Key takeaways

Law firm accounts receivable is the money clients owe after a law firm delivers legal services. The process can be as simple as executing the work, sending the bill, and receiving payment. However, some law firms struggle to receive on-time payments and may not receive payments until well past the due date.

Most lawyers don’t get into law expecting to tackle accounts receivable management. However, nearly every firm needs to address unpaid client bills at some point. Repeatedly following up on payments is tedious, takes time away from billable work, and can seriously impact your firm’s profitability.

What if we told you there’s a better way to get clients to pay on time?

Consistent processes, billing modernization, and payment flexibility can help you get paid faster without wasting time on invoice follow-up.

Our 2024 Legal Industry Report found that:

47% of legal professionals say their firm can accept more cases by offering “Pay Later” options (legal fee financing).

48% of legal professionals say their firm collects more money over the course of a case when offering payment plans compared to cases when they didn’t offer plans.

Legal professionals have a 50% invoice recovery rate with online payments compared to 17% with checks and cash.

This guide covers the main challenges of managing a law firm’s accounts receivables and steps to improve your process.

What is Law Firm Accounts Receivable Management?

Accounts receivable are the payments that you haven’t collected from clients. This includes invoices that have been sent but aren’t yet due—as well as overdue bills.

The process generally looks like this:

The law firm completes services and sends the client an invoice.

The law firm records accounts receivable while awaiting payment.

The client receives the bill and pays before the due date (typically 30 days after the firm issues the bill).

The law firm receives the payment, credits account receivable, and debits cash or bank account (using the double-entry accounting method).

It’s important to stay on top of accounts receivable since it represents revenue for your law firm. A streamlined billing and accounts receivable process also makes it easier to maintain a healthy cash flow, create a better client experience, and optimize your overall law firm accounting system.

If the client does not pay the bill by the due date, then a longer process starts, which may include follow-up emails, phone calls, and—in the worst case scenario— the involvement of a debt collection company to help recover payment. This can result in payments coming in several months later (or not at all). In the meantime, your law firm has a revenue leakage problem due to completing hours of work for free.

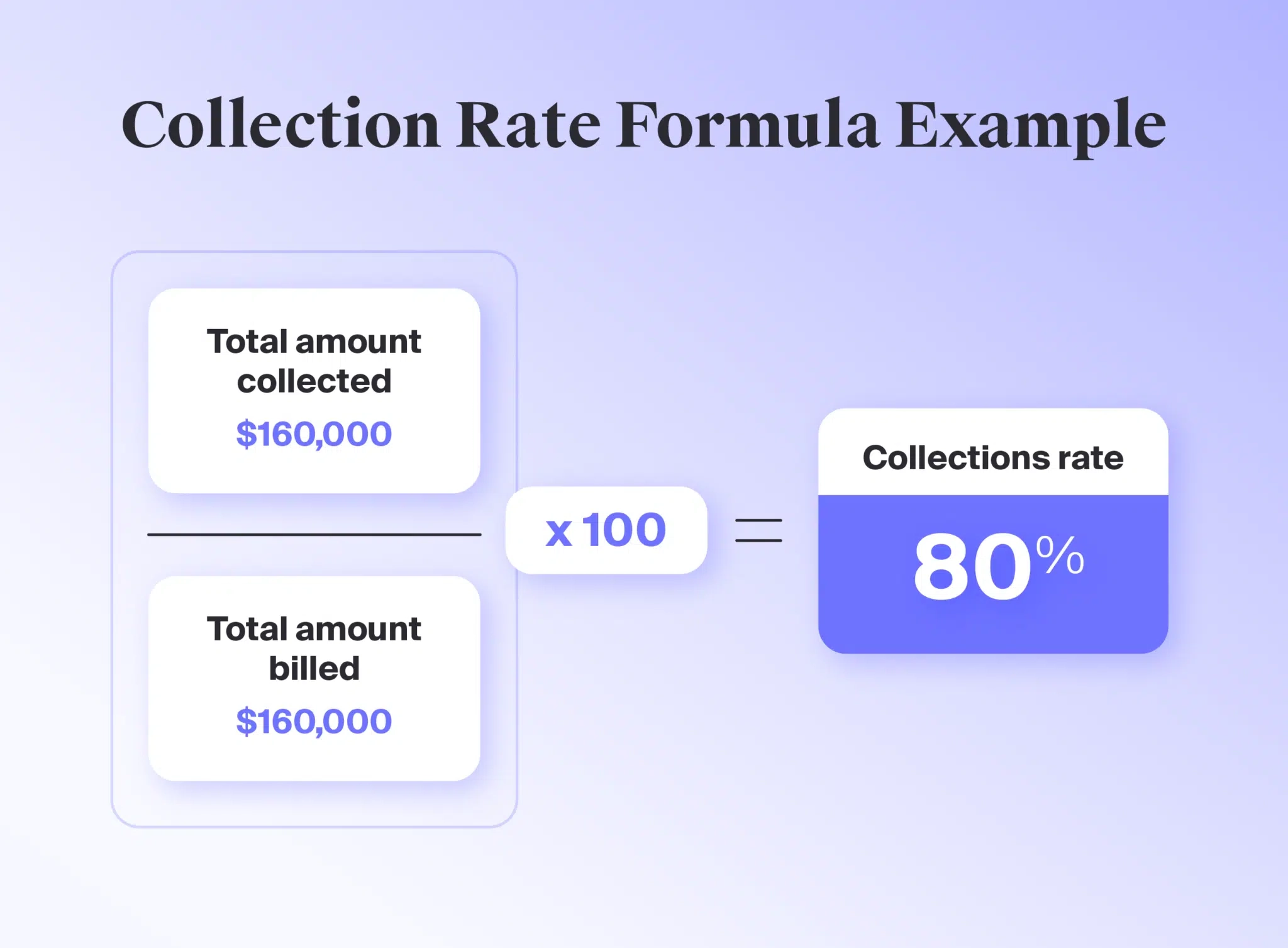

Using the Collection Rate Formula

Calculating your collection rate for the past year can give you an idea of how your law firm is performing. To calculate it, divide the total amount you’ve collected by the total amount that you’ve billed. Then, multiply by 100 to get a percentage.

For example, if you’ve billed $200,000 in the past year but only collected $160,000, then your collections rate is 80%. The higher this number, the better.

What are the Main Challenges of Managing Legal Accounts Receivable?

The main challenges of managing accounts receivables for law firms are:

Managing manual or tedious billing practices, which can require extensive amounts of non-billable hours. Manually following up with clients, updating ledgers and transactions, tailoring custom billing cycles, and creating invoices take crucial time away from billable work.

Following trust accounting requirements, which impacts your ability to access client funds in client trust accounts. Lawyers can’t touch these funds until clients approve their bills—even if they’re retainer funds. Clients are also entitled to request their account status at any time, but this requires lawyers to consistently and accurately track all transactions. Local IOLTA account requirements can also increase the workload for those who don’t have automated, streamlined processes in place.

Tracking billable work and fees, which can further complicate the billing process for those who manually track hours or mileage. It’s also time-consuming to track down all of your notes and time-tracking information when it’s time to send your next invoice.

More than 1 in 10 surveyed legal professionals from our 2024 Legal Industry Report said that getting paid is the most significant challenge their firm faced. However, our report also uncovered that software adoption was key for solving common problems (like getting paid).

Modernizing the collections process can help your law firm create a more efficient workflow while freeing up your billable time.

How To Level Up Your Law Firm’s Accounts Receivable Management

Collecting from clients may feel daunting now, but a few changes can help streamline the process and make things easier for everyone. Below, we’ll go over the steps your law firm can take to avoid common challenges and make your law firm’s accounts receivable process more efficient.

1. Establish Clear Billing Terms

The best way to prevent unpaid bills is to clarify your fees upfront. Clients who know what to expect are more likely to commit to paying for your services. A good client intake process for law firms can help you establish expectations early with prospective clients.

Plan to touch on the following during your first few interviews and meetings with the client:

Engagement fees

Billing frequency and due dates

What services you will bill them on

Typical costs

Communication frequency regarding billing

Consequences for late or non-payment (late fees, interest, etc.)

Payment methods

Dispute process

Online services (client portal, online statements, etc.)

Discussing billing upfront also gives your law firm a chance to answer questions and clear up confusion before work starts.

Learn how to modernize your billing practices to improve collection rates and optimize the client experience.

Webinar

Watch Now

2. Maintain Consistent Communication

Now that you’ve made a great first impression, it’s important to maintain that level of service by keeping clients up-to-date on their case, billing, and account status.

Consistency is key to establishing a routine and helping clients pay invoices on time. One of the tried and true best practices for collecting accounts receivables is consistent invoicing. If your firm bills on a predictable basis, such as the first of every month, then clients know when to expect them. It also holds your firm accountable for sending timely invoices.

When scheduling invoices, consider your clients’ preferred bill delivery methods. For example, MyCase enables your team to send invoices and reminders via:

The secure MyCase Client Portal

Text message

Email

U.S. Mail

Afterward, utilize financial software for an overview of all accounts receivable debt owed to your firm. With a holistic overview of your firm’s performance and growth, you’re empowered to be proactive rather than reactive.

Consistent communication can help you get on the same page with clients and minimize the chance of disputes or billing issues down the line. Using succinct descriptions in the invoice can also help clients easily understand what you’re charging them for.

Information to communicate early and often can include:

Future changes in billing rates

Explanation of charges both before the invoice is processed and in the invoice itself

Upcoming payment deadlines

Regular updates on their account, including the amount available in their retainer

3. Streamline Time and Expense Tracking

Accurate bills start with proper timekeeping. However, keeping up with tracking can be a challenge without the right tools. Whether you’re using an app or manually jotting down time spent on tasks, you’re likely not tracking as much time as you could. Plus, it can take a lot of time to transfer that information to invoices.

The first step to solving this challenge is finding a solid time-tracking solution.. Ideally, your firm’s time-tracking software should integrate with your billing and invoicing technology.

Our 2024 Legal Industry Report revealed that 65% of surveyed legal professionals have adopted online time-tracking tools, with 78% saying their firms captured more billable hours each week using these tools.

With MyCase time-tracking software, you can keep track of billable or non-billable time spent—for flat fee and pro bono cases. You’ll be able to start and stop timers as you work, so you don’t have to recall time retroactively—improving your team’s utilization rate.

Plus, with our Smart Time Finder, your firm can capture billable time you may have missed via a passive time-tracking feature. MyCase passively tracks activities done in the platform to ensure you’ve tracked time for all billable work.

The report also revealed that our customers:

Captured more than 18 million hours during the year using our online time-tracking feature

Captured an additional 579,665 hours by using our Smart Time Finder, resulting in about an additional $22,425 in billable hours per lawyer (assuming a $330 billable hourly rate)

4. Provide Several Ways to Pay

Accepting various forms of payment can improve your firm’s collection speed and realization rate. More payment options also help you cater to different client preferences and needs. These additional payment methods include:

Online transactions, including card payments, automated clearing house (ACH) payments, eChecks, and third-party processors (like Stripe or Square)

In-person transactions, including credit or debit card payments made via point-of-sale (POS) systems

Providing multiple payment methods can make it easier for clients to pay bills without requiring them to mail a check or visit your office.

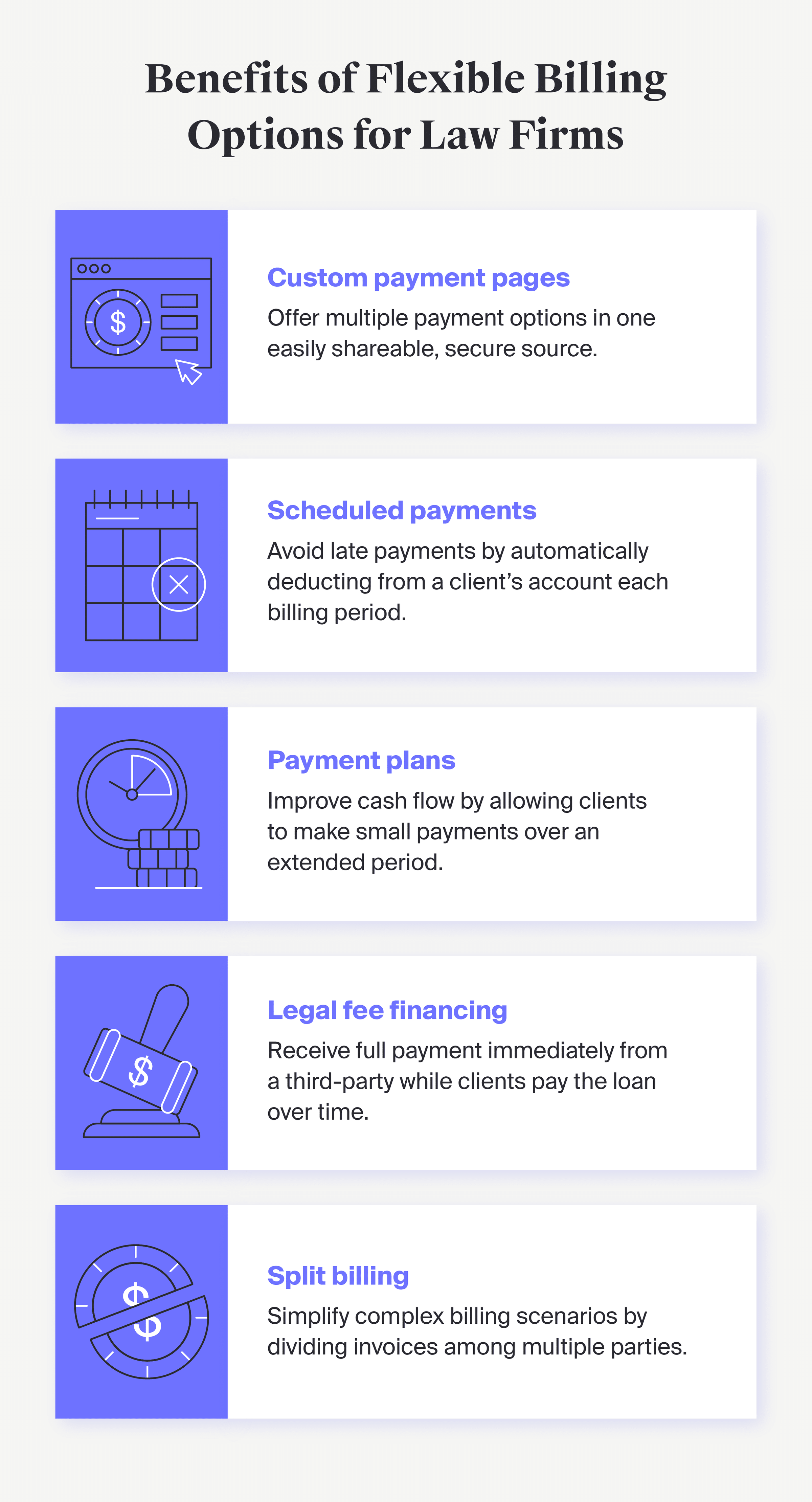

Flexible payment terms and services can also help customers who are struggling to stay on top of payments. This includes:

QR codes and secure custom payment pages that you can send via email or post in-person in your office to help customers easily access a safe and reliable payment process.

Scheduled payments that allow you to automatically bill your client’s card or account to ensure on-time payments.

Payment plans that break up invoices into more manageable portions over a longer period than a traditional invoice.

Legal fee financing that pays your law firm upfront while your client can defer full payment and instead pay back a third party for the loan over time in installments.

Split billing that easily divides invoices by percentage to simplify complex billing that involves multiple parties.

Offering more options can help improve collection rates and positively impact your law firm’s cash flow. For example, our 2024 Legal Industry report uncovered that our customers collected 33% more from clients who paid online. When looking at dollar amounts, we learned that more than one-half of legal professionals collected $3,000 or more each month on average when offering online payments.

With legal payments software, offering multiple ways to pay doesn’t have to be an administrative nightmare.

With LawPay, our sister company under AffiniPay, your firm can accept debit and credit cards, eChecks, and electronic payments while complying with ABA and IOLTA guidelines. LawPay serves more than 55,000 law firms around the U.S. and integrates seamlessly with MyCase. This makes accounts receivable management accessible for firms of all sizes, including solo practitioners and small and medium teams.

Tip: MyCase customers who sign up for LawPay will pay no monthly fees on this additional service for the life of the account, but processing fees will still apply. Sign up for a free demo of MyCase to see how a combined legal practice management plus payments solution can increase firm productivity.

5. Prepare for Disputes and Unpaid Bills

Despite your best efforts, law firm collections aren’t always smooth sailing. Some clients may still struggle to make payments, refuse to pay, or file a chargeback if they disagree with the charges.

Below are some steps you can take if your client is struggling to pay their bills:

Offer payment options, such as scheduled payments, payment plans, and legal fee financing, that can help clients get back on track with payments.

Discuss a reduction of service that can bring down costs without compromising the work on their case, if possible.

Increase the frequency of reminders and follow-ups the longer bills remain unpaid. For example, increase reminders from biweekly to weekly if a bill is past due more than a month.

Warn the client early on that you’ll need to stop work if you have not been paid and cannot come to an agreement.

There may be other cases where a client tries to dispute charges with you directly or by filing a chargeback on their card. A client may refuse to pay or dispute payments if they’re unhappy with the results of their case or if they don’t believe the charges align with what you agreed upon.

If a client confronts you directly, you can use our legal file management system to point to documentation of invoices, communication, and any signed agreements to help them understand the reasoning behind your fees.

If a client files a chargeback and their bank or credit card company finds it valid, the card company will contact you to ask if you’d like to dispute the chargeback. If so, you’ll need to provide evidence to show that the charges are legitimate. The card company will then use this information to decide whether the chargeback is valid. If it’s found valid, you must refund the client’s payment.

The client should dispute directly with you since you still have some control over the process. A chargeback can be challenging since the outcome is up to the card company’s discretion. Regardless of whether the chargeback is valid or not, you’re still typically responsible for chargeback fees.

In extreme cases, when you cannot come to a solution with clients, you may need to engage with a collection agency that can assist with recovering payment. Another option is to take your client to small claims court.

The best way to avoid these issues is to thoroughly vet clients before taking them on, prioritize communication and transparency throughout the case, and know when to take action (or stop work entirely) when clients start falling behind.

6. Modernize Your Invoicing Process

When you’re busy serving clients, the last thing you want to do is stop to handle online billing and other administrative work.

A powerful online legal billing and payments solution prevents you from deciding between doing client work right now or making sure you get paid for work already completed. Implementing a solution that automates accounts receivable processes minimizes the possibility of human error, such as inaccurate invoices, duplicate entries, and overpayment. It also allows you to keep invoicing and accounts receivable in-house rather than needing to fully outsource.

Below are the benefits of upgrading your law firm’s process and moving to electronic invoices.

Quickly Create Detailed Invoices

Instead of spending time consolidating information from multiple spreadsheets and handwritten notes, you can log information in a single platform that automatically generates itemized invoices for clients.

Itemized bills help clients understand how you used their money and what you accomplished in the past billing period. It also pushes your firm to consistently and accurately log information to get paid. Some bar associations also require that law firms make itemized bills available to clients in certain situations.

With MyCase, you can easily create detailed invoices and speed up the legal billing and invoicing process. Below are a few features that help save law firms time:

Automatically insert task descriptions and billable hour time entries as line items once it’s time to invoice.

Edit or add hours and descriptions as needed.

Associate team members and billable rates with various tasks to produce a comprehensive list of services and associated costs.

Insert expenses and trust account transactions in the invoice with just a few clicks of your mouse.

Provide an overview of accounts receivable and invoice status.

Instantly Send Statements

Instead of taking trips to the post office and relying on snail mail to deliver attorney billing statements, you can send them electronically. This allows clients to instantly access billing information and send payments quickly and avoids issues like tracking down lost mail.

With MyCase, you can automatically send electronic invoices to clients through our secure client portal. Our platform will also notify your team when a client views or acts upon an invoice.

Automate Routine Communication

Managing payments, remembering to send reminders, and constantly following up with clients can add up to a significant amount of non-billable work. Instead, you can set up automated reminders as the next billing date approaches.

MyCase will send invoice reminders automatically, so you don’t have to follow up with every client to receive payment. You can also apply late fees automatically (if desired) to take one more task off your plate.

Growing Firms Need Accounts Receivable Automation

Law firm profitability and growth depend upon the ability to collect accounts receivable consistently. For modern firms, that means an automated accounts receivable system, such as MyCase legal invoicing software.

We specialize in legal practice management software, including accounts receivable tools. More than 73,000 law firms trust MyCase and LawPay to track time, generate ready-to-send invoices, send automated reminders, accept payments, and crunch analytics.

Try law firm accounts receivable management at its best. Start your free 10-day trial of MyCase today (there’s no credit card needed).

About the author

Morgan MartinezSenior Content Manager

Morgan Martinez is a Senior Content Manager for leading legal software companies, including MyCase, Docketwise, and CASEpeer, as well as LawPay, the #1 legal payment processor. She specializes in writing about the latest advancements in legal technology, financial wellness for law firms, key industry trends, and more.