Getting paid can be challenging for law firms of all sizes. In our recent 2024 Legal Industry Report, we uncovered that 15% of firms say getting paid is one of the most challenging aspects of their business. Though the reasons for lack of payment can vary from client to client, it often comes down to tight finances.

Offering more flexible lawyer payment plans rather than requiring clients to pay in full at the time of service can help you expand your client base and decrease the stress over outstanding invoices.

In this article, we will go over what a lawyer payment plan looks like, its potential benefits, and what you should consider when creating one.

How Do Lawyer Payment Plans Work?

The most effective lawyer payment plans are those tailored to your firm and clients. However, most practices establish payment plans that allow clients to pay off what they owe in installments, even if you’re charging an hourly rate. This helps break the cost of your legal representation and advice into multiple payments, which could be easier for clients to manage.

The payment plan should account for common expenses such as:

Lawyer fees

Incidental expenses

Filing fees

Expert witness costs

Rather than requiring clients to pay for legal fees upfront or as work is performed, lawyer payment plans let you break the total your clients owe into smaller installments. They’ll still pay you in full, but they’ll do so over time.

Do Lawyers Accept Payment Plans?

Law firms can accept different types of payment plans depending on their preferences, billing structure, and client needs. There are no rules or regulations prohibiting law firms from accepting payment plans if they choose to do so. However, law firms must abide by ethical and payment compliance measures along with the American Bar Association’s guidelines around fees.

Ultimately, it’s up to each firm or each attorney to decide if payment plans will work for their business and goals. They’re also able to set their own law firm billing parameters with regard to payment plans. Some law firms have specific payment plan options (for example, charging half the amount upfront and the other half later), while others are willing to customize a plan with their client. It all depends on the firm.

Benefits of Offering Payment Plans in Your Law Firm

Offering lawyer payment plan options as part of your practice can benefit your client and law firm. Here are a few benefits you may see by implementing these plans.

Helps attract more clients: Standard attorney fees can be too expensive for some people to afford. By offering attorney payment plans, you’ll make your services more accessible to a broader client base by giving clients the option to break your lawyer fees into smaller installments.

Creates steadier revenue: When you use payment plans, you’ll receive payments over time, creating more predictable and frequent revenue.

Improves reputation: Attorney payment plans can help elevate the client experience by giving your clients different payment options so they can choose what works for their finances. This may lead to better online reviews and more referrals.

Legal Fee Financing vs. Payment Plans

Offering different payment options to your clients can have a huge impact on your practice and improve the client experience. However, some law firms choose to incorporate legal fee financing alongside payment plans to further expand their clients’ options.

Though both allow clients to make payments over time rather than upfront, they work in different ways.

Legal fee financing: This alternative payment method works similarly to short-term loans. Clients make payments over time to a third-party loan provider and are typically charged interest on the amount they owe in exchange for the ability to pay in installments. Since clients owe the loan provider, firms often recieve full payment upfront.

Legal fee payment plans: These payment plans are negotiated between the client and the law firm directly. In most cases, payment plans offer a better client experience because these plans pose less risk for your clients’ credit scores.

How to Implement a Payment Plan

Implementing these plans can seem daunting at first, but they only take a few key steps. Here’s what the process will look like for most practices:

Understand what you want your payment plans to accomplish. Many attorneys implement these plans to make their services easier to afford for a broader client base. By identifying your ‘why,’ you’ll better structure the plans and your billing statements to fit your goals.

Develop a payment schedule. Before you launch your payment plans, you’ll want to create your payment schedule. Decide how often you want your clients to make payments. Some firms prefer weekly or bi-weekly payments, while others prefer monthly payments. Every payment plan should specify the total amount due as well as the amount due during each payment period.

Know what forms of payment to accept. Many lawyers that use payment plans also accept various payment types to make their client’s lives easier. For example, you may choose to accept credit cards, debit cards, and eChecks to accommodate your clients’ needs more effectively.

Determine what happens with late payments. Consider how you want to handle late payments and at what point you’ll consider late payments subject to any penalties. Some firms charge interest on late payments, while others charge flat fees for each late payment.

Write your payment plan agreement. Though every case may differ, your repayment plans should follow the same structure. This will simplify your accounting efforts and help your support staff follow up with any clients who fall behind. Create a clear payment plan agreement that you can use for each client.

Don’t hesitate to check in. Though your clients are ultimately responsible for making payments on time, it’s in your best interest to follow up with them throughout the repayment period. Give them updates on their case and let them know that payments are due on specific dates. This shows them that you’re still involved and actively working on their behalf.

With clear processes in place, you’ll be better able to collect payments on time and continue adding to your law firm’s revenue.

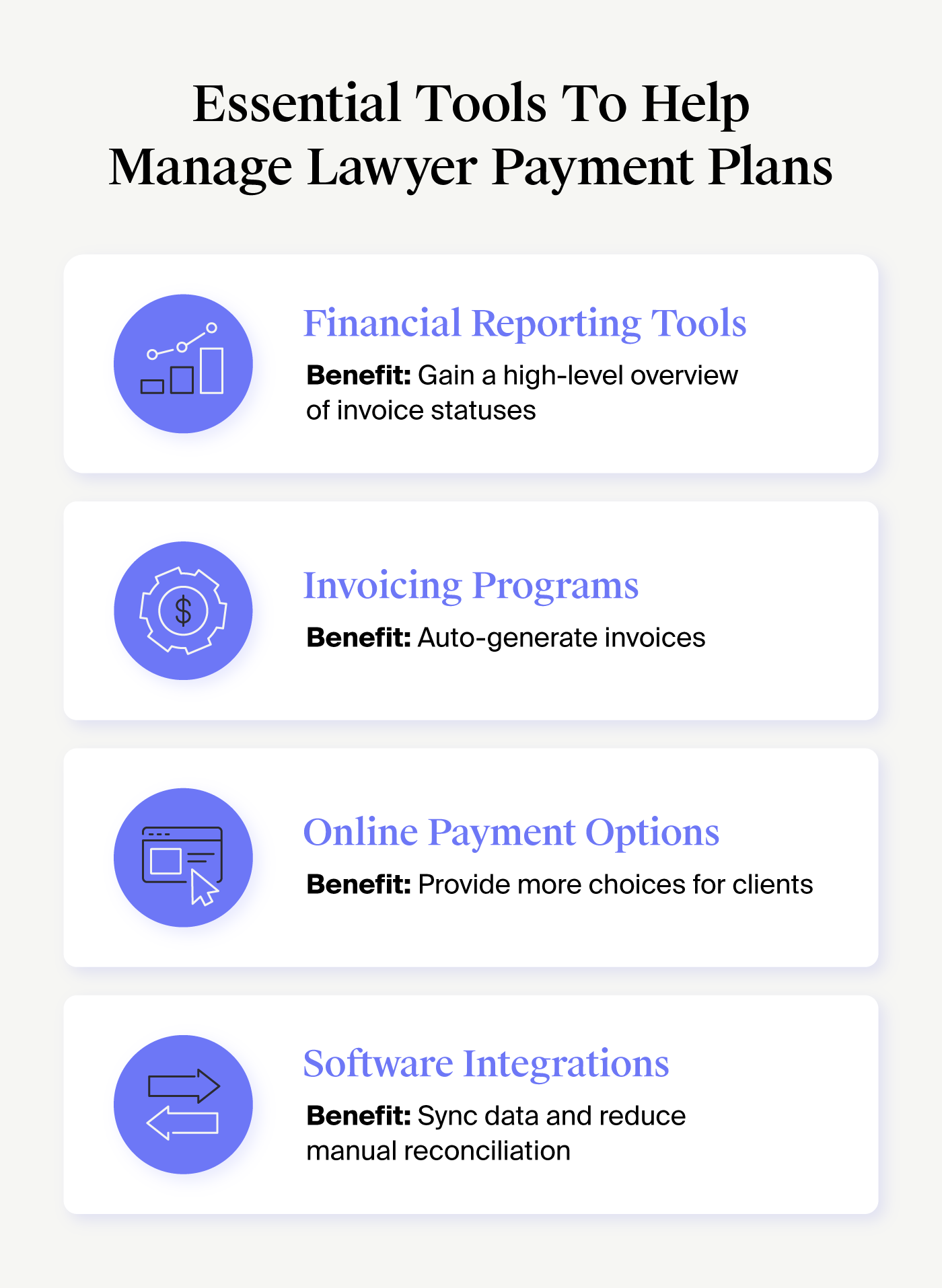

Essential Tools for a Payment Plan

The right tools and programs can make executing payment plans in your practice easier, faster, and more effective. Here are a few specific payment software features that can help you streamline payment plans to improve the process and take control of your firm’s finances:

Financial reporting tools: These tools can help you streamline your financial reporting process so you can identify which invoices are paid, which are outstanding, and which are late.

Invoicing programs: These programs help you auto-populate invoices based on billable work performed, making time-tracking easy whether you’re billing upfront or letting your clients make payments over time.

Online payment options: Tools that let you accept payments online can make it easier for your clients to make payments on time. Consider using tools that work with most major credit card issuers and accommodate ACH payments to make the process even easier.

QuickBooks integration: Incorporating QuickBooks into your law firm’s processes help you track time, monitor billing efforts, and stay on top of expense entries all in one central place.

Streamline Lawyer Payment Plans With MyCase

Offering lawyer payment plans in your firm can make your services more accessible and help you stand out when trying to attract new customers. However, you’ll want to ensure you have the right tools to streamline your billing efforts and track your clients’ payment of their legal fees.

MyCase’s comprehensive legal billing software can help you take control of your payments and invoices. Whether you’re looking to simplify your legal payments and collections processes or want to offer a wider variety of payment options, you’ll find the tools you need to strengthen your practice. Schedule a demo today.

About the author

Mary Elizabeth HammondSenior Content Writer

Mary Elizabeth Hammond is a Senior Content Writer and Blog Specialist for leading legal software companies, including MyCase, Docketwise, and CASEpeer, as well as LawPay, the #1 legal payment processor. She covers emerging legal technology, financial wellness for law firms, the latest industry trends, and more.