted payment methods, and communication guidelines for payment expectations.

Client consent procedures: Decide when you’ll need client signatures.

Accounts receivable process: Go over how your law firm manages accounts receivable, grace periods, and when to turn debts over to collections agencies.

Dispute resolution process: Cover how staff should manage disputes, escalation procedures, and potential resolutions.

Technology guidelines: Outline the steps for using law firm expense management software, invoice generation, and other finance-related software.

Once you’ve created these guidelines, dedicate time to reviewing them with staff, walking through processes, answering questions, and collecting feedback. This can help avoid confusion, process delays, and errors down the line.

Scheduling periodic reviews of these policies also allows your firm to identify necessary updates. For example, if your team found a more efficient process for logging receipts, ensure your guidelines reflect this change.

4. Leverage automation and spend management software

Transparent processes and training are essential to effective spend management, but workflows that rely on manual tasks like data entry can quickly overwhelm staff. Over time, this leads to:

Inaccurate or delayed billing

Missed or untracked expenses

Administrative bottlenecks and burnout

Technology helps firms reduce this friction by:

Automating repetitive spend-related tasks

Minimizing human error

Providing clear, real-time visibility into firm cash flow

Legal spend management software, such as 8am Smart Spend, is specifically designed for law firms, enabling practices to pay, track, and manage firm and client expenses in a centralized system. With real-time financial insights, firms can control costs more effectively, spot inefficiencies sooner, and make data-driven decisions with greater confidence.

When combined with centralized case and financial data, spend management becomes even more powerful. For example, 8am Smart Spend automatically links case expenses to the correct client matters—helping firms generate accurate invoices and ensure no billable expense falls through the cracks.

Webinar

Financial Wellness for Law Firms: Using Data to Connect the Dots to Profitability

Download Webinars

5. Implement regular financial reporting

Routinely reviewing legal spending insights and other financial reports can show you how you’re progressing toward your law firm’s goals—and if you need to make adjustments sooner rather than later.

Below are some examples of financial reports that your law firm may leverage:

Cash flow statements show how much money flows into the firm (e.g., from client work) and out (e.g., unreimbursable expenses).

Time and expense reports track the time spent on client matters and the expenses incurred for each client. Depending on your reporting solutions, you can view this based on individual employees, cases, and the total firm.

Profit and loss statements (also called income statements) show the firm’s revenue, costs, and expenses during a specific period to communicate total profit or loss.

Accounts receivable reports show clients and vendors who owe funds based on work performed.

Aging invoice reports display outstanding invoices, grouped by the number of days they are overdue (e.g., 1-15 days, 16-30 days).

Case revenue reports show what your law firm billed for cases compared to what your firm earned.

Balance sheets show your law firm’s assets, liabilities, and equity during a specified time period.

Client profitability analysis reveals how your firm generates income by examining the profitability of individual clients, legal matters, and practice areas.

Budget variance reports compare actual spending against budgeted amounts.

Tax returns summarize financial information for tax purposes, including tax breaks and deductions that have been taken.

Trust account reports show an overview of a client’s trust account activity.

The following table goes over examples of financial reports, who may be involved in creating and reviewing them, and how often you may want to review these reports. Modify these recommendations based on your law firm’s goals.

Frequency | Example financial reporting | Who may be involved |

Weekly | Cash flow statement, time and expense reports, and trust account reports | Bookkeepers, legal assistants, paralegals |

Monthly | Profit and loss statements, accounts receivable, aging invoices, and case revenue reports | Accountants |

Quarterly | Balance sheet, client profitability analysis, budget variance report | Department heads, controllers |

Annually | Year-end balance sheet, year-end income statement, cash flow statement, tax returns | Controllers, tax professionals, external auditors |

Example legal spend management workflow for law firms

A structured spend management workflow helps law firms control costs, capture billable expenses, and maintain confidence in their financial data—without adding administrative burden. Below is an example of how a typical law firm might manage spending using a legal spend management system.

Step-by-step workflow:

Capture expenses at the source: Firm and client-related expenses are recorded as they occur—whether it’s a filing fee, expert invoice, travel cost, or subscription charge. Receipts and transaction details are captured immediately, reducing the risk of forgotten or misplaced expenses.

Expense is processed and recorded. When expenses are paid, they are automatically recorded in the system of record. Expenses are linked to the relevant client matter or to general operating expenses, ensuring accurate and up-to-date, audit-ready records.

Spend data is aggregated and categorized: All spend data is centralized and categorized by matter, vendor, and expense type. This creates a single source of truth for firm spending across cases and departments.

Review financial reports and dashboards: Firm leaders and administrators review real-time dashboards and reports to monitor spending trends, identify variances, and assess budget performance.

Adjust budgets and controls as needed: Insights from spend data inform budget updates, spending policies, and resource allocation—helping firms respond quickly to changes in caseload, costs, or client demand.

This workflow enhances budget control, ensures that billable expenses are consistently captured, improves forecasting accuracy, and provides firm leadership with greater confidence in financial decision-making—especially during periods of economic uncertainty.

Essential features for law firm spend management software

While there are numerous legal spend management solutions available today, they primarily solve the needs of in-house legal teams. However, new software is emerging—and that’s good news for law firms.

When searching for the right best law firm spend management software, here are the must-have features to look for:

Reporting and dashboards: Tracking your finances should be simple and intuitive. Look for software with easy-to-read dashboards and reports that provide a reliable view of spending, budgets, and trends at a glance.

Expense tracking: The right software ensures you never miss another reimbursable expense. Find a solution that streamlines billing by automatically adding reimbursable expenses to client invoices

Budget spend limits: Controlling spend can help your law firm proactively prevent financial risk. Prioritize software that allows you to set spending limits for cards, categories, and staff. The right technology should also let you easily manage monthly budgets with pre-approved spend categories.

Integrations: If you use multiple financial software platforms, look for a solution with integrations that seamlessly sync data across your firm’s tech stack. This can help reduce manual work, avoid silos, and ensure information stays up to date everywhere.

Centralized case and financial data: Rather than using separate solutions for case management and law firm financial management, consider using a single solution that keeps all of your data in one place. By centralizing your case and financial information, you can enable more complete performance analysis and more efficient workflows across the firm.

Improve spend management with 8am Smart Spend

A strong spend management strategy plays a critical role in a firm’s financial efficiency, profitability, and long-term stability. In an unpredictable economic environment, law firms require systems that provide clarity and control, enabling leadership to make informed decisions even as costs and client expectations fluctuate.

While traditional legal spend management systems were designed for in-house legal teams, 8am Smart Spend was purpose-built specifically for law firms. It’s designed to help attorneys maximize profit margins, manage cash flow more effectively, and gain a clear, real-time understanding of monthly finances.

8am Smart Spend provides the visibility and controls firms need to reduce manual data entry, minimize errors, and lower the risk of internal financial issues. With centralized spend tracking and real-time insights, lawyers can stay ahead of cost overruns and respond quickly as financial conditions change.

With 8am Smart Spend, law practices can:

Track firm and client expenses in real time

Apply automated spending controls and approval rules

Capture billable expenses accurately and consistently

Monitor cash flow and spending trends with built-in reporting

Reduce administrative overhead tied to manual expense tracking

Smart Spend is available within MyCase, Casepeer (the #1-rated practice management software for personal injury firms), and LawPay (the top-rated legal payments solution trusted by over 50,000 lawyers), providing firms with flexibility as they grow and adapt.

Ready to reduce cash flow uncertainty and protect your firm’s profitability? Schedule a MyCase demo to see how 8am Smart Spend supports smarter, more resilient spend management for modern law firms.

FAQs about legal spend management

About the author

Mary Elizabeth HammondSenior Content Strategist and Blog Specialist8am

Mary Elizabeth Hammond is a Senior Content Strategist and Blog Specialist for 8am, a leading professional business solution. She covers emerging legal technology, financial wellness for law firms, the latest industry trends, and more.