Key takeaways

Attorneys face unique financial challenges, including late earnings, student loan debt, and inconsistent cash flow.

Personal financial planning focuses on saving, budgeting, long-term investing, and risk protection.

Law firm financial planning centers on cash flow, revenue tracking, profitability, and strategic growth decisions.

Integrated financial tools, such as MyCase, help attorneys strengthen both their personal and business finances by improving clarity, consistency, and long-term forecasting.

Even the most accomplished attorneys know that managing money isn’t always straightforward. Between uneven income, high student loan balances, late bill payments from clients, and the pressure to plan for the future, financial planning for lawyers often feels uniquely challenging.

Unlike many professions, attorneys face unpredictable billing cycles, extended periods of delayed earnings, and the added responsibility of managing firm overhead. For firm owners, the line between personal and business finances becomes even more challenging to separate.

This guide breaks down both sides of the equation—personal financial planning for attorneys and firm-level planning—so you can build long-term stability and confidence. Throughout the article, you’ll also see how 8am™ MyCase financial management tools give firms the visibility they need to track revenue, manage expenses, and strengthen profitability.

Common financial challenges lawyers face

The financial realities of legal practice create hurdles that many attorneys don’t anticipate early in their careers. These challenges affect solo practitioners, large-firm associates, and partners alike.

Delayed earnings: Becoming a lawyer often involves years of education, clerkships, and early-career positions before earning a stable or peak salary. This delay compresses the time available to build savings, invest, and plan strategically.

High student loan debt: Law school debt is often substantial enough to impact major milestones such as homeownership, retirement savings, and emergency planning. It can also influence career decisions, such as delaying opening a solo practice.

Inconsistent income: Even established lawyers face fluctuations—seasonal matters, unpredictable billing cycles, late-paying clients, and, in some practice areas, contingency fees. These factors make cash flow planning essential.

Business overlap: For solo and small firm attorneys, firm finances have a direct impact on personal financial stability. Income depends on consistent billing, reliable collections, and controlled expenses—any disruption impacts the attorney’s household budget.

Limited time: Lawyers often juggle demanding caseloads and long hours, leaving little room to proactively manage finances or reevaluate long-term goals.

Law firm financial planning vs. personal financial planning

Financial planning for lawyers isn’t a single discipline—it’s two related, but distinct, areas of focus.

Firm-level financial planning involves:

Revenue tracking and forecasting

Expense management

Profitability reporting

Legal accounting and compliance

Cash-flow management

Technology investments that support efficiency

Long-term planning for growth, retirement, or succession

Personal financial planning includes:

Setting financial goals

Managing student loans

Budgeting based on after-tax income

Investing for long-term wealth

Retirement planning (401(k), IRA, etc.)

Insurance and risk management

For firm owners, both areas intertwine. Firm profitability affects personal income, retirement savings, and even debt payoff schedules.

Quick comparison:

Firm financial planning | Personal financial planning |

Revenue tracking and forecasting | Budgeting and cash-flow planning |

Expense management | Debt payoff and saving |

Profitability insights | Investing and retirement planning |

KPI monitoring | Insurance and risk protection |

Growth and succession planning | Long-term wealth building |

Key strategies for personal financial planning for lawyers

Smart long-term, personalized financial planning for lawyers helps build wealth steadily and reduce financial stress. Whether you're a new lawyer or a seasoned professional, the right strategies support a stronger financial future.

Set clear personal financial goals and priorities

Financial planning begins with clarity. Define both short- and long-term goals that guide your decisions:

Short-term goals:

Establishing an emergency fund

Paying down high-interest debt

Managing student loans strategically

Long-term goals:

Homeownership

Long-term investing

College savings for children

Business ownership or expansion

Your goals provide a roadmap for daily spending and saving decisions.

Build a strong financial foundation early in your career

This is especially important for those exploring financial planning for new lawyers, since the first few years of income often set the tone for the decade ahead. Early habits around spending, saving, and debt repayment are easier to build before lifestyle creep sets in and financial obligations multiply.

New attorneys should:

Automate savings as soon as possible: Treat savings like a required bill so it happens consistently, even when work gets busy.

Understand your true after-tax income: Plan your budget based on your actual take-home pay rather than your gross salary.

Create a realistic monthly budget: Align spending with priorities such as loan payments, housing, and early retirement contributions.

Build a small cash reserve, then expand it: Start with a one-month emergency fund and work toward three to six months of essential expenses.

Evaluate student loan repayment options (income-driven repayment, refinancing, etc.): Choose a strategy that balances monthly affordability with long-term payoff and career flexibility.

These early habits create stability long before peak earning years begin and give you more options if you later decide to change practice areas, relocate, or start your own firm.

Diversify your investments to grow wealth steadily

Diversification protects attorneys from market volatility and supports consistent long-term growth—even when markets are choppy or your firm’s income fluctuates. Spreading investments across different asset types reduces the impact of any single underperforming area and helps keep your overall plan on track.

A balanced portfolio may include:

Index funds: Broad market exposure with low costs and less need for day-to-day management.

Roth or traditional IRAs: Tax-advantaged accounts that support long-term retirement savings.

Employer-sponsored retirement plans: 401(k) or similar plans; especially valuable when an employer match is available.

Low-risk assets such as bonds or money market funds: Provide stability and income to offset stock market swings.

Tax-efficient investment accounts: Help optimize after-tax returns, particularly important for higher-earning attorneys.

This approach aligns well with wealth management for lawyers, supporting steady, predictable long-term returns while giving you flexibility to adjust as your income, goals, and risk tolerance change.

Plan for taxes, retirement, and risk protection

Lawyers benefit from proactive planning around taxes, retirement, and insurance—especially those juggling multiple revenue streams, partner distributions, or law firm ownership. Thoughtful planning here reduces surprises, smooths cash flow, and protects the wealth you’re working to build.

Plan by:

Automating quarterly tax estimates: Reduce the risk of underpayment penalties and year-end tax shocks, particularly if you receive K-1 income or irregular bonuses.

Maximizing retirement contributions: Utilize options such as a 401(k), Roth IRA, SEP IRA, or Solo 401(k) to reduce taxable income, accumulate long-term savings, and benefit from compounding.

Maintaining essential insurance: Protect your earning power and assets with disability, life, and malpractice coverage that matches your income level, debt load, and family needs.

Reassessing coverage annually: Adjust policies as your income, dependents, and business obligations change, so gaps don’t appear as your career grows.

Consistent attention to taxes, retirement savings, and risk management helps protect both your current income and your long-term financial stability—regardless of how the market or your caseload fluctuates.

How to manage your law firm’s finances for long-term success

Strong firm finances lay the groundwork for long-term personal wealth. Predictable revenue, healthy margins, and clear visibility support better decisions both inside and outside the office.

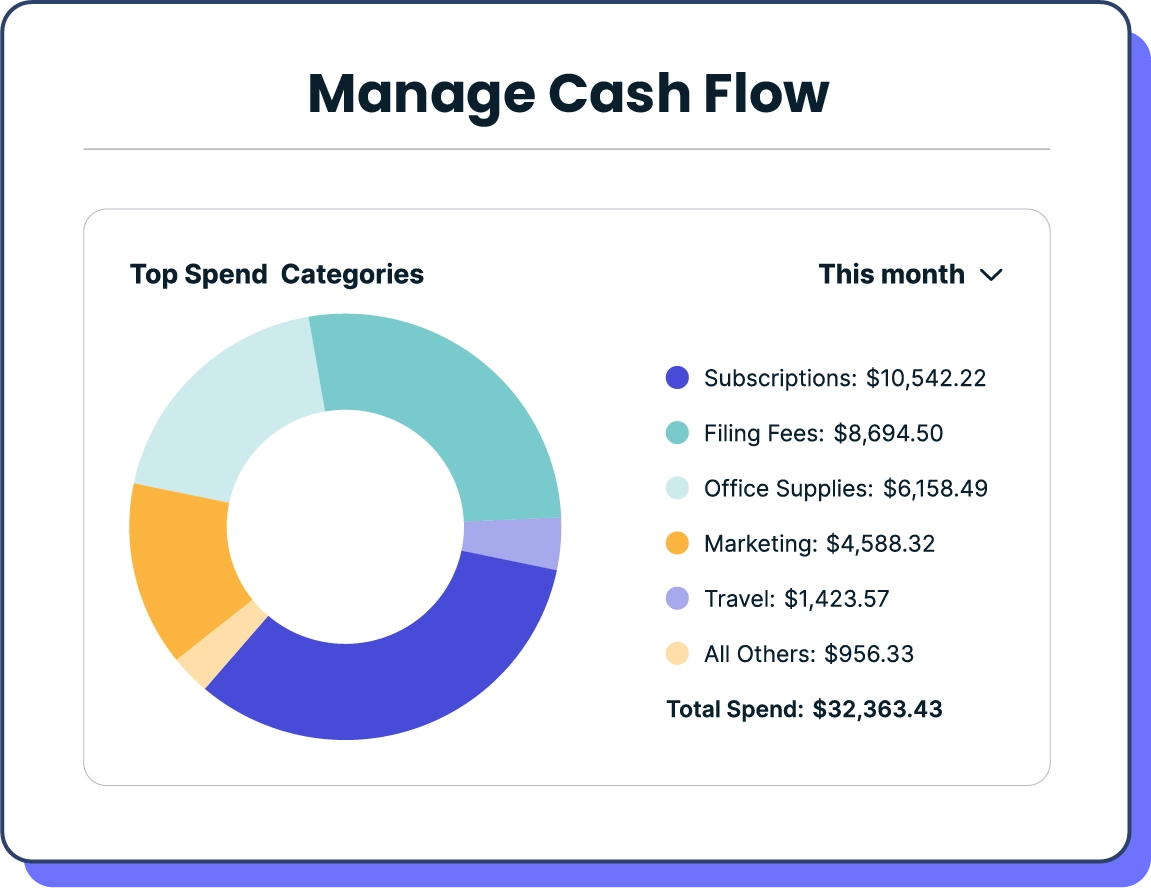

Manage cash flow and firm profitability with precision

Healthy firm cash flow ensures predictable income for attorneys and reduces financial stress during slower periods. Strong profitability gives you options—whether that’s hiring, investing in technology, or building your own long-term savings and retirement strategy.

Effective cash flow management means monitoring closely:

Revenue patterns: Which practice areas, matters, or clients generate the most reliable income—and where revenue is declining or inconsistent.

Invoice timing: How quickly work turns into bills, and whether delays in invoicing are creating avoidable cash flow gaps.

Collections: How often invoices are paid on time, which clients routinely pay late, and where follow-up or payment options (like online payments or plans) can improve results.

Spending and overhead: Which expenses are essential, which can be reduced, and how fixed costs impact your required monthly revenue.

Tracking and evaluating these metrics helps attorneys make precise, informed decisions that protect margins and stabilize their personal income over time.

Use data to make informed financial decisions

Consistent KPI monitoring enables firms to identify opportunities, mitigate financial leaks, and make informed strategic decisions for growth. Essential KPIs include:

Realization rate: How much billed work becomes revenue

Utilization rate: Percentage of work time that’s billable

Collection rate: Speed and reliability of client payments

Profit margin: Revenue retained after expenses

Aging accounts receivable: How long invoices remain outstanding

Revenue per case or client: Identifying the most profitable matters

These insights enable firms to take measurable steps toward achieving stronger long-term financial performance.

Prepare for firm growth and succession planning

Planning ahead—whether you’re making your first hire or thinking about eventual retirement—helps ensure your firm remains sustainable and valuable over time. Growth and succession aren’t one-time decisions; they’re ongoing financial planning exercises that should tie directly into your budget, profitability goals, and long-term wealth strategy.

Attorneys should consider:

Staffing and future hiring needs: When to add staff, which roles to prioritize, and how new hires impact utilization and margins.

Reinvestment strategies: How much profit to reinvest in technology, marketing, or new practice areas versus taking distributions.

Savings for capital improvements: Setting aside funds for office changes, new tools, or larger strategic investments.

Succession or ownership transition plans: Defining what happens when an owner steps back—whether through a sale, internal buyout, or gradual transition.

Use technology to organize and optimize firm finances

Technology turns firm-level planning from guesswork into a repeatable process. With MyCase financial management tools, firms can centralize key financial operations so leaders always know where the business stands and what to do next.

MyCase brings together:

Accounting to keep books accurate, compliant, and ready for reporting

Payments to improve cash flow with online payments, payment plans, and faster collections

Reporting to surface real-time dashboards, KPIs, and profitability insights

When billing, expenses, payments, and reporting all live in the same system, attorneys gain a clear picture of revenue, costs, and performance. That visibility makes it easier to set realistic budgets, spot trends early, and make decisions that support both firm growth and long-term personal wealth.

Building financial resilience in uncertain markets

Economic pressure is now a constant for law firms—rising costs, client payment delays, inflation, and policy shifts all affect how and when attorneys plan for growth. Financial resilience, in this environment, means having sufficient clarity and control over your numbers to make informed decisions, even when the broader outlook feels uncertain.

Long-term personal planning and diversified investments matter, but the firm’s financial health is what truly stabilizes everything else. When cash flow is predictable, expenses are monitored, and performance trends are clear, lawyers can decide whether to invest, hire, or hold steady based on data instead of instinct.

Resilient firms rely on three essentials:

Visibility: Real-time, accurate financials and KPIs

Planning: Budgets and forecasts that model different revenue and expense scenarios

Proactive decisions: Systems that stabilize revenue, accelerate payments, and reduce financial leaks

Solutions like MyCase support this kind of resilience by tightening billing and collections, surfacing key financial insights, and giving firms a clearer picture of where they stand. With that level of visibility, attorneys are better equipped to protect margins, reduce stress, and keep moving forward—even when the market fluctuates.

Strengthen your firm’s financial future with MyCase

Long-term financial success for attorneys depends on clarity, consistency, and proactive planning. MyCase financial management software helps bring those principles to life by giving firms the tools to:

Track revenue and expenses accurately

Automate billing and collections

Improve cash flow visibility

Evaluate profitability

Monitor KPIs

Plan for short-term needs and long-term growth

Paired with the personal wealth-building strategies outlined earlier, MyCase empowers attorneys to build sustainable practices and predictable personal income. See how MyCase can help you plan, track, and grow your firm’s financial future.

Lawyer financial planning FAQs

About the author

Mary Elizabeth HammondSenior Content Strategist and Blog Specialist8am

Mary Elizabeth Hammond is a Senior Content Strategist and Blog Specialist for 8am, a leading professional business solution. She covers emerging legal technology, financial wellness for law firms, the latest industry trends, and more.