Introducing MyCase Smart Spend

Powered by the LawPay Visa® Business Card.

Smart Spend revolutionizes how you pay and manage expenses by integrating the LawPay Visa® Business Card with expense management automation in MyCase.

Unlike traditional business cards, Smart Spend*—powered by the LawPay Visa® Business Card—gives you peace of mind that firm expenses are controlled, organized, and fully accounted for.

Watch How You Can Track Every Dollar in Real Time

Say goodbye to the financial chaos of missing receipts, uncontrolled spending, and expense reconciliations.

Automated Expense Tracking

Eliminate manual reconciliations by capturing receipts and categorizing purchases as they occur.

Advanced Costs Management

Improve profitability by automatically linking case-related purchases to cases for accurate tracking and billing.

Flexible Spend Controls

Issue cards to staff or departments with individual spend limits, and instantly pause or lock them when needed.

Streamlined Firm Data

Gain full financial visibility with a single destination for firm operations, billing and payments, and firm spend.

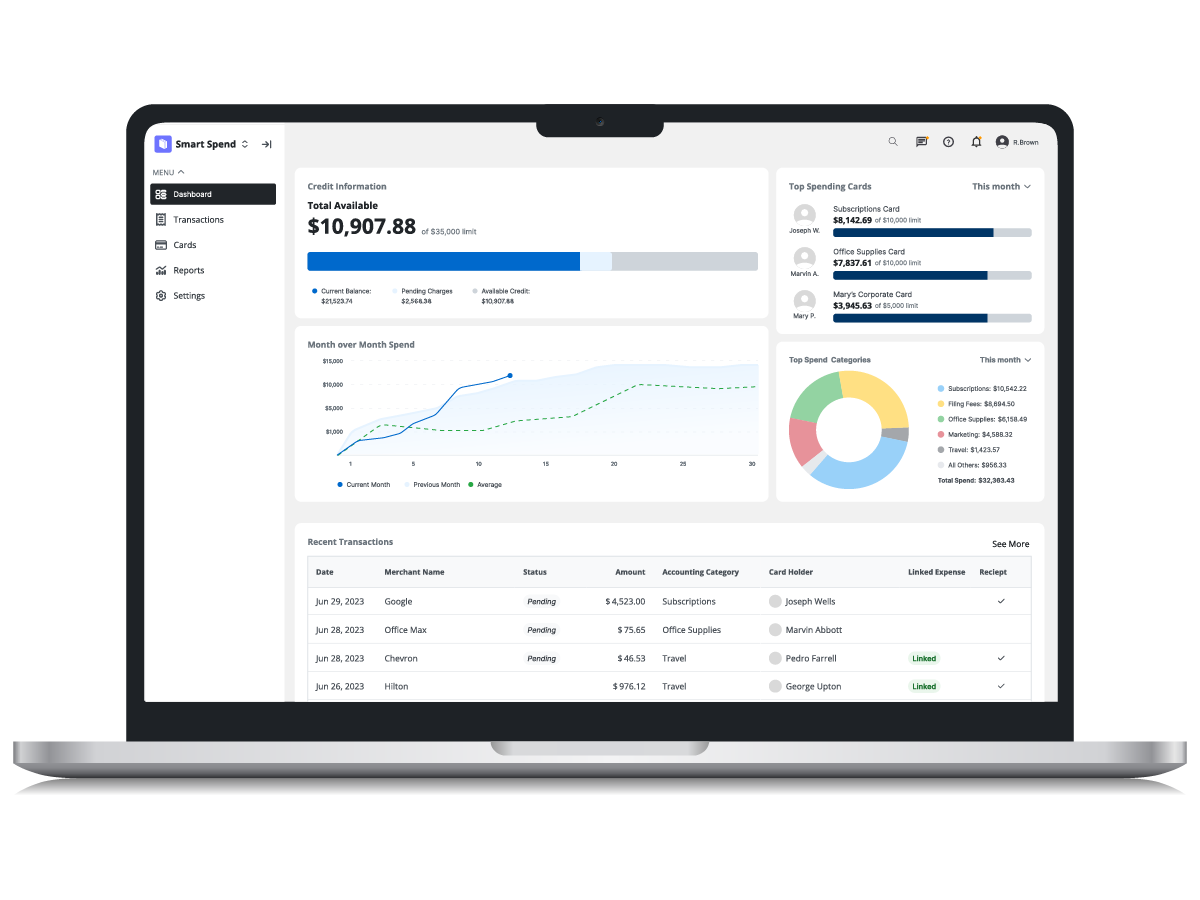

Real-time Dashboard Reporting

Make more informed financial decisions with real-time firm spend analytics and insights.

Enjoy these additional benefits:

$0 annual fee

Smart Spend software is free

Bonus Cash Rewards Offer.

$500 statement credit when you spend $7,000 on your card within the first 90 days of account opening.**

Save on Business Expenses with Visa SavingsEdge⨥

Free to enroll

Shop at participating merchants

Save automatically on qualifying purchases

Cashback offers and Instant Coupons merchants

The LawPay Visa® Business Card is issued by Emprise Bank, pursuant to a license from Visa U.S.A., Inc.

* Smart Spend is provided by AffiniPay. Emprise Bank is not affiliated with and does not endorse or promote Smart Spend. All questions or concerns should be directed to AffiniPay at 844-335-3373 or lawpaycard@support.lawpay.com.

** Bonus Cash Rewards Offer. You will qualify for a $500 statement credit if you use your LawPay Visa® Business Card account to make any combination of purchase transactions totaling at least $7,000 (excluding any interest or fees) that post to your account within 90 calendar days of the account activation date. Returns, credits, and adjustments to this card will be deducted from purchases, even if this card was not the original payment method. Cash Advances, Balance Transfers, traveler’s checks, foreign currency, money orders or wire transfers, lottery tickets, casino gaming chips, race track wagers, or similar betting transactions, and pending, unauthorized, or fraudulent charges are not considered purchases and do not apply for purposes of this offer. Limit 1 bonus cash rewards offer per new account. This one-time promotion is limited to new customers opening a new account in response to this offer and will not apply to requests to convert existing accounts or for existing customers who already have an account. Your account must be open and in good standing in order to receive this offer. If you qualify, your statement credit will be posted to your account within ninety (90) calendar days after you earn it. The value of this reward may constitute taxable income to you. You may be issued an Internal Revenue Service Form 1099 (or other appropriate form) that reflects the value of such reward. Please consult your tax advisor, as neither we, nor our affiliates or service providers, provide tax advice. Additional terms and conditions may apply. This offer is subject to change at any time.

Emprise Bank does not promote or endorse this offer. For any questions regarding this offer, please contact 1-844-335-3373 or lawpaycard@support.lawpay.com.

⨥ Discounts provided as credits on future account statements. ⨥ Visa SavingsEdge is a Small Business loyalty and discount program offered by Visa U.S.A. Inc. to eligible businesses and their authorized cardholders that hold an eligible Visa Business card. Visa Small Business cardholders can receive savings through two types of discount offers: Instant Coupons and Cashback. With Instant Coupons cardholders may receive a discount at the time of purchase by using an applicable coupon code or link from a participating merchant. A linked card is not required for cardholders to use Instant Coupons. With Cashback offers, cardholders must link (enroll) their eligible card in the program and use their linked card to make qualifying purchases of goods or services pursuant to an active cashback offer provided by a participating merchant, and that transaction must be processed or submitted through the Visa payment system (a “Qualifying Purchase”). Visa may modify, restrict, limit or change the program in any way and at any time. Visa reserves the right at any time to cancel the program. Visa also reserves the right to suspend or cancel any cardholder’s participation in the program. Cardholders will only receive discounts for qualifying purchases that are in full compliance with the terms of the applicable discount offer. Discount offers may be subject to additional terms and conditions. Discount offers may be removed from the program at any time and are subject to availability. Discount offers are also subject to any applicable law or regulation that may restrict or prohibit certain sales. Discounts will not appear on a cardholder’s receipt at the point of sale. For Cashback offers, discounts are provided in the form of credits posted to the cardholder’s applicable Visa Business card account. Please visit www.visasavingsedge.com for complete details on the program, including the program terms and conditions.

©2024 Visa. All rights reserved.