Reducing Expenses without Cutting Staff (During COVID-19)

Apr 30, 2020

| 8 min readBy this point, we are all well aware of the widespread challenges this crisis poses for lawyers and their businesses. An unstable economy paired with court closures around the nation, many (if not most) practices are finding themselves in financial distress. Large firms, small firms, legal aid, and the like are all experiencing an impact. We’ve witnessed a variety of large firm staff layoffs, hour reductions, furloughs, as well as pared-down summer programs and hiring. Of course, a substantial part of any law firm’s budget is its staff.

For small firms, oftentimes operating lean with minimal reserve funds, maintaining the cost of staff during this crisis can be extraordinarily difficult. No one wants to make the decision to cut staff, the very people you rely on to keep your business operating, particularly at this time when finding a new job may be nearly impossible. Many small firms view themselves as “family unit”, sometimes employing family members and longtime staffers. While there is no uniform way to approach these decisions as each circumstance is unique, there are places you can look and potential actions you can take to reduce expenses before resorting to staff cuts.

First and Foremost: Communicate with Staff

Before we begin to look at reducing expenses and potentially reducing staff, it is important to first communicate with your staff. Transparency is key. Be open and honest, even if you don’t have answers (and chances are, you won’t have all the answers they are looking for). Don’t merely reassure them that it will be ok. Tell them you are or will be working on ways to support them and openly acknowledge the stress you are all experiencing. Whenever possible empower them to help you brainstorm, research, and make decisions. These actions will go a long way toward maintaining good relations with your staff and improving everyone’s well-being.

Reducing Expenses: The Elephant in the Room

Even before this crisis, many firms had already experimented with flexible work arrangements, remote work, and even full-fledged virtual law practices. Now, even more firms are following suit whether they like it or not. Many firms will experience increased efficiencies with remote work and decreases in expenses, and thus may never go back to the way they practiced “pre-COVID-19”. That, along with mounting evidence that the traditional 9 to 5 workday is neither productive nor great for our health, suggests that this crisis could forever change the way we work.

Now, to tackle the financial challenges; first, take a look at your budget. What percentage of your expenses are devoted to your physical space? This would include your lease payments as well as an insurance, utilities, and other expenses tied to that physical space. My guess is that it is responsible for at least 25-30% of your overhead.

Now might be the right time to think about whether you really need all the space. Mid to large firms are already contemplating changes, for the long term. Think about the months (years?) ahead. If and when you return to work, it’s likely that you won’t be using the space as you had previously. You can get a taste of that in the Morgan Lewis guide for business re-openings, which discusses precautions for businesses and envisions different types of workspaces as we transition back to physical offices.

You also might contemplate a change in your physical location. Do you need to be in a major urban area or can you do just as well with an office outside of a major city? Remember that we no longer live in a world where attorneys hang a shingle outside of their office and expect to get clients; especially in light of COVID-19! Business development is most effective by building relationships and in many cases through online marketing.

Think about the relationships that you are continuing and cultivating during this “remote” period of work. Will your clients become accustomed to working with you remotely? Are some finding it easier to do so? Is it more efficient for your firm? Even if you reopen your physical office, when will clients feel comfortable trekking into your physical office? Have you made investments during this period in technological systems that can support your work virtually so that a physical office space is no longer a necessity? Just how much money could you save by entering into a new office arrangement, such as a full or hybrid virtual workspace, shared space with other legal professionals, or co-working space with other professionals.

If you do decide that now is the time to shift away from a physical space but cannot get out of your lease, look into whether you can defer lease payments for a period of time. Along those lines, there are a number of loans and grants being offered to small businesses. In Massachusetts, we have a COVID Relief Coalition that provides updated information and explanation of the various financial relief options available to small businesses as well as opportunities for pro bono assistance.

Scrutinizing Your Expenses

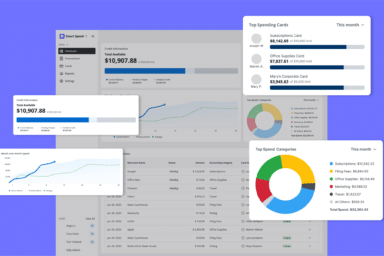

Beyond office space and external financial relief, now is the time to take a hard look at your expenses and budget. Separate fixed and variable costs. Fixed costs might be premium payments for your malpractice insurance, subscription software costs, or lease payments. Variable costs include mail and courier service, travel, and office supplies and utilities. Chances are, some of those variable costs may have decreased. Have you seen any savings as a result? Which of the variable costs that have been cut out of sheer happenstance can you continue to keep low in the future? Cutting a fixed cost, such as a lease payment should have major and predictable financial ramifications. Query whether there are other expenses that you could cut?

Getting Creative

What else can you do to cut costs without sacrificing staff? Are you in an area of practice such as permitting, real estate, or trial law work where you have experienced a significant drop in clients and work? Alternatively, are you in an area of practice that is flourishing, such as employment law, financial, and litigation? There are those that are struggling and there are some that are flourishing. Might these two types of practices work together? Use your network to seek out other firms and attorneys to either search for or provide opportunities for attorneys and support staff, thus supplementing some income.

Think about alternative uses for your staff. If your caseload is stagnant and staff doesn’t have case work to do, are there other projects or roles they can take on? Instead of drafting and sending letters, maybe they’re creating a training manual for how to use your virtual software or outlining new procedures. You can also have staff help work on new business development and marketing concepts. For example, staff could systematically reach out to clients to check in, ask how they are doing and what the firm could be doing for them. This will help maintain and strengthen those relationships. The last thing you want is to lose strong clients during this time.

Search for deals and freebies. Many businesses are offering free products or deals on products as a result of COVID-19. Look for deals on CLE; now might be a good time to catch up on it.

Conclusion

We all understand that this crisis will have a major impact on the legal profession. Unfortunately, many of the changes are not within our control. Focus on what you do have control over. Keeping solid financial records, reviewing those records, and making decisions based upon knowledge is all within your control. Hopefully, some of the tips above will help you make better decisions about your finances, lower stress, and enable you to retain staff.

—

About the Author

Heidi S. Alexander, Esq. is Massachusetts’ first Director of the Supreme Judicial Court Standing Committee on Lawyer Well-Being where she works to help all Massachusetts lawyers attain greater success in achieving a healthy, positive, and productive balance of work, personal life, and health. Heidi is an avid speaker on topics ranging from attorney well-being, time management, productivity, and legal technology, and an author of numerous articles and a book published by the American Bar Association’s Law Practice Management Division, entitled Evernote as a Law Practice Tool. Heidi was formerly the Deputy Director of Lawyers Concerned for Lawyers and led the Massachusetts Law Office Management Assistance Program. She is a native Minnesotan, former collegiate ice hockey goaltender for the Amherst College Women’s Ice Hockey Team, CrossFit coach, and mother of three young girls. She can be reached via email at [email protected], Twitter @heidialexander, or LinkedIn www.linkedin.com/in/heidisarahalexander.