Boost Cash Flow With Modern Attorney Fees

By Mary Elizabeth Hammond

Sep 28, 2022

| 8 min read

Lawyer payment can be a complicated process that depends on several factors, such as practice area, case type, firm size, and how the lawyer chooses to charge. Fortunately, there are ways to plan and simplify your firm’s pay structure to maximize profit. In this article, we’ll answer the question “how do lawyers get paid?”, discuss different payment methods, and provide tips on how to more easily collect client invoices.

Types of Attorney Fees

How do lawyers get paid? Well, it depends on how they charge. Below are some of the most common types of attorney fees.

Fixed Fees

These types of lawyer fees are a predetermined and set amount. A fixed fee is most commonly used for routine legal matters such as a standard real estate closing contract. In this instance, lawyers should clearly communicate what services will be rendered for the fee, including any additional expenses that could be incurred.

Contingency Fees

This charge is contingent on the lawyer obtaining a settlement or monetary award. Contingency fees are most commonly used in personal injury cases. In these cases, a lawyer will take a predetermined percentage of any money obtained in a settlement. If the case is lost and nothing is awarded, the lawyer will not receive payment.

Contingency fees cannot be used when an attorney is representing a defendant in a criminal case or in a domestic relations matter (such as divorce or alimony).

With contingency fees, lawyers are required to provide a written copy of the agreement to the client. This should clearly outline the percentage of the award that the lawyer is due and whether that percentage is taken before or after court fees and litigation expenses are deducted.

Retainer Fees

An individual or business may have an attorney or firm on retainer. This means that they compensate the attorney or firm in order to reserve their services should the need arise. Retainer fees are typically paid in a lump sum. When legal services are required, lawyers may charge additional attorney’s fees and costs.

Hourly Rates

An hourly rate is a fixed dollar amount charged for each hour spent on a legal matter. Hourly rates can be charged on their own or on top of a fixed fee. If a firm enters into an arrangement with hourly rates, they should communicate the estimated amount of time to be spent on the legal matter. This includes any employees or lawyers that will work on the case and require additional compensation. One lawyer’s fees may be different from another.

To learn about the average hourly rates for lawyers and how lawyer fees can differ by practice area and geographic location, check out the statistics here.

Electronic Payment Method Options for Law Firms

Online payment options are convenient, effective, and ultimately help you get paid faster. In the MyCase 2022 Industry Report, 61% of respondents claimed that their firms collected more money because of online payment processing software. Legal payment management software allows you to set up electronic payment options right through your website—allowing your clients to easily pay their invoices in just a few clicks.

Below we dive into some of the most common and convenient ways to accept electronic payments from clients.

Credit & Debit Cards

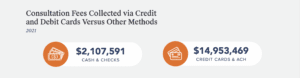

Credit and debit card payment options are not only convenient but also becoming increasingly expected from clients. The 2019 Federal Reserve Payments Study found that credit card transactions have gone from $23.9 billion in 2000 to $117.4 billion in 2018. In addition, electronic card payments are a quick and easy way to get paid—there is next to no time wasted between when the client makes the payment and when your firm receives it.

Debit payments are a great way to avoid fees and service charges while still having the efficiency of electronic payment. Credit cards have their benefits too—they allow clients to pay the full amount when it’s due and give them the option to pay off their credit card over time.

However, there are some ethical considerations to consider when credit and debit cards are used to pay attorney fees. For example, collecting attorney fees for services rendered is acceptable, but taking unearned fees may be problematic should a dispute with those fees arise. Additionally, credit card payments and associated processing fees can be particularly tricky when managing trust accounts—where the balance must be closely monitored at all times.

In general, you need to determine if and how your firm will:

- Accept advanced payment of fees via credit cards

- Compensate for processing fees

- Set up recurring charges via credit card to clients

- Securely store credit card data

- Keep trust accounts compliant

Some state ethics committees have addressed these issues, while others have not. Be sure to review your state’s guidelines before proceeding with card payments.

ACH Payments

ACH, or automated clearing house payments, is another online payment option that essentially serves as an eCheck. Similar to a traditional check, an ACH payment transfers funds electronically from one account to another—this allows clients to pay directly from their online banking account. ACH payments function similarly to an online credit card payment but typically have fewer fees associated.

For a complete guide to understanding ACH payments, refer to this post.

PayPal

PayPal is a convenient and familiar payment method. Many of your clients will have a PayPal account. But be wary of fees—make sure you understand PayPal’s processing fees and determine if that will come out of the client’s wallet or yours.

If you choose to accept PayPal payments, follow trust accounting procedures to remain in compliance. Also, familiarize yourself with your state’s ruling about accepting legal payments via PayPal. These rules vary from state to state.

Payment Plans

Lawyer payment plan options allow clients to pay for legal services through installments instead of a lump sum. Firms that offer payment plans open the door to clients with steady, limited income.

Payment plans are set up in a variety of ways. A firm may choose to have pre-set payment plan options or to work with a client to build a customized option. For information on building lawyer payment plans that are tailored to meet the needs of your firm and clients, check out this post.

Four Tips for Increasing Cash Flow

Successfully collecting client payment is the only way to have a profitable law firm. Yet, 73% of 2,000 surveyed legal professionals claimed that getting paid was a challenge for their firms. Below are tips on improving cash flow for your services while providing a positive client experience.

1. Establish a Clear and Thorough Billing Policy

When it comes to billing it’s important to communicate clearly and regularly. Ensure that you and your client are on the same page with your billing policy. Scheduled invoices and reminders can help create a predictable cash flow, inform clients on payment expectations, and allow them to budget accordingly. Utilizing legal billing software allows you to automate these tasks to ensure they get done accurately—without taking up too much non-billable time. Creating an attorney billing statement can also help clarify fee expectations and promote transparency.

2. Include a Payment Due Date

Let clients know when they need to pay their invoice. If they don’t pay their invoice on time, communicate the associated late fees. Attorneys’ fees could be a percentage of the invoiced amount or a flat fee. Refer to your state bar association for regulations on implementing late fees.

3. Offer Different Ways to Pay

Everyone has different payment preferences—the more options you can provide, the more likely you are to collect. Offering a variety of electronic payment methods listed above is a surefire way to improve your accounts receivable.

4. Track Time Spent

Accurately tracking your time ensures that you are getting paid for all of your billable hours. Lawyers who manually record and estimate how much time they spend on a case risk inaccuracy and leave money on the table.

Legal time-tracking software can ensure that no billable activity gets overlooked. This tool’s features allow you to keep tabs on billable expenses, track time spent on calls and emails related to cases, and automate prompts to track time.

Utilize the Right Tools for Your Firm’s Finances

Set up a payment system that works for your firm. Rely on MyCase and LawPay as your legal payment platform to oversee your firm’s finances, increase payment frequency, and boost long-term profitability. Try a risk-free 10-day free trial today.

Interested in seeing more posts like this? Our “For The Record” email newsletter shares insightful content focused on increasing law firm profitability, improving work productivity, boosting client intake, and more. Enter your email address in the right-hand sidebar near the beginning of this article to subscribe.