Running a Remote Law Firm: Getting Paid During COVID-19

Apr 29, 2020

| 6 min read

In March, life as we knew it ground to a halt as COVID-19 descended upon our country. In many states, nonessential businesses were forced to close, people were strongly encouraged to practice “social distancing” by avoiding public places and gatherings, and all but the most essential court proceedings were adjourned indefinitely.

As the virus quickly took hold, businesses closed their doors and, to the extent that it was was possible, sent their employees home to work remotely. For many law firms, this sudden departure from business as usual was an unexpected and unwelcome turn of events.

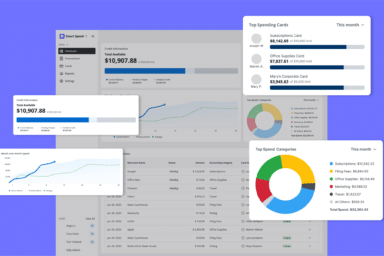

Remote law firm billing software

Although law firms have faced a number of challenges while transitioning to remote work, one of the most difficult for many firms has been setting up a process to get paid promptly. Under normal circumstances, when clients put off paying a legal bill, or even ignore it completely, law firm finances can be affected significantly. This problem is all the more amplified during the COVID-19 crisis, since cash flow can be negatively impacted by the unpredictability of the current situation.

That’s why, in the midst of the uncertainty, it’s so important for small firms lawyers to make it as easy as possible to invoice clients and allow them to pay for legal invoices. The simplest and most cost effective way to accomplish this is with law practice management software with built in legal billing features. This software provides an out-of-the-box, streamlined billing process that makes it easier than ever to remotely track time, invoice clients, and accept online payments.

Simplify the invoice creation process

Before the advent of electronic billing, creating and sending out paper invoices used to be a time-consuming process. Fortunately, legal billing software has changed that and nowadays it’s easier than ever to generate legal invoices quickly using any internet-enabled device, and then immediately send them to clients electronically.

There are a host of ways to reduces legal billing inefficiencies, but one of the easiest is to reduce the number of steps needed to create and send out invoices. One way that legal billing tools built into law practice management software accomplishes this goal is by automatically providing necessary billing information, such as LEDES billing codes. Additionally, the built-in ability to customize invoices allows you to easily determine what information appears on your firm’s invoices, such as which time or expense entry columns you would like to appear on an invoice.

Automate invoice reminders

Another way to improve your law firm’s cash flow is to use software that allows you to set up automated invoice reminders. With this built-in tool, you can schedule reminders when you send out the very first invoice to a client. If the invoice isn’t paid, a follow up invoice will automatically be sent to the client, reminding the client that the billed amount is still outstanding.

This convenient tool will save your law firm time and money. The initial invoice needs to be sent just once; after that, the software follows up with your client. No need to waste time re-sending the invoice manually. The system does the work, ensuring that your law firm is paid in a timely manner.

Allow clients to set up payment plans

Another way to get paid quickly is to allow your law firm’s clients to set up payment plans for their legal bills. By doing this you provide your clients with increased flexibility, making it easier to pay large legal bills.

The simplest way to do this is to use your firm’s law practice management software to set up a payment plan using built-in payment plan features. You can create the payment plan, establish the amounts due and due dates, and share that information with your client, who can then instantly pay via e-check (ACH) or credit card using your firm’s legal billing software with built-in online payment tools You can then set up invoice reminders for the amounts due, as discussed above. That way, your client has all the information needed to make regular payments under the payment plan, and will receive convenient reminders when the payments are due.

Utilize advanced billing and revenue reporting features

Finally, ensure that your law firm’s billing process is as efficient and effective as possible by tracking and analyzing your firm’s financial and billing information. One of the best ways to do this is to run reports that provide you with an overview of your law firm’s billing, invoicing, and collection data. Here are some of the reports you can run:

- Aging Invoice Report: A report will of overdue balances grouped into 1-15, 16-30, 31-60, and 61+ days overdue.

- Accounts Receivable Report: A report detailing your law firm’s receivables, which can be filtered to show a particular client or case; you can also choose various grouping options to better format the data for your law firm’s specific needs.

- Case Revenue Report: Shows cases billed during a certain time period and allows comparison of monies earned on those cases during that same timeframe.

- Fee Allocation Report: Displays amounts billed and collected by specific users at your firm during a certain time period.

- Trust Account Summary Report: Shows all contacts with trust balances, including total credit, total debits, and “as-of” balance.

- Electronic Payments Report: Shows all payment activity made via eCheck and Credit Card within a specified time frame.

- Credit Card Fees Report: Offers a detailed view into which fees taken from the Operating account.

Related: [Blog Post] Remote Working: Lessons for Law Firm Leaders

Remote billing tools = continued success

Just because your law firm is operating virtually, doesn’t mean your firm can’t successfully collect payments from clients. As long as your firm uses law practice management software with remote billing and accounting tools built-in, it’s business as usual. Using this software, your law firm’s billing processes will be streamlined, making it easier for clients to pay their legal bills. In turn, this means that you firm will get paid quickly and reap the benefits of the hard work performed on behalf of your firm’s clients. In other words, despite the uncertain times, the ability to remotely track time, invoice clients, and accept online payments can make all the difference to your firm’s bottom line and ensure your firm’s continued success in the immediate future and beyond.

To learn more about how the billing tools in law practice management software can help you law firm bill more effectively and efficiently, download this FREE guide: The Ultimate Guide to Legal Billing.