Today’s legal consumers have different expectations than they did even five years ago. Your clients are used to conducting business and obtaining the information they need online.

For example, one thing consumers do on a regular basis is pay their bills online. Doing so saves them time and money. There’s no need to pay for envelopes and stamps or waste time writing out a check; instead, they can instantly pay their bills with the click of a button.

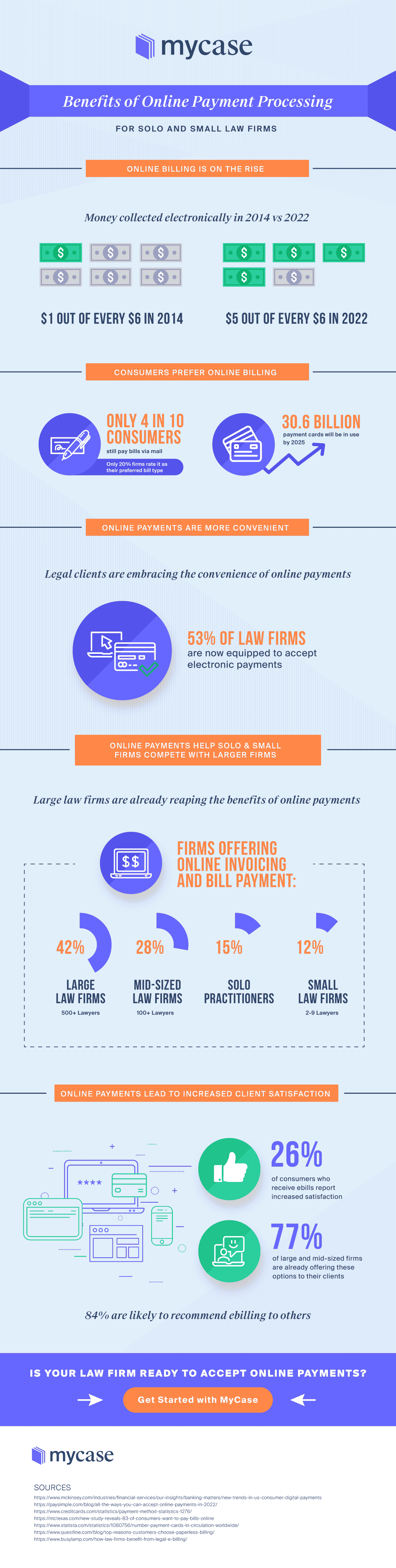

Because it’s so easy to pay bills online, the number of dollars collected via online payment processing has increased dramatically in recent years. In 2014, only $1 out of every $6 was collected online whereas, in 2022, roughly $5 out of every $6 is collected via online payments.

Only 4 in 10 consumers in the US still pay bills via mail, and less than 1 in 5 consumers rates it as their preferred method to make payments. It’s no surprise that the number of payment cards in circulation is expected to grow to 30.6 billion by 2025.

Legal consumers’ payment choices are in line with this trend as well. Currently, 53% of law firms are equipped to accept electronic payments.

The good news for solo and small firm lawyers who accept online payments via credit card or ACH (eCheck) is that doing so increases client satisfaction (26% of consumers who receive ebills report increased satisfaction) and allows your law firm to compete with the whopping 77% of large and mid-sized firms that are already offering these options to their clients.

Does your law firm offer online payments options to your clients? If not, it’s time to get started! The infographic below solidifies the need to expand your law firm’s payments options in 2022. (Don’t forget to download and share this infographic with your friends and peers!)

About the author

Nicole BlackPrinciple Legal Insight StrategistMyCase and LawPay

Niki Black is an attorney, author, journalist, and Principal Legal Insight Strategist at AffiniPay. She regularly writes and speaks about the intersection of law and emerging technology. She is an ABA Legal Rebel and is listed on the Fastcase 50 and ABA LTRC Women in Legal Tech.