50,000

+Trusted by over 50,000 law firms across the U.S. and Canada.

Simplified online payment system for law firms

MyCase and LawPay combine to create the most comprehensive legal practice management and payments platform.

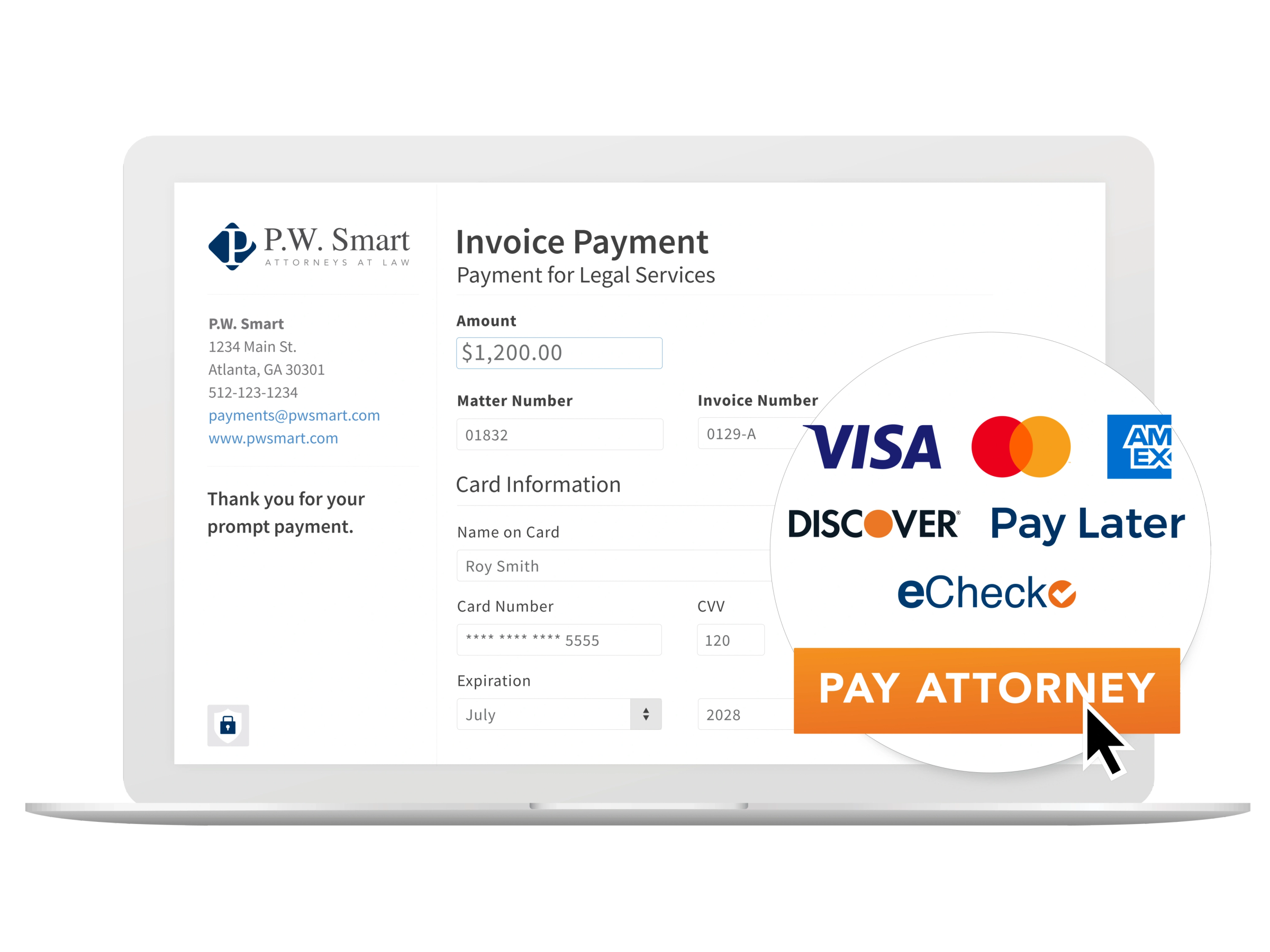

LawPay, the industry leader in legal payments, provides a cost-effective solution for more than 50,000 law firms around the country. Streamline your billings and collections by accepting cards, eChecks, and electronic payments from your clients while ensuring compliance with ABA and IOLTA guidelines.

MyCase customers who sign up for LawPay will pay no monthly fees for the life of the account!

50,000

+Trusted by over 50,000 law firms across the U.S. and Canada.

125

+Vetted and recommended by all 50 state bars and over 75+ local bars.

15

+More than 15 years of online payment expertise.

LawPay makes it easy for your firm to securely accept client payments, while ensuring compliance with ABA and IOLTA guidelines with legal payment software.

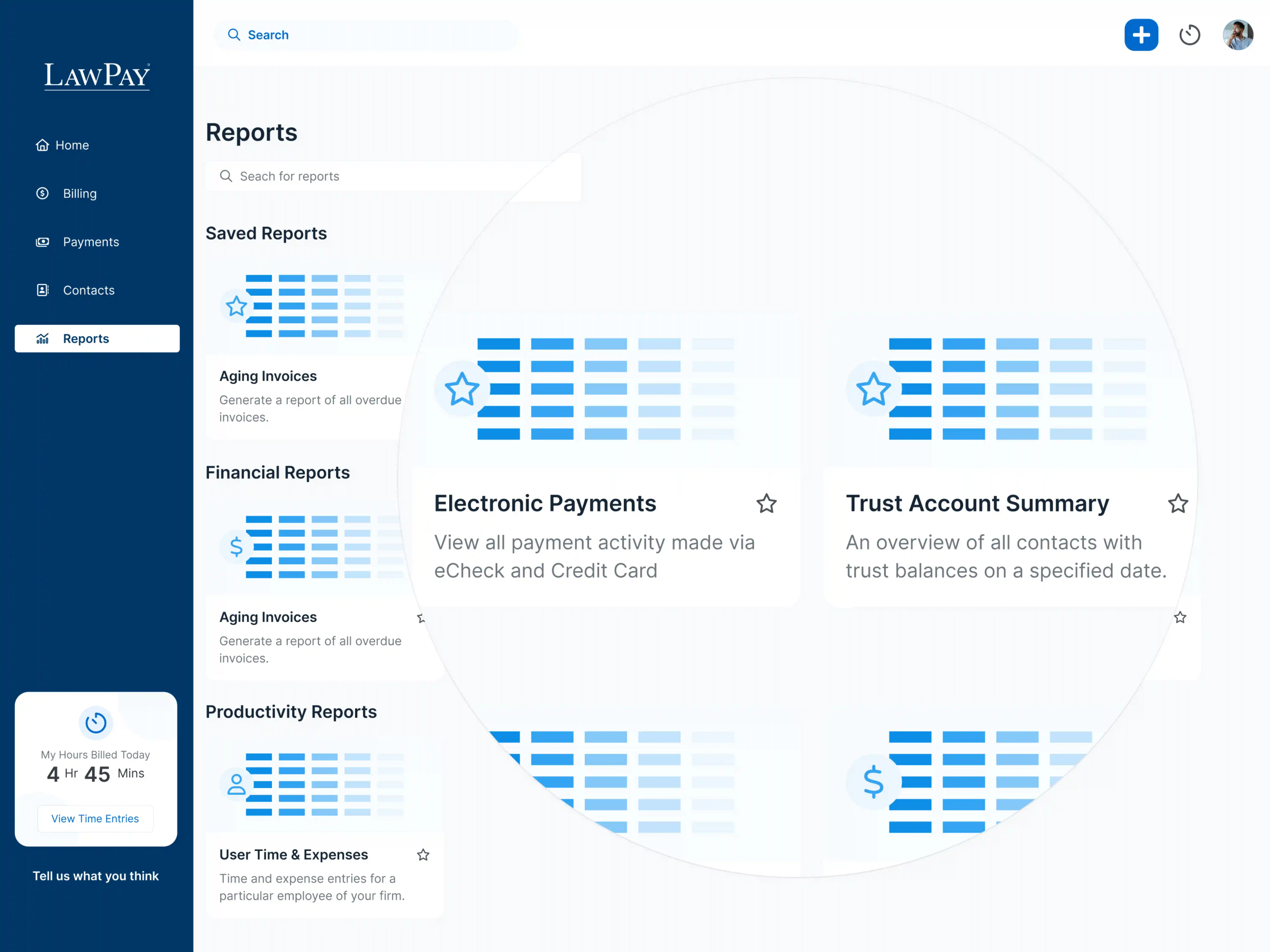

Our robust set of features allows you to plan payments in advance, get detailed transaction information, refund payments, and manage both your finances and your practice.

LawPay makes my life easier knowing that funds are coming into the right account and fees are being paid from a different account. I also like the fact that I can integrate LawPay through my website, my practice software and send a link to a client to get paid.

Shahzad Khan / Shahzad R. Khan Legal, PLLC

With LawPay handling end-to-end payment processing, every transaction is secure from start to finish. Our legal payment online portal is certified as a Level 1 service provider, the highest level of security available.

The LawPay+MyCase integration can easily be linked on your firm’s website to create a seamless experience for you and your clients.

No contracts, setup, or cancellation fees

Debit, credit, and eCheck payment types

Trust account protection

Customizable payment pages

More than 50 software integrations

Unlimited users

Custom reporting for reconciliation

PCI Compliance ($150 value)

Unlimited phone support

Join lawyers from over 18,000+ firms who trust MyCase to grow their firm while managing their caseload.